RBI’s October Rate Call: Patience May Prevail Over Pressure

The RBI is expected to keep interest rates unchanged in its October meeting, despite global central banks initiating rate cuts. Domestic inflation concerns and uncertainties over MPC appointments are likely to drive a cautious "wait-and-watch" approach, with potential easing only by December.

As the Reserve Bank of India (RBI) approaches its crucial Monetary Policy Committee (MPC) meeting on October 9, the focus of financial markets has shifted to the central bank's interest rate decision. With global central banks, such as the U.S. Federal Reserve, already moving toward monetary easing, the RBI faces increasing pressure to follow suit. However, despite the recent 50 basis point (bps) cut by the Fed and easing moves from other emerging market central banks like the Bank of Indonesia, India's domestic economic conditions are likely to keep the RBI cautious. We expect the RBI to maintain its current interest rate at 6.5%, continuing a policy of "wait and watch," with a potential rate cut only being considered toward the end of the year.

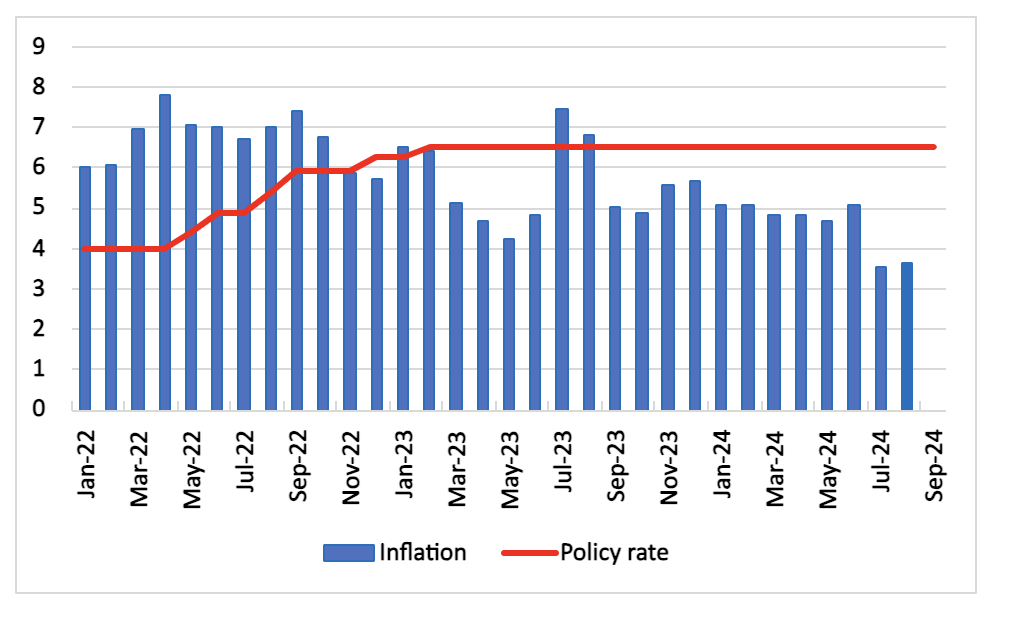

Figure 1: India CPI and Policy Rate (%)

Source: Continuum Economics

One of the primary factors influencing the RBI’s decision is inflation, which, although within the central bank’s 2-6% tolerance band, remains a point of concern. The Consumer Price Index (CPI) inflation in August fell to 3.65%, offering some respite and coming in well within the RBI’s comfort zone. However, food inflation has proven volatile, posing a risk to the broader inflation outlook. The RBI has consistently emphasised that before considering a rate cut, it wants inflation to stabilise around its 4% target. Shaktikanta Das, the RBI Governor, has reiterated the importance of a sustained disinflationary trend before any monetary easing, dampening market expectations for a rate cut in the upcoming October meeting.

Adding to this cautious stance is the uncertainty surrounding the composition of the MPC itself. Three external members of the committee are set to complete their terms on October 4, just days before the meeting. Their replacements have not yet been announced, raising concerns about the potential impact on decision-making. This situation is reminiscent of 2020 when delays in appointing new MPC members forced the RBI to postpone its scheduled meeting. The government’s delay in announcing these new appointments is generating anxiety, particularly as the outgoing external members have typically advocated for more dovish policies, often pushing for rate cuts in past meetings. Their successors' stance, which remains unknown, could affect the committee’s dynamic, but given the complexity of the issues at hand, it is unlikely they will have enough time to fully acclimate before the October meeting.

In addition to the uncertainty over MPC appointments, the looming expiration of Governor Das’s term in December, along with Deputy Governor Michael Patra’s term ending in January 2025, adds another layer of complexity. While no clear signals have been given regarding their reappointments, any change in leadership could potentially lead to shifts in the RBI’s policy direction. Under Das’s tenure, the RBI has focused on balancing inflation control with supporting economic growth. His departure could bring in a new governor with different priorities, potentially impacting the trajectory of monetary policy. However, we anticipate no significant policy shifts until these leadership transitions are resolved.

Moreover, domestic factors are weighing heavily on the RBI’s decision-making process. One such issue is the high Credit-Deposit (C-D) ratio, which reflects a mismatch between the rate at which banks are extending loans and the rate at which they are attracting deposits. The high C-D ratio, driven by robust retail lending, has raised concerns about the banking sector’s capacity to sustain credit growth without straining its resources. A reduction in interest rates could exacerbate this situation by stimulating further lending, thereby worsening the C-D ratio. Additionally, the erosion of household savings, partly due to inflation, has impacted consumption and could potentially slow down economic growth. These factors suggest that the RBI may prefer to maintain its current policy stance until there is more clarity on inflation and banking sector dynamics.

While the immediate outlook for a rate cut remains dim, we expect that the RBI could begin to pivot towards an easing cycle by December, provided inflation continues to trend down. In conclusion, while the RBI’s October meeting will be closely watched for signals of a shift in policy stance, the rates will remain unchanged for now. Inflation, though moderating, is still too volatile to justify a rate cut, and domestic economic conditions, particularly the C-D ratio and household savings, suggest that the RBI will continue to take a cautious approach.