India CPI Review: Cooling Inflation - Will India’s RBI Shift Gears?

India's inflation cooled to 3.54% yr/yr in July, marking its lowest in nearly five years and slipping below the RBI's 4% target. With food prices driving the decline, the central bank may now consider a rate cut. However, future inflation risks remain amid uncertain monsoon patterns and global price fluctuations.

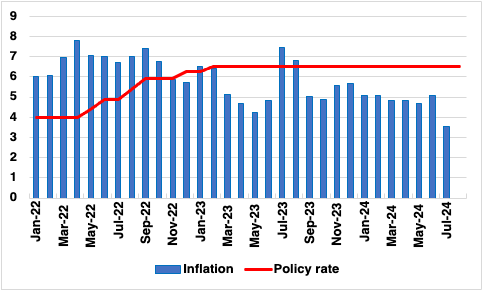

Figure 1: India Consumer Price Inflation and Policy Rate (%)

Source: MOSPI, Reserve Bank of India, Continuum Economics

India's Consumer Price Index (CPI) has offered a significant reprieve in July 2024, easing to 3.54% yr/yr, the lowest inflation rate recorded in nearly five years. This marks the first time since 2019 that inflation has slipped below the Reserve Bank of India’s (RBI) 4% target, a milestone achieved largely due to a sharp deceleration in food prices and high base-effects. With inflation now below the central bank's upper tolerance band, the prospects for a shift in monetary policy are becoming increasingly plausible.

A Detailed Look at the July CPI Numbers

The latest data from the Ministry of Statistics and Programme Implementation reveals a marked decline from June's 5.08% and the 7.44% recorded in July of the previous year. The reduction in inflation was primarily driven by the food and beverages segment, which saw a significant deceleration to 5.06% yr/yr, down from the double-digit increases witnessed in previous months. The most notable decline was observed in the prices of vegetables, fruits, and spices, subgroups that have historically been volatile and sensitive to seasonal factors.

Rural and urban inflation rates were 4.10% yr/yr and 2.98% yr/yr, respectively, underscoring a more pronounced easing of price pressures in urban areas. The CPI for fuel and light recorded a staggering negative inflation of -5.48% yr/yr, reflecting the global decline in energy prices and subdued domestic demand.

The July inflation data has reinforced market expectations that the RBI may reconsider its monetary stance. Although the central bank has kept the repo rate unchanged at 6.5% for nine consecutive policy meetings, the recent drop in inflation could prompt the Monetary Policy Committee (MPC) to either cut rates or shift to a more accommodative stance in its upcoming October meeting. RBI Governor Shaktikanta Das had reiterated the central bank’s commitment to ensuring price stability while supporting economic growth in the August meeting. The inflation outlook for the remainder of 2024 remains finely balanced. The RBI’s August projections for FY25 anticipate inflation to average 4.5%, with quarterly expectations set at 4.4% for Q2, 4.7% for Q3, and 4.3% for Q4. The central bank's cautious stance reflects uncertainties around global commodity prices, potential supply chain disruptions, and the domestic monsoon’s performance.

Factors Influencing Future Inflation

Looking ahead, several factors could impact CPI in the coming months. First, the performance of the southwest monsoon will be critical. The Indian Meteorological Department (IMD) has predicted above-normal rainfall for the August-September period, which should bolster the kharif crop yields and ease food prices further. However, any deviation from this forecast, such as flooding or erratic rainfall, could disrupt agricultural output and lead to renewed inflationary pressures, particularly in perishable items. Second, global commodity prices, especially for oil, will play a significant role. While global food prices have shown signs of easing, geopolitical tensions and supply constraints could reverse this trend, adding to domestic inflationary risks. Additionally, the pass-through of higher global prices to domestic markets could be exacerbated by currency fluctuations, given India's reliance on imports for several essential commodities. Furthermore, the latest tariff hikes for telephone will also work into the headline number.

Lastly, core inflation, which excludes volatile food and fuel prices, will need to be closely monitored. While core inflation has moderated, sustained pressure from sectors such as housing and services could limit the scope for any significant easing in overall price levels.

Outlook

The sharp decline in inflation to below 4% is a positive development for India’s economy, providing much-needed relief to consumers and bolstering the RBI's credibility in maintaining price stability. However, the path ahead remains uncertain. We anticipate headline inflation to rise in Q3 before declining again in Q4 2024. The next few months will be crucial in determining whether the current disinflationary trend continues or if latent risks push inflation back towards the upper tolerance band. In our view, the RBI will only cut interest rate once this year in Q4 2024 by 25bps.