Inflation Heatwave: India's CPI and WPI Climb

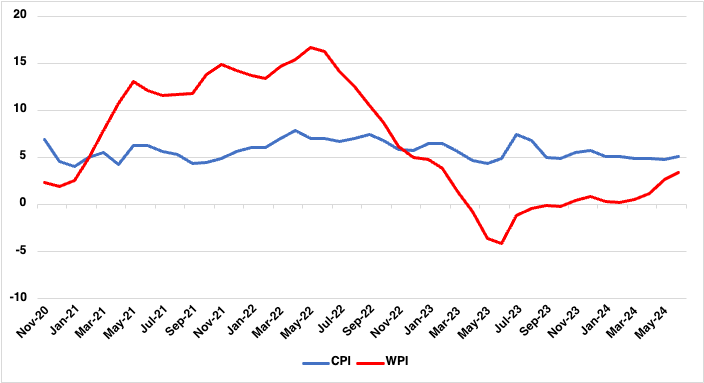

India's inflation surged in June with wholesale prices hitting a 16-month high at 3.36% y/y, driven by soaring food costs. The CPI also rose to 5.1% y/y, reversing a five-month decline, prompting caution from the RBI, which anticipates inflation to ease as seasonal factors stabilise. Governor Shaktikanta Das has indicated a cautious and tight monetary policy stance amid fluctuating food prices.

Volatile Food Prices Drive Price Surge

India's inflationary pressures surged further in June, as both consumer and wholesale price indices painted a picture of escalating costs, primarily driven by food price hikes. According to recent data released by the Ministry of Commerce and Industry, wholesale inflation reached a 16-month high, registering an of 3.36% yr/yr in June. This uptick follows a contraction of 4.18% recorded in the same period last year, marking a significant turnaround in pricing dynamics for manufactured goods and food items alike. The inflationary trajectory, particularly in the wholesale segment, was propelled by a notable surge in food prices. Vegetable prices, for instance, skyrocketed with inflation soaring to 38.76% in June, led by exorbitant increases in onion and potato prices, which saw rates of 93.35% and 66.37%, respectively. Pulses also witnessed a substantial rise, climbing by 21.64% year-on-year.

Figure 1: India CPI and WPI (% yr/yr)

Simultaneously, the Consumer Price Index (CPI), released by the Ministry of Statistics and Programme Implementation, revealed a rise in headline inflation to 5.1% yr/yr in June, up from 4.8% in May. This reversal in the CPI's downward trend over the past five months underscores the persistent inflationary pressures stemming predominantly from food prices. Rural areas experienced higher inflation at 5.7% yr/yr, compared to urban centers at 4.4% yr/yr.

The CPI's food price index surged to 9.4% yr/yr in June, driven by adverse weather conditions that affected crop yields across the country. Heatwaves and floods disrupted agricultural output, leading to substantial price increases in vegetables, fruits, and cereals. Despite some sectors such as household goods and services and health seeing slight moderation in inflation rates, overall consumer prices continued to feel the strain of elevated food costs.

RBI's Policy Response

The Reserve Bank of India (RBI), in its commitment to maintaining price stability, has been closely monitoring these inflationary trends. Governor Shaktikanta Das recently emphasized in interviews that while inflation has trended upward in June, this was expected and that the central bank views the current surge as transitory. The RBI anticipates inflation to ease as seasonal factors normalize, particularly with the advancement of the monsoon season, which traditionally alleviates food supply pressures.

Given these dynamics, the RBI has indicated a cautious stance on monetary policy adjustments. Despite inflation hovering above the RBI's medium-term target of 4%, a rate hike is deemed unlikely at this juncture, considering the central bank's assessment of inflationary pressures as temporary. Moreover, with global economic uncertainties and fluctuating commodity prices further complicating the economic landscape, Governor Das has refrained from providing forward guidance on potential rate cuts, emphasizing the need for data-driven decisions in the coming months.

India's latest inflation figures underscore a challenging economic environment characterized by surging food prices and cautious monetary policy responses. While the RBI remains vigilant in its pursuit of price stability, the trajectory of inflation will largely hinge on forthcoming developments in agricultural production and global economic conditions. We anticipate only a single rate cut in Q4 this year of 25bps.