UK CPI Review: Inflation Below Target – BoE Hawks Placated?

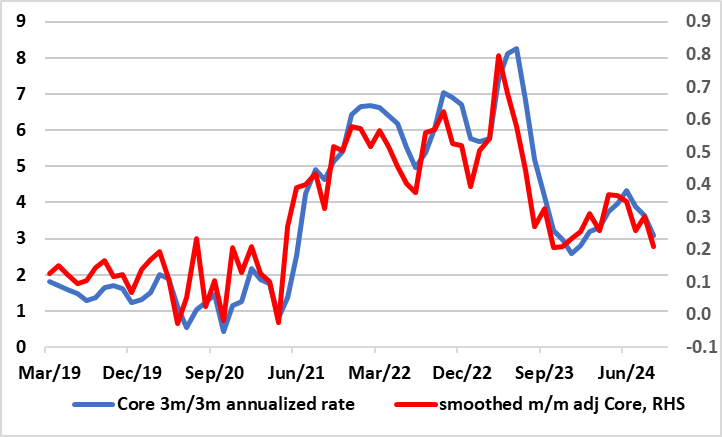

Helped by a fall in fuel prices and airfares, amplified by base effects, alongside some belated broader softening in services costs, UK inflation dropped to 1.7% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. This drop was greater than expected and included an unexpectedly large fall in services inflation to a 28-mth low of 4.9%, in turn dragging the core down 0.4 ppt to a cycle low of 3.2% (Figure 1). Admittedly, the drop in the headline is likely to be short-lived as this month’s rise in the energy price cap and a recovery in airfares should pull the headline rate back to around 2.2% in October and average a little higher for the whole of Q4. Regardless, the data backdrop is consistent with underlying inflation having fallen, especially when assessed in shorter-term dynamics (Figure 2) but with still some services stickiness. As such a CPI picture, now weaker than BoE thinking, should make the much-vaunted Bank Rate cut at the looming November MPC meeting almost a given. But as for a possible further mover as soon as the December MPC meeting this is still a possibility, but a growing one, even given apparent splits within the BoE hierarchy as real economy risks emerge afresh.

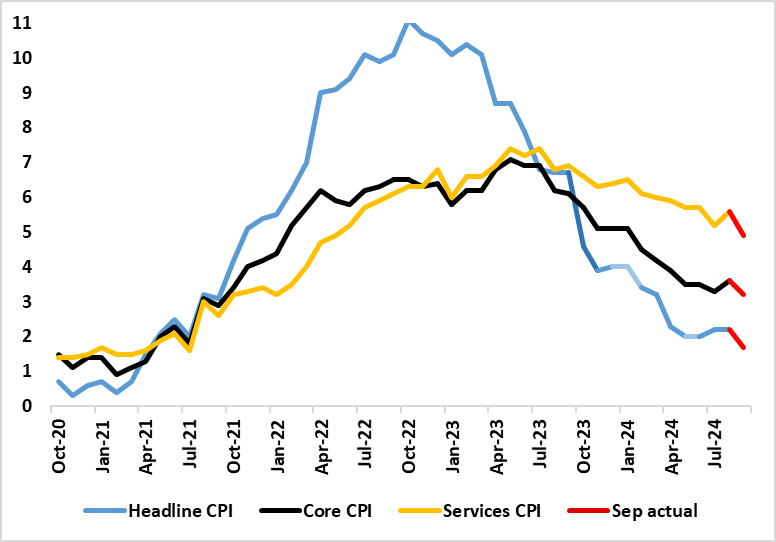

Figure 1: Clear and Broad Inflation Drop?

Source: ONS, Continuum Economics

The Consumer Prices inflation was 1.7% in the 12 months to September 2024, down from 2.2% in August. On a monthly basis, CPI was little changed in September 2024, down from a rise of 0.5% in September 2023. The largest downward contribution to the monthly change in CPI annual rates came from transport, with larger negative contributions from air fares and motor fuels; the largest offsetting upward contribution came from food and non-alcoholic beverages. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.2% in the 12 months to September 2024, down from 3.6% in August; the CPI goods annual rate fell from negative 0.9% to negative 1.4%, while the CPI services annual rate fell from 5.6% to 4.9%. The drop came in spite of a pick-up in food inflation while the drop in services inflation was broad enough to convince even the BoE hawks that apparent price resilience is starting to ebb; one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence.

BoE Debate Less Acute?

This is likely to encourage the kind of thinking that triggered BoE Governor Bailey’s recent interview in which he hinted that the BoE could be more aggressive in its easing cycle ahead, not least from the better signs in underlying services. The headline measure of services inflation has been driven mainly by volatile and indexed categories of late, so the MPC has built a gauge that excludes those categories and this has seemingly fallen more markedly and now for a few months in a row but maybe not enough to place the hawks completely. But this has not persuaded his colleague and BoE Chief Economist Pill from citing policy caution ahead, with an apparent very open split emerging between the two principal members if the MPC about how gradual a rate easing cycle may be. But amid a much sifter inflation backdrop now emerging, albeit one we have stressed as being likely, it may actually be real economy matters that determined the pace of BoE easing ahead.

Figure 2: Adjusted Core CPI Pressures Falling Afresh

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

This split is very unlikely to prevent a rate cut next month, but if this involves another formal dissent from Pill, then a further easing in December would be more problematic. Indeed, the question is for how long could Pill formally dissent against an MPC majority, especially as his recent speech seemingly questioned the validity not only of the BoE’s formal CPI projections but also some of the assumptions that his MPC colleagues had agreed (most notably whether the neutral policy rate has risen of late or not). Of course, other considerations will be important, not least the extent and speed to which other DM central banks may ease policy. This is linked to downside growth risks, which may be spilling over to the UK somewhat sooner and more sizably than the BoE has expected; the labor market is clear slowing both in terms of becoming less tight and where the drop in private sector jobs questions the validity of the apparent upbeat GDP backdrop. The fiscal backdrop is also uncertain as the looming October 30 Budget could easily see a possible easing of the currently planned fiscal tightening even with some likely tax rises. Overall, the Nov 7 BoE policy decision will be more important for what is said, than done, especially as it seems that even a further projected undershoot of the inflation target will not placate the MPC hawks!