ECB Preview (Oct 17): A Change of Tune, A Change of Rates

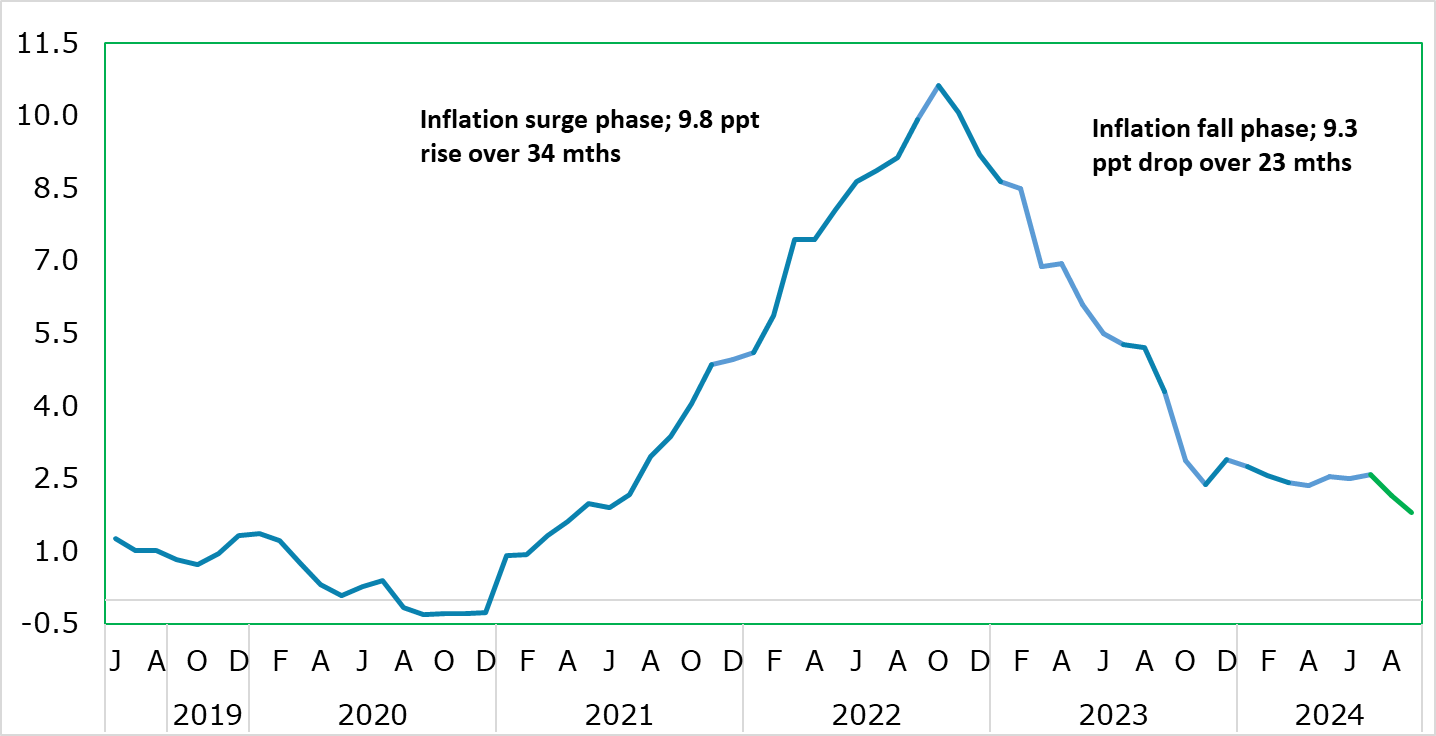

It now seems very likely that the ECB will cut rates at a successive Council meeting for the first time in this easing cycle dating back to June. To date the ECB has allowed the impression that it would ease only every other meeting, ie once a quarter, partly to give it access to what it sees as key labor cost numbers. But yet another downside inflation surprise, alongside business survey data highlighting both fresh stagnation risks and much reduced cost pressures, have changed the ECB mindset. Thus we see a 25 bp cut at both the looming October 17 decision and a further such reduction in December. Given that energy base effects may push headline inflation back above target (something the Council seems preoccupied with), at this juncture we think he ECB may revert back to a slower easing pace in 2025. But amid signs that downside growth risks may be materializing, the risk from hereon of easing at every meeting into mid-2025 is a growing one and has been flagged by Bank of Greece Governor Stournaras. After all, that is how policy was tightened amid the marked jump in inflation, but where the subsequent fall has actually been faster (Figure 1).

Figure 1: EZ Inflation – What Goes Up….?

Source: Eurostat, EZ HICP headline, % chg y/y

The ECB may label this likely October move formally as an ‘insurance’ cut, but its language will be more important in determining how far-reaching has been any policy reassessment. One possible shift in rhetoric may be President Lagarde using the October press conference to repeat that policy will still have to remain restrictive but possibly amending of even omitting the ‘for some time’ qualification used of late. After all, the ECB has underlined that the speed at which the degree of restrictiveness should be reduced depended on the evolution of incoming data.

EZ Inflation Drop – Gauging its Extent

Clearly, a change of tune from the ECB has been building; as the official account published today confirms, the ECB September Council meeting seemed not as dismissive of further and earlier rate cut as perhaps President Lagarde suggested in the her press conference last month. Indeed, the minutes (account) did suggest some discontent with both the growth projections and the extent of emerging downside risks that seems to have accumulated if not materialized. Furthermore, the minutes suggest more discussion took place about a further and earlier possible rate cut, specifically citing ‘optionality should be retained as regards the speed of adjustment’ which reinforced the value of a meeting-by-meeting and data-dependent approach that maintained two-way optionality and flexibility for future rate decisions. We would argue that while the inflation news has been the most headline grabbing, other issues are increasingly important.

But as for the inflation news, some perspective! Indeed, it is notable that from the pre-pandemic low set at end-2019 of just over 1%, HICP inflation jumped to a peak of 11.1% by Oct 2022, only then to slump back to its now below-target 1.8%. Admittedly, inflation did trough lower than the end-2019 rate, but these 2020 outcomes were due to pandemic related distortions rather than cyclical or policy driven factors. This means that the jump in HICP inflation averaged 0.3 ppt per month, while on the way down it has averaged 0.4 ppt (Figure 1). Even the allegedly resilient core rate has fallen faster that it rose, averaging just over 0.1 ppt on the way up but nearer 0.2 ppt on the way down!

This very much to us highlights the manner in which the inflation slump has surprised many, not least the ECB. It also highlights the manner in which inflation swings have been very much driven by swings in supply pressures, this being important as it raises the question as to what degree current restrictive policy may add to disinflation pressures by hitting demand. Indeed, even with the discount rate moving down to 3% by end year, policy will still be highly restrictive. To some extent this downside inflation surprise was acknowledged by the ECB last month; the September account stressed that inflation had recently been declining somewhat faster than expected, and the risk of undershooting the target was now becoming non-negligible

Downside Signals

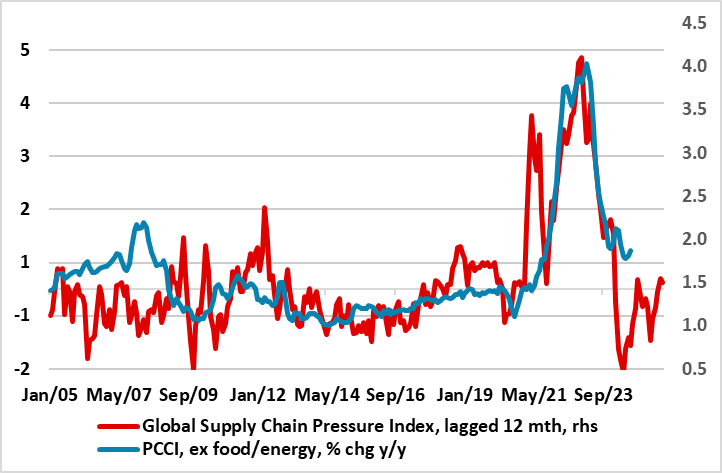

With this in mind, business survey data increasingly suggest that a weakening demand environment is contributing more clearly to softer inflationary pressures. This pattern of disinflationary signals is backed up by European Commission survey data, most notably in terms of retailer’s price expectations. Supporting the notion of recent disinflation being supply driven are an array of survey data, with the New York Fed aggregating them into its global supply chain index. This index tallies with the Persistent and Common Component of Inflation which ECB Chief Economist Lane has very much underscored is the best predictor of inflation one and two years ahead and this is all the more notable as this measures have eased to below 2% of late and stayed there (Figure 2). Given that it perhaps the best measure of price persistence, it is already arguing that worries about services price resilience are overdone.

Figure 2: Persistent Price Pressures Have Ebbed Further as Supply Constraints Recede

Source: Federal Reserve Bank of New York ECB, PCCI is Persistent and Common Component of Inflation

ECB Focus Broadening Out Beyond Prices

This may be why the ECB’s tune has changed to a degree that policy is now being shaped by real economy considerations rather than just an inflation assessment. Indeed, those same survey data suggest that the EZ economy has been seeing downside risks but ones that may now be materializing. Notably the data not just suggests weaker activity, but now including services to a degree that implies that the support the sector has given the whole EZ economy through into H1 this year may have dissipated, if not reversed. This is important as the September Council minutes largely drew comfort from what at the time seemed to be strong services growth. This threat seems to have materialized given recent innovative official data on services output has seen a flat underlying trend in the last 4-5 months. It will be interesting to see if the looming new Bank Lending Survey (Oct 15) reinforces a downside risks scenario, in suggesting weak credit demand and/or curtailed supply.

Either way, the ECB Council September minutes did see some reservations about the economy. Indeed, it was noted that ‘private domestic economy had contributed negatively to GDP growth for the second quarter in a row and had been broadly stagnating since the middle of 2022’ and whether the projections relied too much on consumption driving the recovery. This is important as even on what may now be considered to be an optimistic growth outlook offered last month was still consistent with HICP inflation e below 2% in 2025 and staying there. Moreover, as those projections were based on market rate thinking which then envisaged (and still does presently) the discount rate close to 2% into 2026, it thereby endorses such thinking too as well as highlighting added disinflationary downside risks.

Gauging Restriction

In conclusion, after the cumulative 50 bp moves now seen by year-end, we see 75bp of further easing through 2025 (still quarterly), with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into anything like a clear expansionary stance. With this in mind, President Lagarde may use the October press conference to suggest again that policy will still have to remain restrictive but possibly amending or omitting the ‘for some time’ qualification used of late. But as suggested above, policy rates would remain restrictive even with around 125 bp of added official rate cuts that we envisage let alone the added constraints stemming from the ECB QT program and banks still tight lending standards.

To us, the risk is of faster rather than more significant easing than our central case envisages; the case for additional easing beyond 125 bp would necessitate a protracted period of weakness. In this regard, we have downgraded the current quarter GDP picture from a rise of 0.1% to a same-sized fall, on the back of the downturn in services. At this juncture we think this is a blip rather than a fresh and weaker trend and are adhering to our rate policy outlook that we have had in place all this year. But we are watching our radar screens acutely for more adverse signs.