Eurozone: Sobering Services and Domestic Demand News is Food for ECB Doves

The fact that EZ growth was revised down a notch to 0.2% in Q2 is of little importance – it partly reflects a small recovery in imports that we have been flagging for some time would be a likely break on recorded activity. Over and beyond more signs of slowing wage pressures in Q2 data, more notable was the fact that two-thirds of the cumulative GDP growth of the last year was from government spending. This still failed to prevent EZ domestic demand from falling of the third quarter in four in Q2, something more likely to persist given added pressure for fiscal consolidation given budget deficit overruns in many economies could reverse government spending increases. But more worrisome is the clearer sign of already faltering activity given signs in monthly official and survey data that services output (which has been the mainstay of recent EZ GDP growth) has started to decline. Given sobering news for early-Q4 reported today in terms of manufacturing output, the risk of fresh q/q GDP drop this quarter is therefore real and growing.

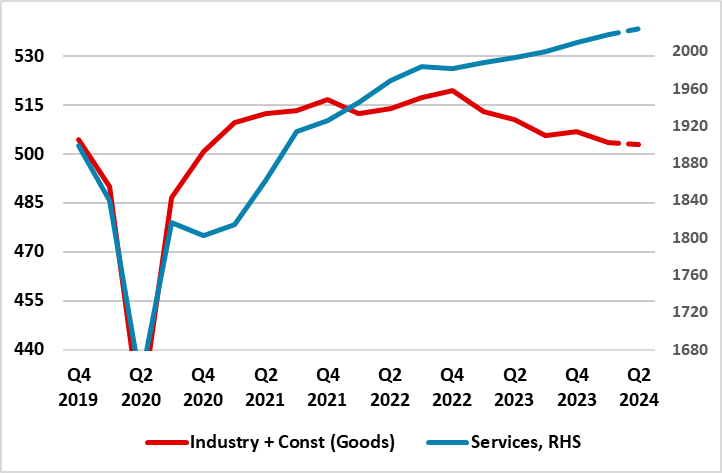

Figure 1: Divergent Sector Performances Within EZ GDP Picture

Source: Eurostat, € billions

Diverging Sectors…

The EZ economy has been seeing downside risks but ones that may now be materializing. The fact that growth rates among the EZ main economies have diverged of late (Spain robust, Germany contracting afresh) actually reflects a marked and very unusual disparity in growth rates between strong services and persisting declines in goods output, this evident in both survey data as well as official national account data (Figure 1). Indeed, services output has risen for six successive quarters a period when manufacturing has fallen successively. In itself this is not troubling, not least as services (an average of around 70% of GDP) are a far more sizeable component of GDP, but where the stronger economies have a relatively higher share.

…Abut to Converge?

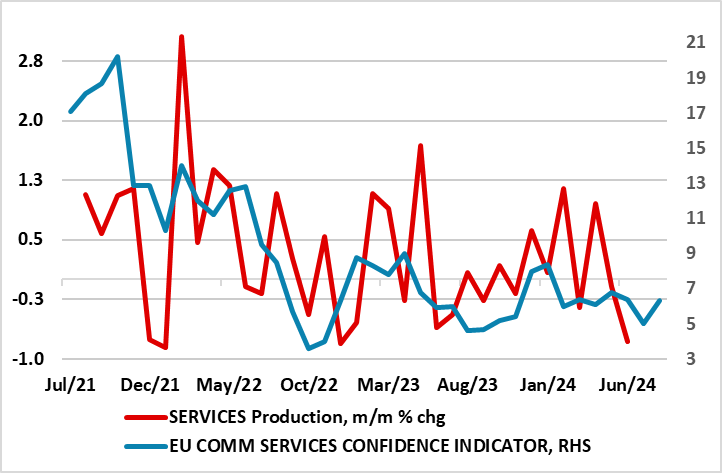

But recent survey data have been suggesting weaker activity, and now including services to a degree that imply that the support the sector has given the whole EZ economy through H1 this year may have dissipated, if not reversed. This threat seems to have materialized given recent innovative official data on services output fell in June for the third month in four. The result is that although an April spike in services production (possibly skewed higher by the timing Easter), still meant that Q2 services production rose, very unfavourable base effects pose clear risks to current quarter GDP. Indeed, unless services output rise by an average of 0.2% m/m each month this quarter (ie an annualised pace not seen since he emergence from the pandemic), then services will now detract from activity, suggesting a real and growing risk of fresh q/q in Q3 GDP – we now see a 0.1% q/q drop.

Domestic Weakness Clearer

But there is also continued reassuring news on price and wage pressures. Following on from the sharp slowing in recently-reported Q2 negotiated wage data, the ECB’s favoured measure of EZ wage pressures eased last quarter too, slowing to 4.3% y/y in the second quarter — down from 4.8% and well below the 5.1% pace that current ECB projections envisaged. And you would think that any fresh GDP correction would only add to such disinflationary signs.

Figure 2: Survey Data Suggests Weaker Services Output

Source: Eurostat, European Commission

This should be the case and particularly if this is based around weak domestic demand. But such weakness is already the case. Domestic demand fell 0.3% q/q in Q2, the third fall in four quarters, a period showing a cumulative drop of close to 1%. Much of this reflects inventory destocking, but the latter has also been behind the drop in imports that has helped bolster recorded GDP. But survey data do not suggest companies further wish to reduce inventories voluntarily – fresh destocking may need a demand shock! We are not seeing such a shock but would note that the support from government spending to the economy over the last year (responsible for two thirds of the cumulative 0.6% GDP growth) is not only unlikely to persist but may reverse amid the fiscal consolidation pressures caused by such large budget deficit overshoots.

Food for the Doves

All of which will be sobering food for thought for the ECB who apparently have already had some misgivings about what some Council members think are over-optimistic GDP expectations. We would concur with these doubters, seeing GDP growth of 0.6% this year compared to the ECB’s 0.9% and with downside risks from both net trade and already faltering domestic demand. We think that this may mean that real economy consideration may start to rival inflation as ECB policy considerations, not least as the trend-type GDP outlook the ECB envisages is almost solely base around solid domestic demand growth.