South Africa’s Inflation Dips Below Midpoint Target with 4.4% YoY in August

Bottom Line: After inflation decreased to 4.6% YoY in July due to slowdown in costs for food, fuel, housing and transportation, the downward trend continued in August and CPI hit 4.4% YoY given suspended power cuts (loadshedding), a relatively stable Rand (ZAR), decrease in inflation expectations coupled with Fed about to start cutting rates. Taking into account that the inflation is now below the midpoint of target band of 3% - 6%, and August reading marks the lowest inflation print since April 2021, we expect South African Reserve Bank (SARB) to cut rates on September 19 by 25 bps to 8.0%, which will be the first rate cut since the regulator started raising rates in November 2021.

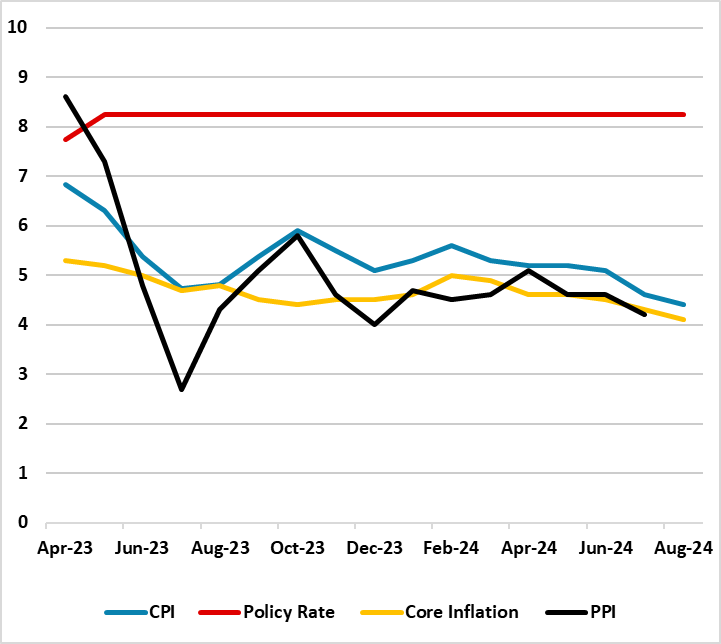

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – August 2024

Source: Continuum Economics

South Africa’s inflation cooled further off to 4.4% in August, and lower annual rates were recorded for transport, housing, and restaurants & hotels prices. According to StatSA, fuel prices also continued to trend downward, declining for a third consecutive month as the fuel index dipped by 0,5% MoM, slowing the annual rate to 1,8%. On the other side of the medallion, inflation for food & non-alcoholic beverages (NAB) and alcoholic beverages & tobacco edged higher in August.

On a monthly basis, consumer prices rose by 0.1% in August, following a 0.4% increase in July. The annual core inflation rate eased further to 4.1% in August from 4.3% in July, which is the lowest reading since May 2022. We think the further fall in CPI was supported by the suspended load-shedding, decrease in inflation expectations, relatively stable ZAR coupled with Fed about to start lowering borrowing costs, which is expected to loosen global financial conditions and potentially easing pressure on the ZAR, and hence on import prices.

On the power cuts front, South Africa’s national electricity utility company, Eskom announced on September 13 that load shedding remained suspended for 170 consecutive days since March 26, reflecting an improvement in the reliability and stability of the power generations coupled with new investments. This is a significant development for South African economy as the suspension helped businesses and households to relieve facing increasing costs from using alternative sources such as diesel backup generators, contributing at lower inflation figures. August inflation outlook was also helped by a relatively stable ZAR, which hovered around 17.8-18.3 against the USD.

Additionally, there has been a recent fall in the inflation expectations as well. According to the BER survey of inflation expectations 2024Q2 released in July, analysts, business people, and trade union officials all lowered their CPI inflation forecast for the entire three-year horizon. On average, they now anticipate inflation of 5.3% in 2024, 5.0% in 2025, and 4.9% in 2026 while their five-year inflation forecast fell below 5% (to 4.9%) for the first time since the fourth quarter of 2021. (Note: We continue to foresee average headline inflation will stand at 5.1% and 4.7% in 2024 and 2025, respectively).

Remaining optimistic, SARB governor Kganyago underscored on September 2 that sustained low CPI may spur rate cut, and added that MPC will only be comfortable lowering borrowing costs when inflation eases sustainably toward 4.5% as the bank is prudent rather than conservative.

As SARB intermittingly signalled that it plans to start cutting interest rates after the inflationary pressures are under control backed up by data and expectations, we foresee an end to SARB tightening on September 19, and SARB will likely decrease the rate from 8.25% to 8.0% given recent fall in inflation, suspended power cuts, deceleration in inflation expectations and a relatively stable ZAR. Our end-year policy rate prediction remains at 8.0% for 2024, and 7.0% for 2025. We believe the probable cut will be relief for the consumers facing high costs of loans, as well as the automotive industry and the property sectors which have been hard hit by the elevated interest rates. (Note: Of course, SARB could also decide to hold the key rate stable at 8.25% and remain cautious this time considering starting rate cuts during the next MPC meeting scheduled on November 21, but this is not our baseline scenario due to reasons mentioned above).

It is worth noting that inflationary risks remain due to the supply-side constraints like crisis at ports and rail network, geopolitical risks, and the U.S. presidential election in November, which shall be closely followed by SARB in Q4 and Q1 2025, before further rate cuts.