Inflationary Pressures Caused CBRT to Restart Tightening Cycle and Hike Key Rate to 50%

Bottom Line: Despite predictions were centred around no change, Central Bank of Turkiye (CBRT) increased the policy rate by 500 bps to 50% on March 21 due to strong inflation, and pressure on FX and reserves lately. According to the CBRT statement, the current level of the policy rate will be maintained until there is a significant and sustained decline in the underlying trend of monthly inflation, and monetary policy stance will be tightened in case a significant and persistent deterioration in inflation outlook. We feel upside risks remain strong in H1 2024, but we expect a fall in the inflation after June 2024, particularly due to favourable base effects, lagged impacts of tightening cycle, and additional quantitative and macro-prudential tightening steps since the February MPC. We think today’s decision proves CBRT’s quick responsiveness to inflationary pressures, and it signals CBRT’s growing independence. Our projection is that policy rate will be held at 50% in the next MPC meeting, which is scheduled for April 25, as soon as the inflation shows another significant uptick between in March and pace of lira depreciation would re-accelerate after the local elections.

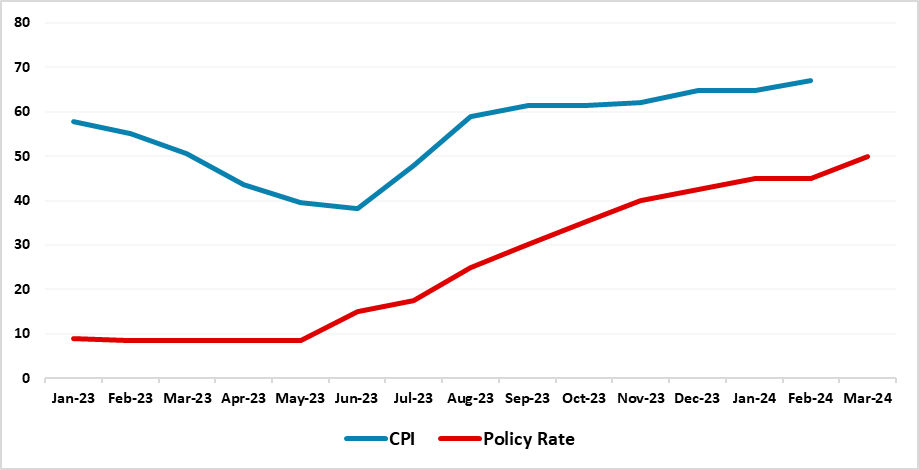

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2023 – March 2024

Source: Continuum Economics

The CBRT decided to lift the key rate to 50% on March 21 MPC meeting as inflation roared strong in 2024, and there has been pressure on FX and reserves lately, leading to a fall in the CBRT’s net reserve position and acceleration in the pace of Turkish Lira (TRY) depreciation.

Taking into account that CBRT Governor Karahan repeatedly indicated that the central bank would review its end-to-tightening-cycle decision if the inflation outlook deteriorated, opening the door to maintaining the tightness when needed, it appears CBRT became worried about the headline inflation trend as YoY inflation in February exceeded 67% and MoM reading remained elevated at above 4%, which is far above CBRT's projections of 3% MoM average rate in the H1 of 2024. (Note: According to the announcement by the Turkish Statistical Institute (TUIK) on March 4, the CPI surged to 67.1% annually and 4.5% monthly in February, as the annual inflation swung to a 15-month high due to increases in hotel, education and food prices).

To fight against the galloping inflation, CBRT also implemented additional quantitative and macro-prudential tightening steps since the February MPC to strengthen the monetary transmission mechanism but apparently the measures were not very helpful putting out the inflationary fire, and decelerate TRY depreciation. (Note: CBRT announced on March 6 that it decided to implement additional tightening measures within the scope of the loan growth-based securities maintenance practice: The monthly growth limit for TRY commercial loans, previously set at 2.5%, was reduced to 2%, and the monthly growth limit for general purpose loans, previously set at 3%, was revised down to 2%).

According to the Bank’s assessment on March 21, in addition to higher-than-expected underlying monthly inflation trend, resilient domestic demand and reiterated inertia in services inflation, geopolitical risks and food prices remained the key drivers of inflation. The Bank reiterated that monetary policy stance will be tightened in case a significant and persistent deterioration in inflation outlook is foreseen, and the lagged effects of the monetary tightness on financial and economic conditions will be closely monitored in the upcoming period. CBRT also pledged to use extra macro-prudential moves in case of unanticipated developments in credit growth and deposit rates.

It is interesting that the hike decision came just ten days before the local elections, particularly considering AKP wants to win back the control of major cities like Istanbul, Ankara and Izmir and President Erdogan is against high interest rates. It is worth mentioning that Erdogan recently underscored that "Today we are tested by the high cost of living and as a result the loss of welfare of our people with fixed income. I assure that as inflation slows down in the second half of the year, employees and pensioners would benefit from the positive outlook in economy."

Despite CBRT’s dedication and lagged impacts of the previous tightening cycle, we still see upside risks to the inflation outlook, especially in H1 2024. However, we also think today’s decision proves CBRT’s quick responsiveness and dedication to tackle galloping inflation and it signals CBRT’s growing independence, which is good news for the economy. Along with additional quantitative and macro-prudential tightening steps after February, this hike will likely ease investors’ concerns in TRY assets and help anchor inflation expectations. In line with this, our projection is that policy rate will be held at 50% in the next MPC meeting, which is scheduled for April 25, as soon as the inflation shows another significant uptick between in March and pace of lira depreciation would re-accelerate after the local elections. We continue to foresee a relative slowdown in the inflation trajectory in the second half of 2024, particularly due to favourable base effects, recommenced tightening cycle, and additional quantitative and macro-prudential tightening steps.