U.S. May Retail Sales - Two straight declines as confidence slides

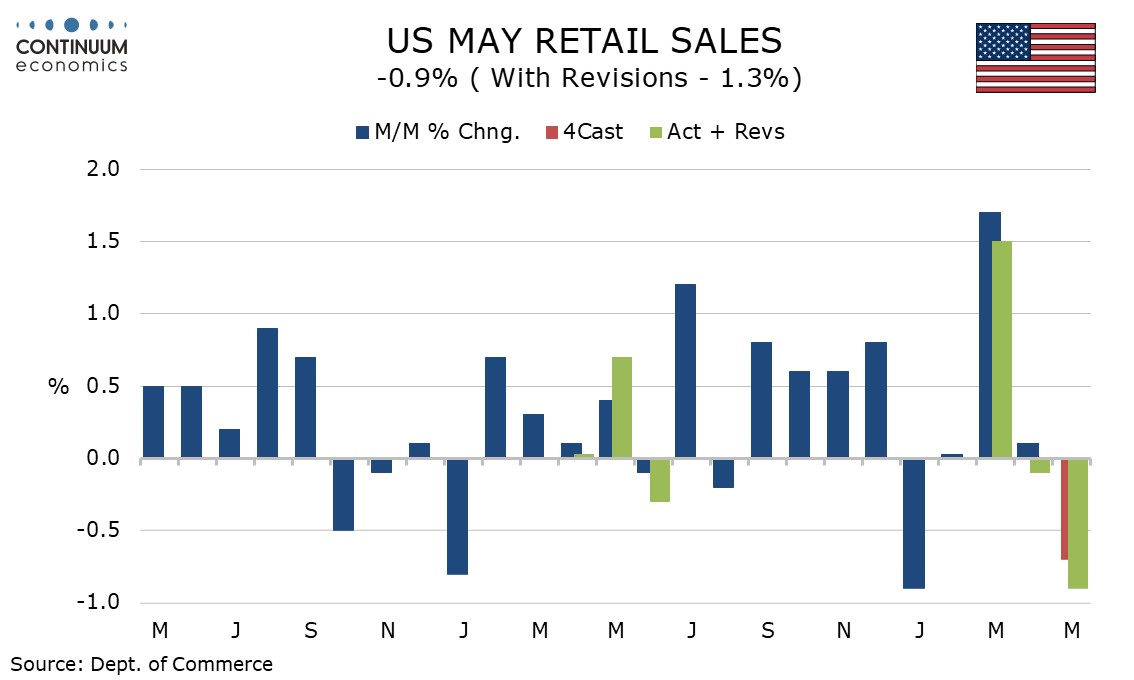

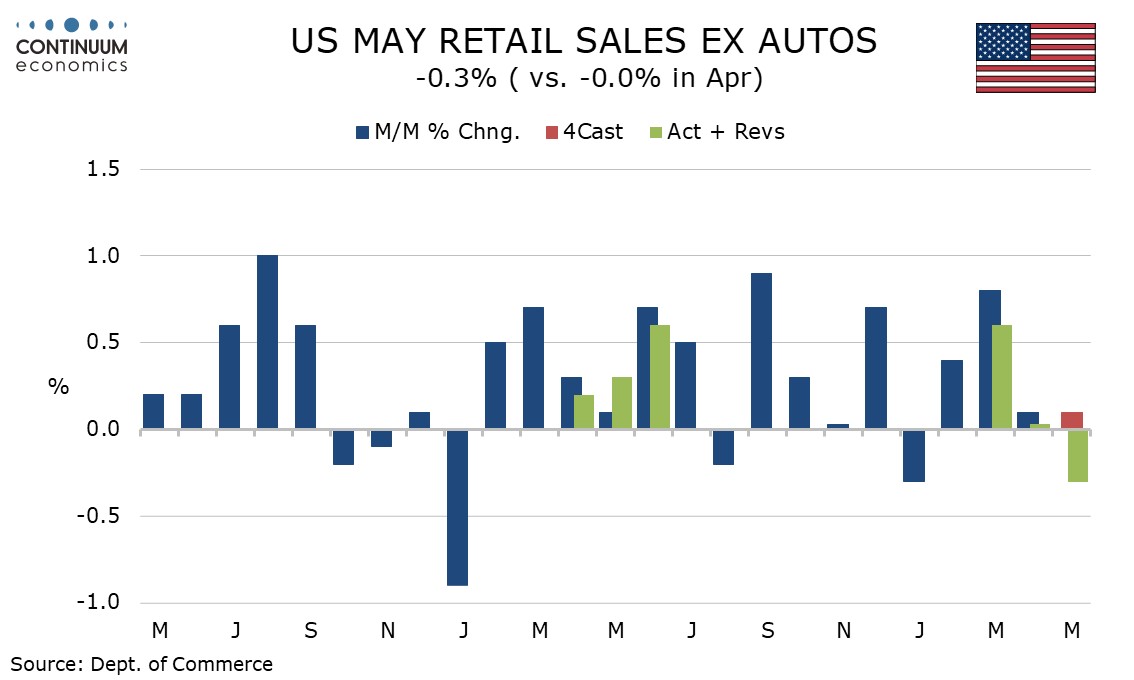

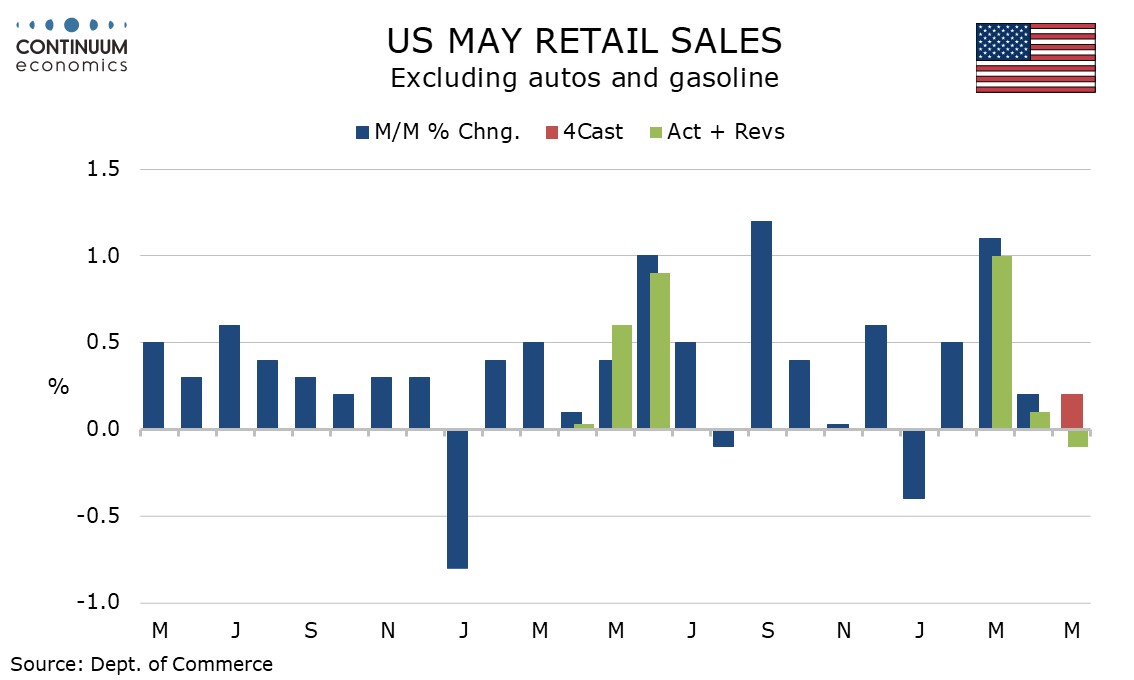

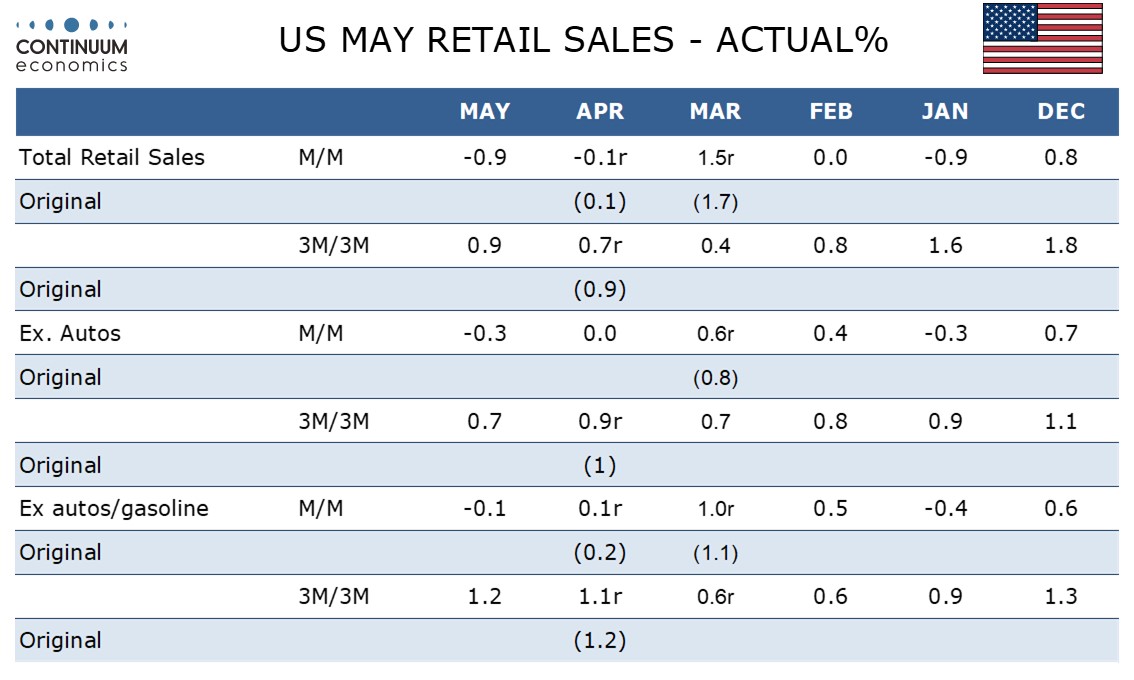

May retail sales with a 0.9% decline are slightly weaker than expected. The ex auto data at -0.3% and ex auto and gas at -0.1% are negative too, though the control group which contributes to GDP was resilient with a 0.4% rise.

Revisions are negative, March and April both revised down by 0.2%, to a 1.5% increase and a 0.1% decline respectively. Ex auto data has seen net revisions of -0.3% and ex auto and gasoline of -0.2%.

Slippage in May auto sales was already signaled by industry data while the negative from gasoline was signaled in the CPI.

In addition to autos and gasoline, negatives were seen in building materials, electronics, food, and food services. Clothing and furniture saw gains.

Sales plunged in January on bad weather but recovered strongly in March. Subdued data in Q2 to date appears to reflect declining consumer confidence. Confidence has picked up in June’s preliminary Michigan CSI but could be undermined by gains in gasoline if the Israel-Iran conflict persists.

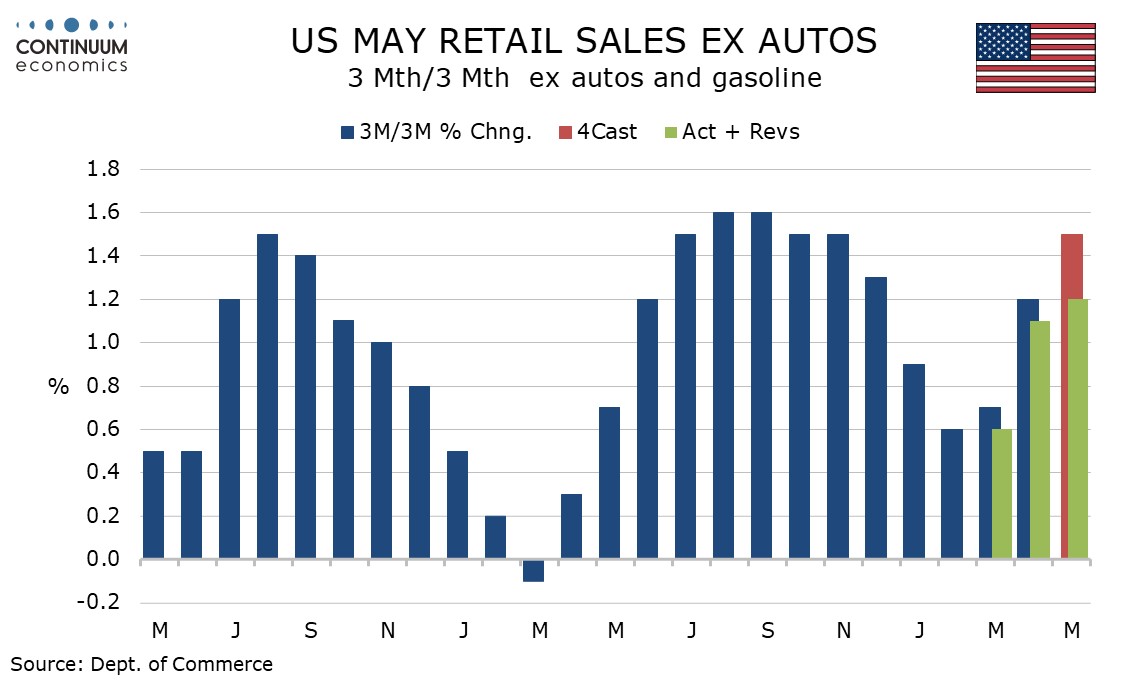

3 month/3 month data still look solid with gains of 0.9% overall, 0.7% ex auto and 1.2% ex autos and gasoline (not annualized), but unless there is a strong June Q2 data is likely to be less impressive as the strong March drops out of the comparison.

.