ECB Preview (Dec 12): Flagging An End to Policy Restriction

While a larger move is possible, we think that the ECB will instead opt for a fourth 25 bp discount rate cut at this month’s Council meeting, to 3%. But this meeting may be as important for what may be a change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough to end policy restriction in due course. In this regard, the first glimpse of 2027 economic projections may support this as they may point to a second successive year of around-target inflation. But with the growth outlook for 2025 also likely to be pared back, we think this transition will involve four 25 bp cuts in H1 next year, with an ensuing around-neutral 2% policy rate. But it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026.

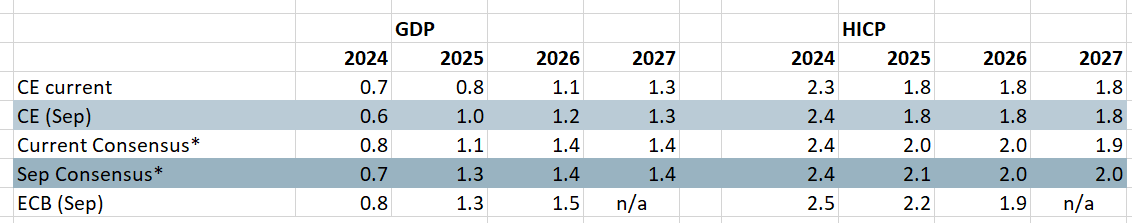

Figure 1: The ECB Outlook in Perspective

Source, Bloomberg, ECB, CE

Gauging Neutrality Amid Guidance Transition

Regardless. this meeting may see a major change in forward guidance. Indeed, and as Chief Economist Lane suggested in an interview this week, this would entail a transition in guidance moving from what hitherto has been backward-looking by being data-dependent to being forward-looking in assessing incoming risks. This should facilitate easing the current restrictive policy stance to one being around neutral. Admittedly, what constitutes neutral varies over time and according to alternative assessments. Notably, according to some ECB hawks, the anticipated 25 bp move this month would constitute policy being at least at the upper end of a range of neutral estimates. This contrasts with the more dovish ECB thinking as highlighted by BoF Governor Villeroy who has pointed to a neutral estimate between 2% and 2.5%. And somewhere in the middle there is also thinking that there may have been a bit of an upward movement in this underlying real interest rate but, albeit probably most of it being cyclical, possibly a result of a recent rise in government deficits reducing the saving/investment balance.

But, if so, this may reverse. Indeed, we suggest it is possible that amid a continued sub-par growth outlook into 2026, and where a shift in the savings balance caused by a continued drift higher in precautionary savings alongside uncertainty deterring investment, may ultimately persuade the ECB to revise down its neutral policy assessment. Then this may create scope, if not rationale, for further easing into 2026. In particular, talk, let alone the reality of tariff or non-tariff measures, would be negative for investment and could accentuate precautionary savings motives. In terms of domestic demand, this would be disinflationary and suggest a fall in the neutral policy rate.

Revised Projections and First Sight of 2027 Thinking

But while these issues will be discussed at the December Council meeting, the dominant theme will be the extent to which downside growth risks have turned into reality. Indeed, preserving growth does seem to have become the ECB policy priority, not least against a backdrop of weak business survey data highlighting both fresh stagnation risks and much reduced cost pressures that could even suggest a contraction in GDP this quarter. Admittedly, not all signs are negative. There is the potential boost of the recent build in household savings and the indications that rate cuts have already stared to boost credit demand according to bank lending surveys and even some signs of a recovery on the consumer side, albeit confined to volatile retailing, not services.

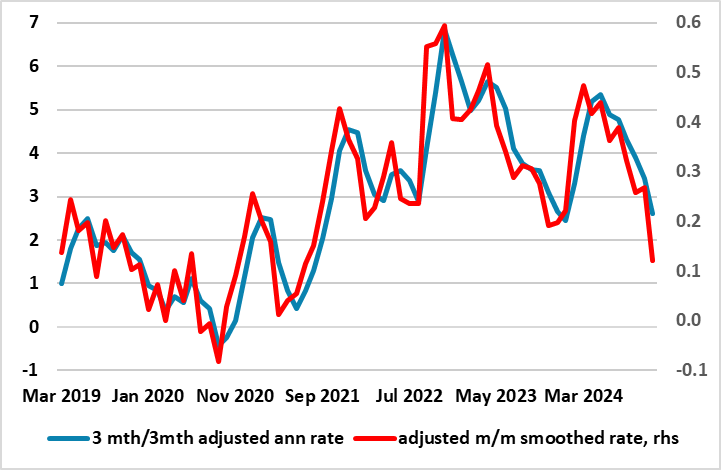

Figure 2: Services Inflation Slumping?

Source: Eurostat, ECB, CE

However, the downside risks are the ones the ECB will prioritize, especially as (even according to its own recent Financial Stability Review, they could fan financial instability issues, the latter already building in France’s ever clearer political impasse and policy vacuum. Thus we see a clear downgrade to the 2025 ECB growth outlook, although maybe not significantly at this juncture given Chief Economist Lane’s recent assessment of the EZ economy backdrop as being some 6 out of 10! But we know that the 25 bp rate cut from the ECB in October was seemingly driven by a reassessment which implied inflation hitting target durably to be in the course of next year as opposed to late 2025 as suggested in the September projections. This is likely to be formalised this time around with fresh actual projections but very likely to at least echo existing ones which even saw the core HICP rate nudging under target by late 2026.

In this regard, this projection update will see the ECB offer its first glimpse of 2027 and where it seems likely that the inflation forecast(s) will see a sustained picture around target. Indeed, there could be an undershoot given any extrapolation from recent data that may calm any hawkish worries about apparently resilient services inflation. Indeed, while services inflation in the just-released flash was little changed at 3.9%, more up-to-date (ie short-term) measures show a completely different story with adjusted m/m figures not only consistent with being below target but also back to a pre-pandemic pace (Figure 2). With this in mind, the ECB this month has to ask itself whether such soft inflation signals are not just an indication of the target being met early and durably but are as much a further symptom of economic weakness.

Admittedly, offsetting this downside risk to the inflation outlook, is the boost to the economy from implied ECB easing. With this revised outlook being based on market interest rate thinking, it is possible the projections will not fully endorse the fall in the deposit rate to well below 2% now being discounted. But the thrust of projections into 2027 will surely support the suggestion that headline and even core inflation are now see staying around, if not below, target on a sustained basis. If so, then the ECB now only can, but should start to be more forward looking and allow policy to be both more neutral and forward-looking.