U.S. January Employment - Stronger across the board, will keep Fed in no hurry to ease

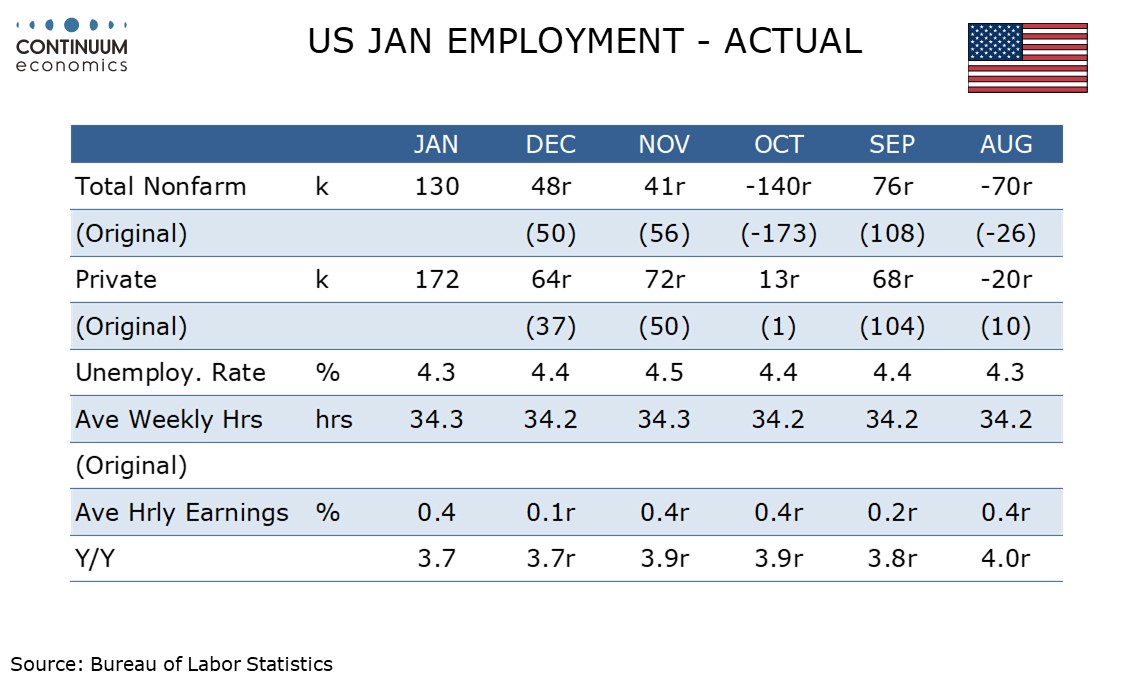

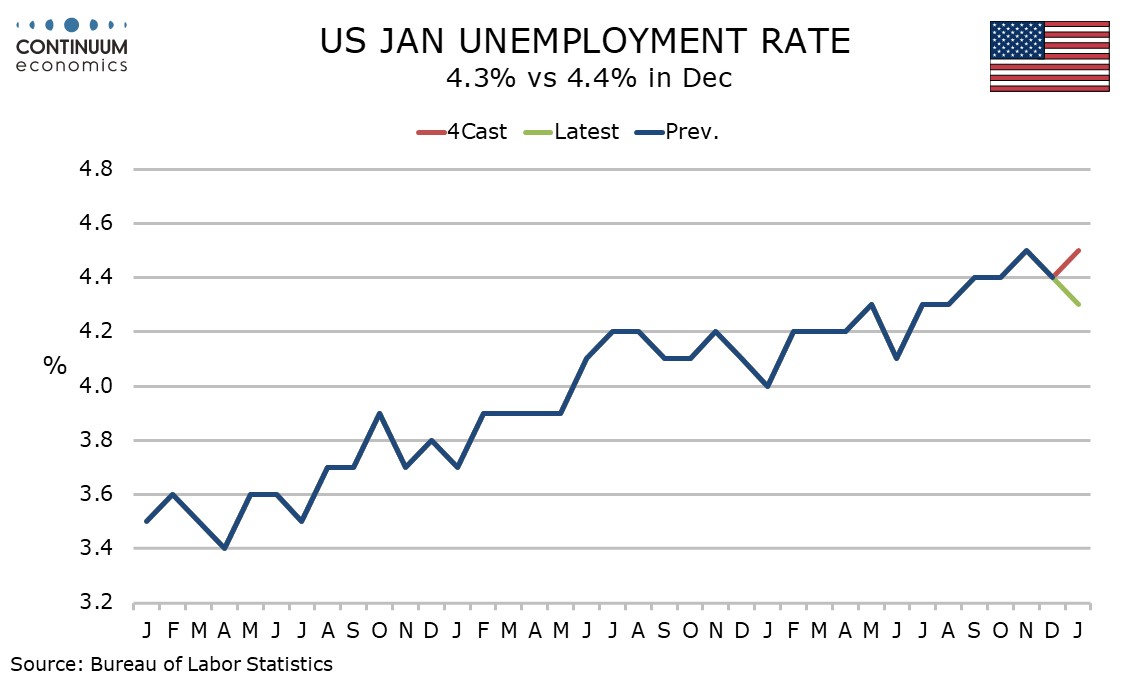

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger than expected across the board. This should ensure the Fed remains in no hurry to ease.

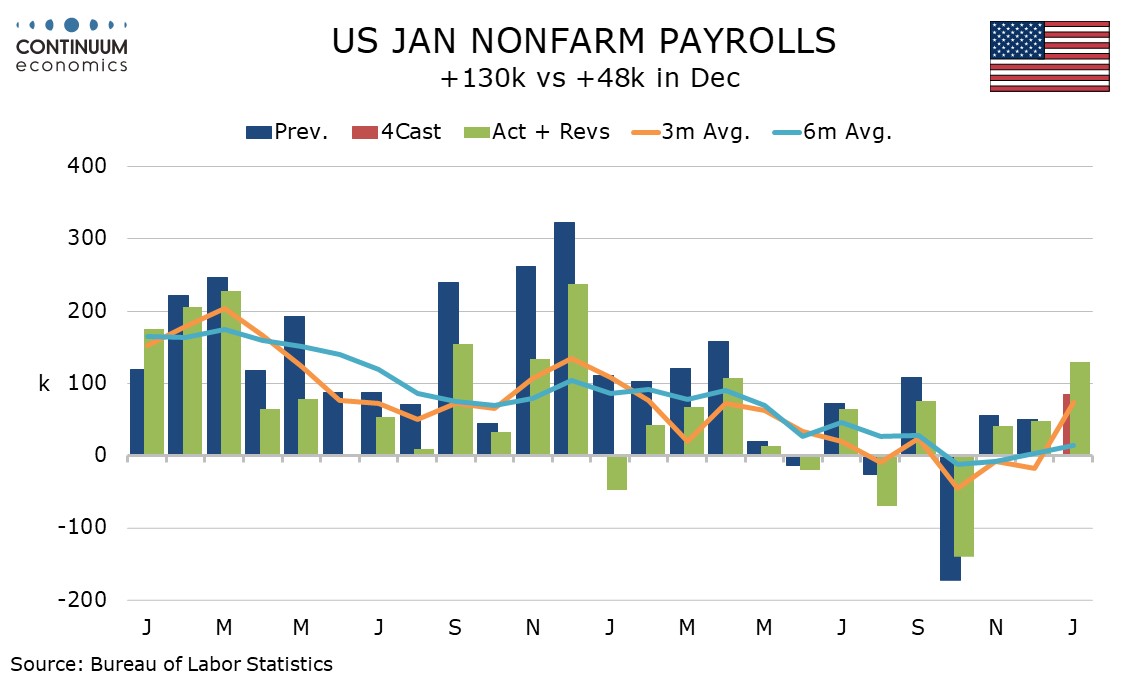

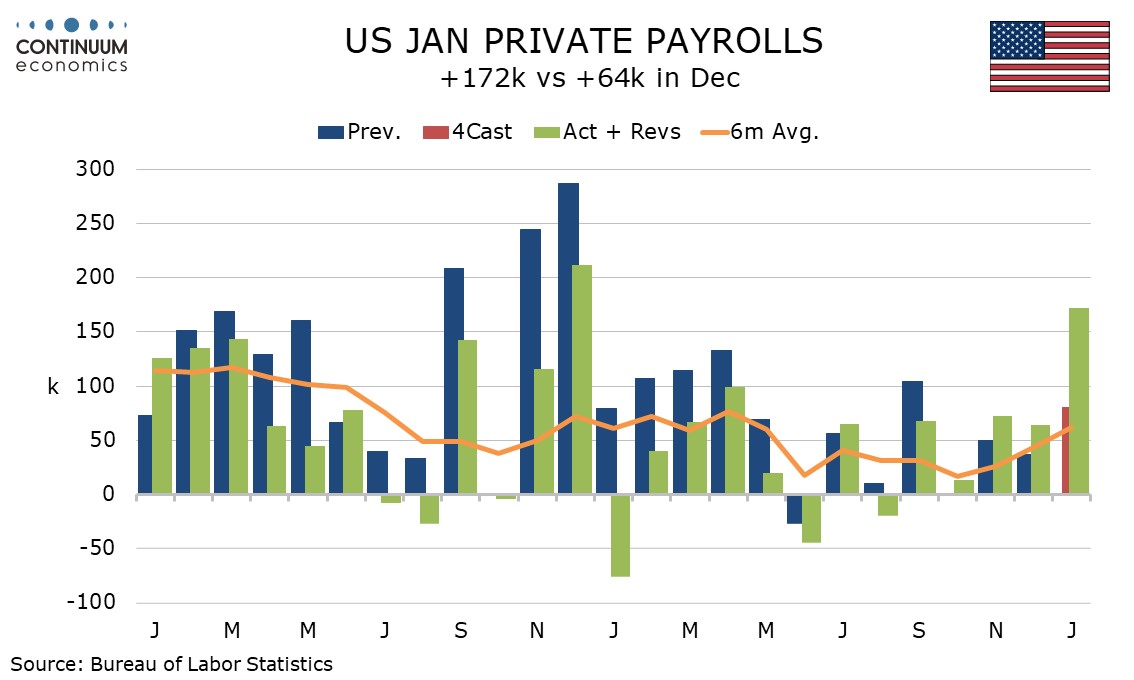

This report contains annual historical revisions with the March 2025 benchmark revised down by 862k, in line with signals already given by the Labor Dep‘t. Since March 2025 revisions are relatively modest, totaling a negative 131k, with 50k of that coming in April 2025. December’s data was revised down by only 2k to 48k with private sector data revised up to 64k from 37k. The revisions do not take much away from the surprisingly strong January detail.

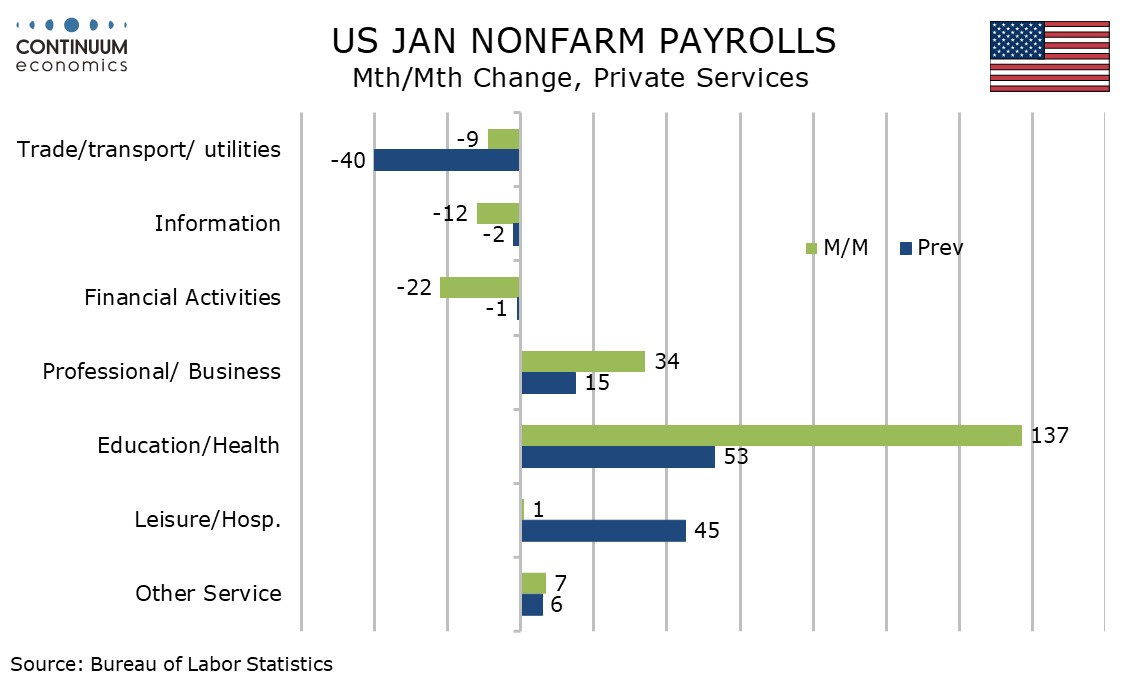

January saw some severe weather late in the month but this came after the reference survey and did not impact the non-farm payroll. The payroll gain was more than fully explained by a 137k increase in education and health, the strongest sector in most recent payrolls but particularly strong this month. 123.5k of that came in health.

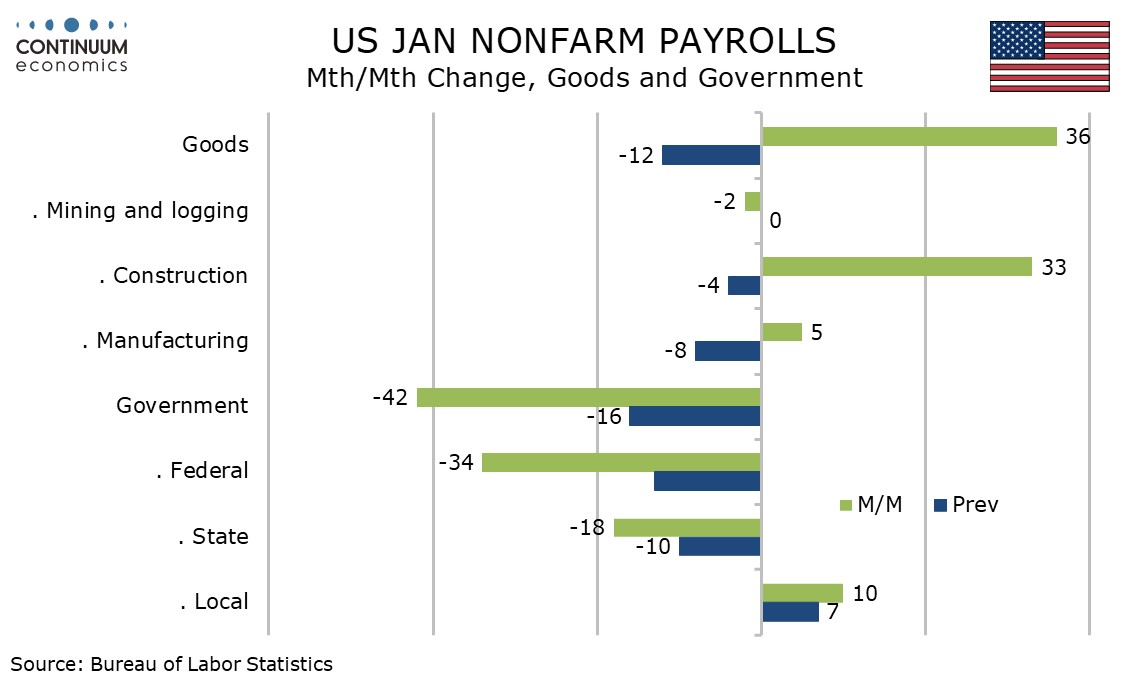

Also above trend was construction at 33k while manufacturing managed a 5k increase, its first in over a year. Professional and business was above trend at 34k but financial was weak at -22k. Retail, a sector where we had seen upside risk after recent slippage, was almost unchanged, up by 1k. This follows a disappointing December retail sales report. Government fell by 42k, led by a 34k decline in Federal.

For private payrolls the 3-month average of 103k is at a 12-month high and the 6-month average of 61.5k is the highest since April 2025. After the recent revisions, trend in private payrolls turned below 100k in mid-2024 but has subsequently been fairly stable, remaining above zero.

January is a month where seasonal adjustments are strongly positive, with payrolls falling by 2.649 million before seasonal adjustment. The seasonal adjustments are appropriate, but in an environment where both hirings and firings are low, a month in which large numbers of firings are assumed has upside risk in seasonally adjusted data. A lack of the usual seasonal hirings could bring weak seasonally adjusted data in the spring.

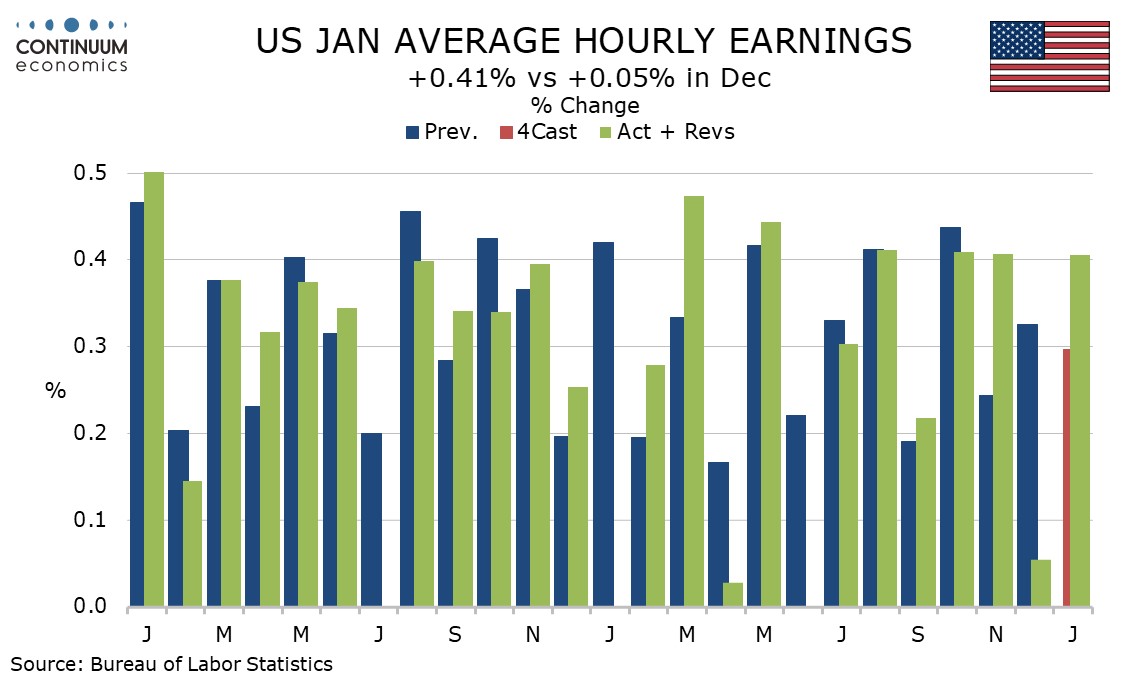

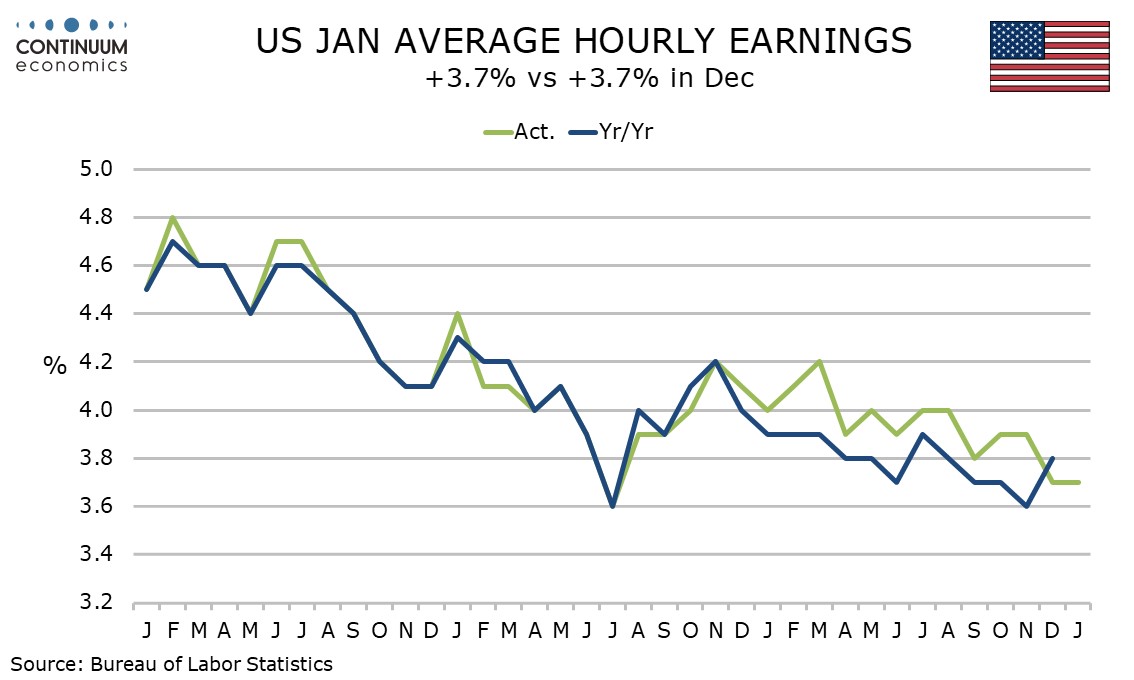

We would not make too much of an above trend 0.4% increase in average hourly earnings, with December revised down to 0.1% from 0.3%. Yr/yr growth is unchanged from December at 3.7%, with December revised down from 3.8%. Still, revisions to yr/yr growth through most of 2025 are positive.

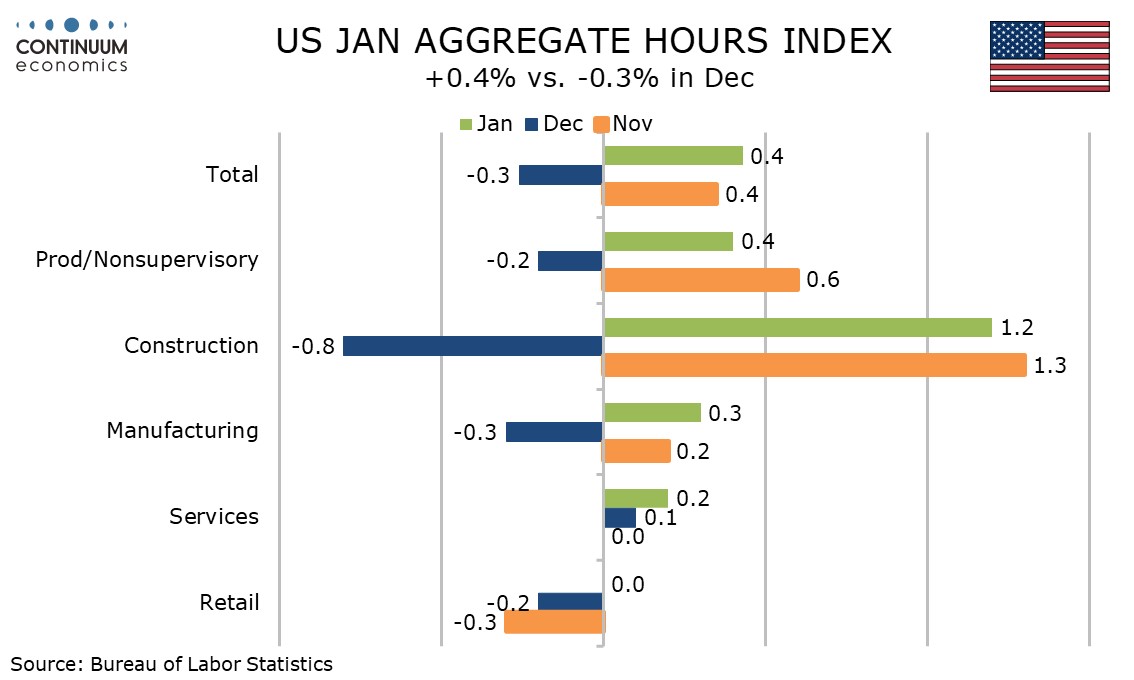

The rise in the workweek saw aggregate hours worked up by 0.4%, more than fully reversing a December dip, with the increase led by a construction at 1.2%. Manufacturing at 0.3% and private services at 0.2% saw modest gains.

The details of the household survey that calculates the unemployment rate are strong, with employment surging by 528k, exceeding a healthy 387k increase in the labor force. The data may be a little less reliable than usual with bad weather causing a lower than usual response rate. The response rate for the establishment survey, which calculates the non-farm payroll, was in contrast normal.

Usually January data sees annual population control adjustments to the household survey, but after recent shutdowns this has been delayed to the February report. Given changes to immigration, the population control adjustment could be more significant than usual when they are released next month.