South Africa’s Inflation Stayed Stable at 5.2% in May

Bottom Line: According to the inflation figures announced by Department of Statistics of South Africa (Stats SA) on June 19, the inflation held steady at 5.2% YoY in May, unchanged from April due to suspended power cuts (load shedding) coupled with unchanged food and non-alcoholic beverages (NAB) prices while inflation remained some way off from the 4.5% midpoint of target band of 3% - 6%. Taking into account that South African Reserve Bank (SARB) has repeatedly noted that it will not start a cutting cycle until inflation is under control and remained concerned over elevated inflation expectations, we foresee the first rate cut could happen in Q4, which could be further delayed to Q1 2025, as we envisage the new coalition will be weaker at least for some time, and less able to undertake necessary fiscal reform policies abruptly and deal with power cuts (load shedding) in the near future.

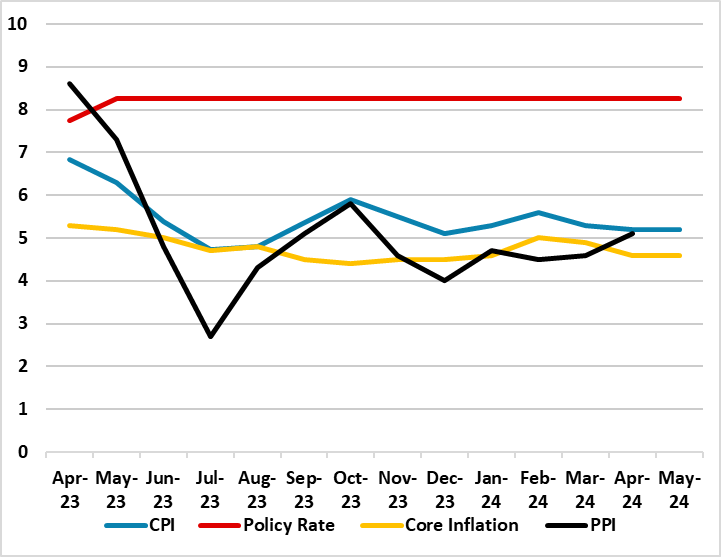

Figure 1: Policy Rate (%), CPI, PPI and Core Inflation (YoY, % Change), April 2023 – May 2024

Source: Continuum Economics

South Africa’s inflation stayed unchanged at 5.2% YoY in May, partly due to food & NAB prices remained steady at 4.7%, unchanged from April. Additionally, inflation was softer for miscellaneous goods & services, communication, clothing & footwear, health and restaurants & hotels. On a monthly basis, inflation was at 0.2% in May softer than the 0.3% rise a month before. Annual core inflation stood at of 4.6% in May, unchanged from the prior month.

On the other side of the coin, inflation in May was driven by higher prices of transportation, the highest rate for the category since October 2023. Fuel was the major culprit, with petrol and diesel prices increasing on average by 9.3% over the last 12 months (and by 0.6% since April 2024).

There was particularly good news from the load shedding front in May, strongly supporting May reading. After Stages 2 and 3 load shedding was implemented broadly in March with the available generation capacity was largely sustained, Eskom announced on June 14 that that load shedding remained suspended for 79 consecutive days, reflecting an improvement in the reliability and stability of the generation coal fleet. This period of stability is the longest since the stretch from July 23, 2021, to October 6, 2021.

Despite inflation held steady in May, we think risks to the inflationary outlook remain strong. According to the last Monetary Policy Review Report released by SARB, the risk of higher inflation still remains, and the return of inflation to the midpoint of the target band (4.5%) is only expected in the last quarter of 2025. Taking into account that SARB Governor Kganyago repeatedly stressed that SARB will wait for inflation to slow to the midpoint of target range before policy is adjusted, we expect SARB will likely keep the rates unchanged at 8.25% on the next MPC meeting on July 18.

We think the first rate cut could happen in Q4, which could be further delayed to Q1 2025, as we envisage the new coalition will be weaker at least for some time, and less able to undertake necessary fiscal reform policies abruptly and deal with power cuts (load shedding) in the near future.