China RRR and Rate Cuts

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bps reserve requirement ratio (RRR) cut rather than cutting key official interest rates.

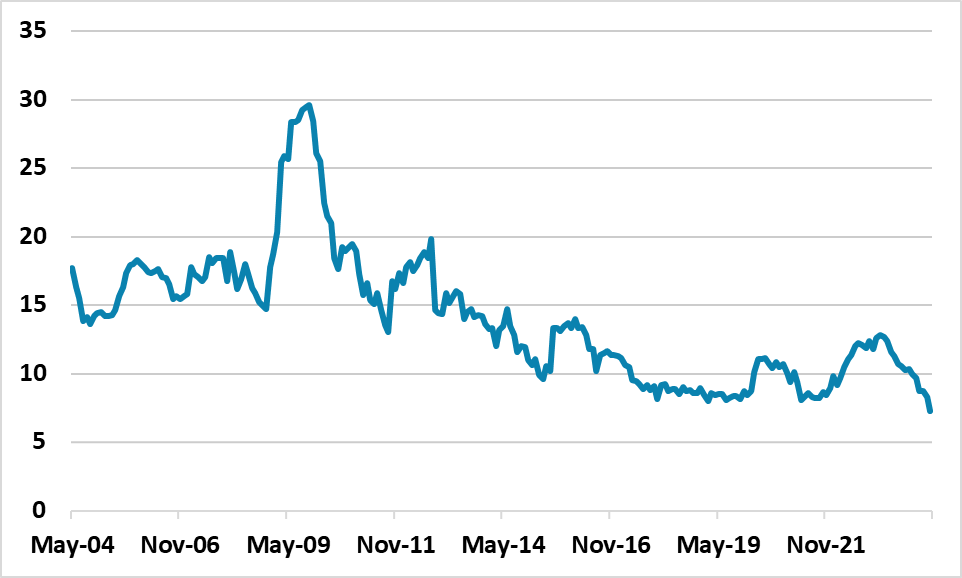

Figure 1: China M2 Growth Yr/Yr (%)

Source: Continuum Economics

Speculation about further monetary policy easing is growing for a number of reasons.

· Politburo signals. The late April Politburo meeting signalled that more use will be made of monetary policy tools including RRR and interest rates. Inflation is not a constraint with the April CPI data over the weekend showing 0.3% Yr/Yr and the core rate at a still subdued +0.7%. The market expectation had been that RRR would be more favoured, as China authorities would still likely be slow in cutting interest rates on fears that it could hurt the Chinese Yuan (here).

· New Tariffs and the Yuan. However, the Biden administration is threatening to increase tariffs on China electric vehicles (EV) and in 2018 China allowed a quick Yuan decline to offset increase tariffs from President Trump. The desire to slow/stop the Yuan decline could be less, if these EV tariffs are increased.

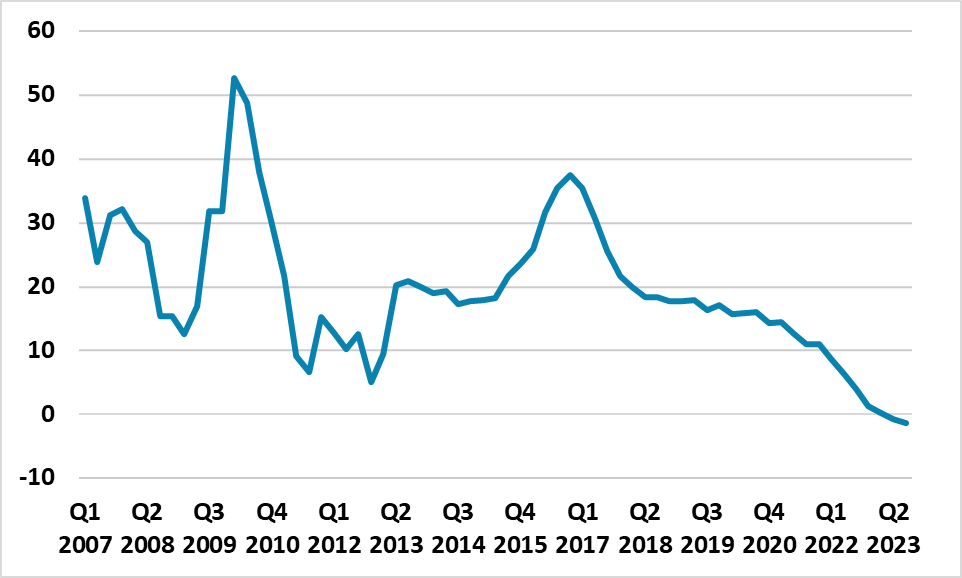

· RRR for credit supply and Interest rates for credit demand. The latest M2 (Figure 1) and total social financing figures have highlighted that credit demand is weak. Though China authorities have cut RRR to boost lending and encouraged consistent lending growth, lack of private sector credit demand is a big issue. Mortgage lending has turned negative, which shows a deep negative attitude of China households reluctance to take out new mortgage loans (Figure 2). China is planning to starts issuing special sovereign bonds Friday May 17 for the Yuan1trn central government infrastructure program, but also needs to do something to boost credit demand. Big game changers in the property sector remain unlikely (here). This could mean that the authorities are willing to cut interest rates instead. A cut to 5yr loan prime rate (LPR) without cutting 1yr Medium term lending facility rate (MLF) is possible like Q1, but we would feel that a 10bps MLF cut is likely in June/July with similar cuts in the 1 and 5yr LPR rates. The next step will likely be a 25bps RRR cut as soon as May.

Figure 2: China Household Mortgage Lending Growth Yr/Yr (%)

Source: Datastream