Bank Indonesia Holds Rate to Support IDR

Bank Indonesia held its key interest rate at 6% in its December meeting. The decision to hold rates steady is primarily influenced by the need to stabilize the Indonesian rupiah. Inflation remains within target, and GDP growth forecasts are steady. Future rate cuts depend on US Federal Reserve actions. A 25bps cut is expected in Q1-2025.

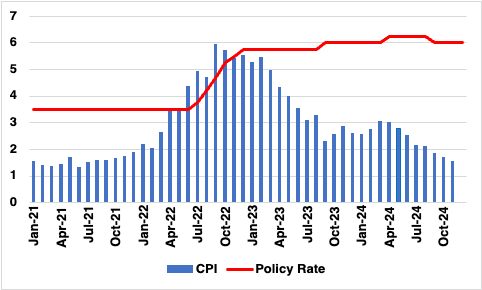

Figure 1: Indonesia Consumer Price Inflation and Policy Rate (%)

Source: Continuum Economics

Commensurate with our view, on December 18, 2024, Bank Indonesia (BI) announced its decision to keep the benchmark interest rate steady at 6.00%, alongside the deposit facility rate at 5.25% and the lending facility rate at 6.75%. This marks the fourth consecutive meeting where rates have remained unchanged, following an unexpected rate cut in September 2024. The decision comes under heightened scrutiny as anti-corruption authorities recently raided BI's headquarters over allegations of financial misconduct.

The decision to hold rates reflects BI’s efforts to stabilise the Indonesian rupiah, which recently hit a four-month low against the US dollar. The stability of the rupiah remains the primary focus of Bank Indonesia's Monetary Policy Committee (MPC) decisions, while inflation, currently within the target range of 2.5±1%, takes a secondary role. Although the rupiah showed some recovery against the US dollar in August and early September, it has since resumed a downward trend. BI Governor Perry Warjiyo emphasised that maintaining current rates is essential to keeping inflation within the 2.5±1% target for both 2024 and 2025 while supporting sustainable economic growth. Rising global uncertainties, including shifts in US monetary policy and escalating geopolitical tensions, have added to the urgency of stabilising the currency. The ongoing corruption investigation into BI’s operations has also raised concerns about investor confidence, as reflected in a 0.7% drop in Indonesia's stock exchange index following the announcement.

At a press briefing, Governor Warjiyo reiterated BI’s commitment to monitoring key economic indicators such as inflation and exchange rates. While there was speculation about potential rate cuts after the September reduction, he noted that current conditions call for a cautious approach. Future rate decisions, he stressed, would be guided by evolving economic dynamics.

Looking ahead to 2025, we predict that BI may hold off on resuming its easing cycle until March, given persistent concerns over currency stability and inflationary pressures. The central bank is expected to remain vigilant in assessing external factors that could influence domestic economic conditions. We anticipate three 25bps rate cuts over 2025 and thw policy rate to be 5.25% by end-2025.