U.S. December Retail Sales and Q4 Employment Cost Index show fading momentum

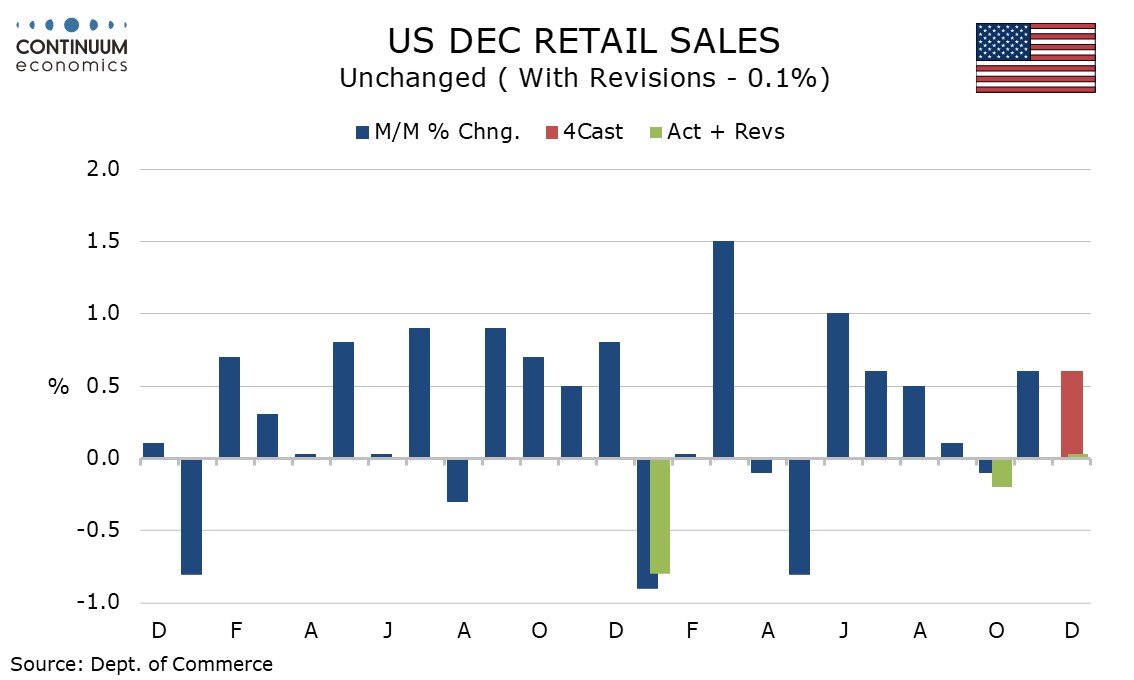

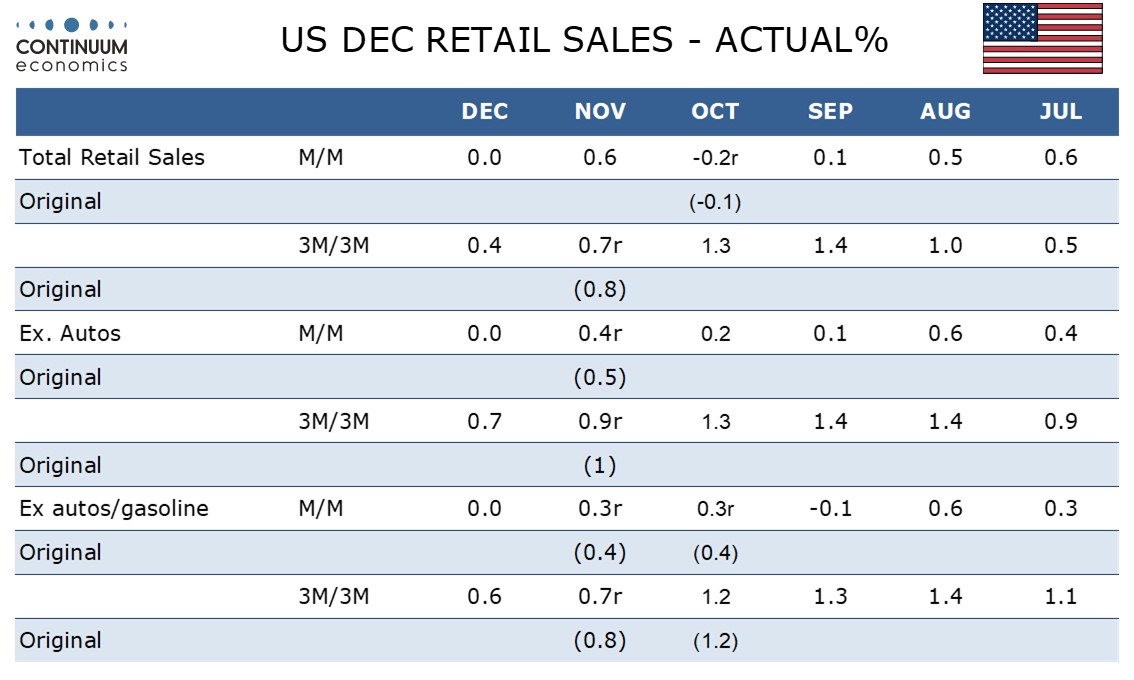

December retail sales are weaker than expected, unchanged overall, ex autos and ex autos and gasoline. This could be a sign of consumer spending losing momentum in response to real disposable income coming in near flat in both Q3 and probably Q4, given limited employment growth and resilient inflation meaning little real wage growth.

Revisions are marginal, with November retail sales unrevised at +0.6% but October revised marginally lower to -0.2% from -0.1%. This leaves November as the only month slowing significant growth in retail sales since June, July and August saw three straight solid gains. It is already known that auto sales slipped in January, though bad weather may have played a part in this.

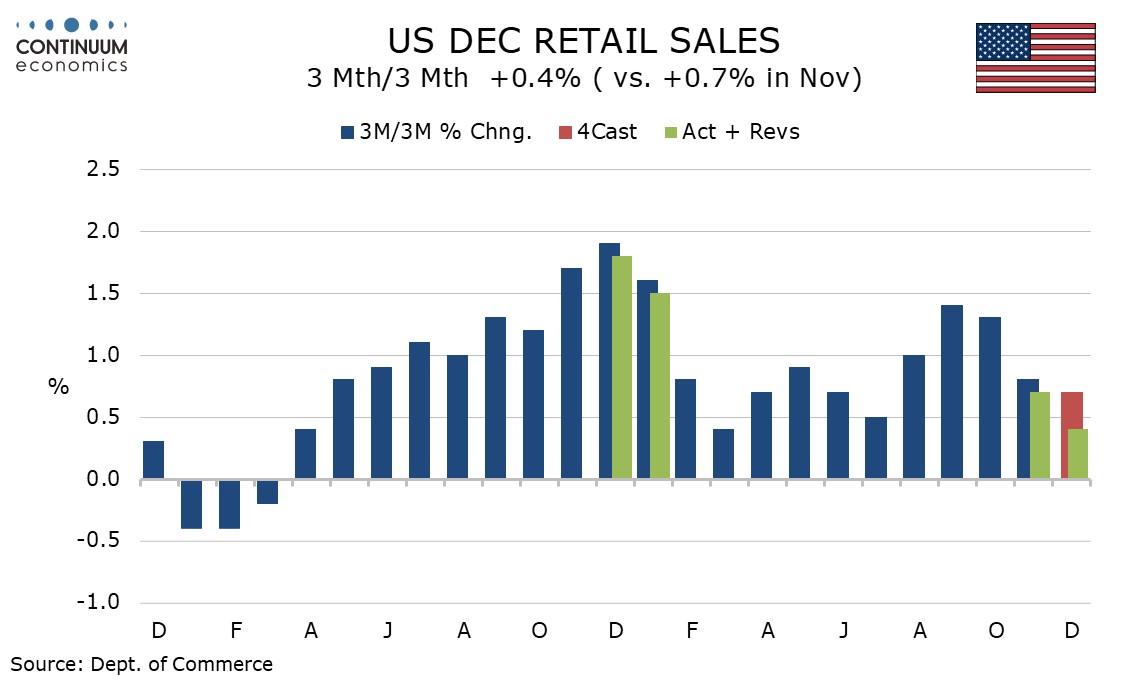

In Q4 overall retail sales rose by 0.4% (not annualized), down from 1.4% in Q3 and the slowest since a matching Q1. Q3 sales ex auto at 0.7% and ex auto and gasoline at 0.6% were also the slowest since matching gains in Q1. The data will see some trimming of what will still be quite healthy Q4 GDP forecasts, and suggest limited momentum entering Q1.

Most components saw subdued or weak December outcomes, an exception being a second straight 1.2% rise in building materials which hints at some pick up in housing as Fed easing resumed, though some recent housing sector surveys have suggested that a pick-up in Q4 is fading as we enter 2026.

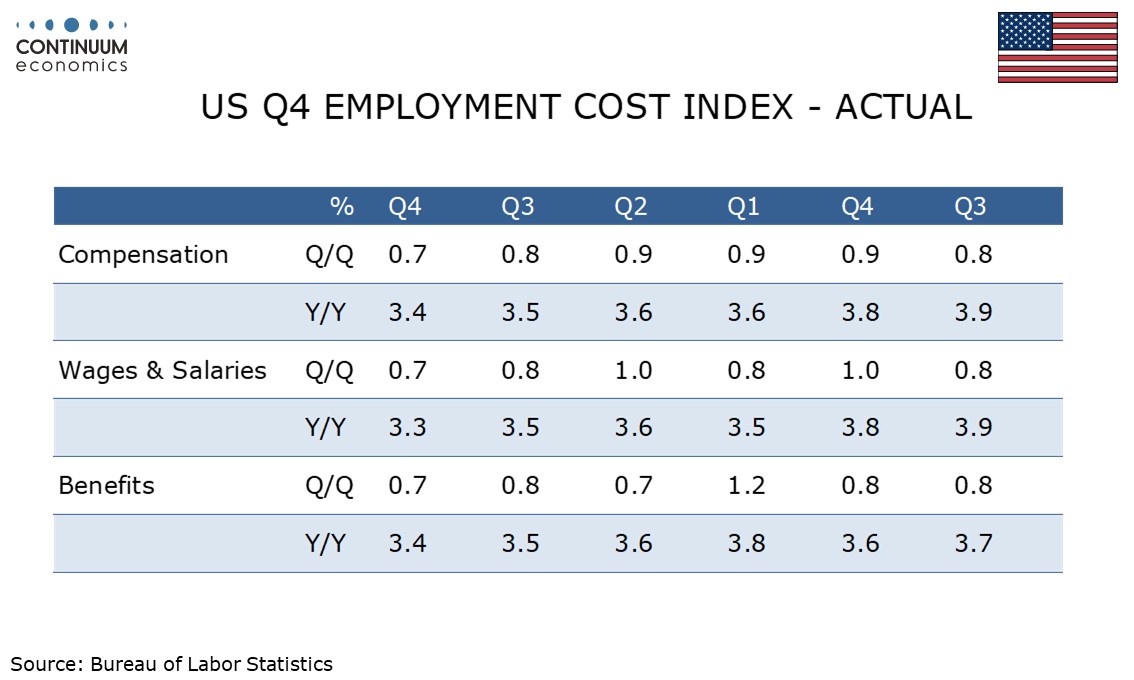

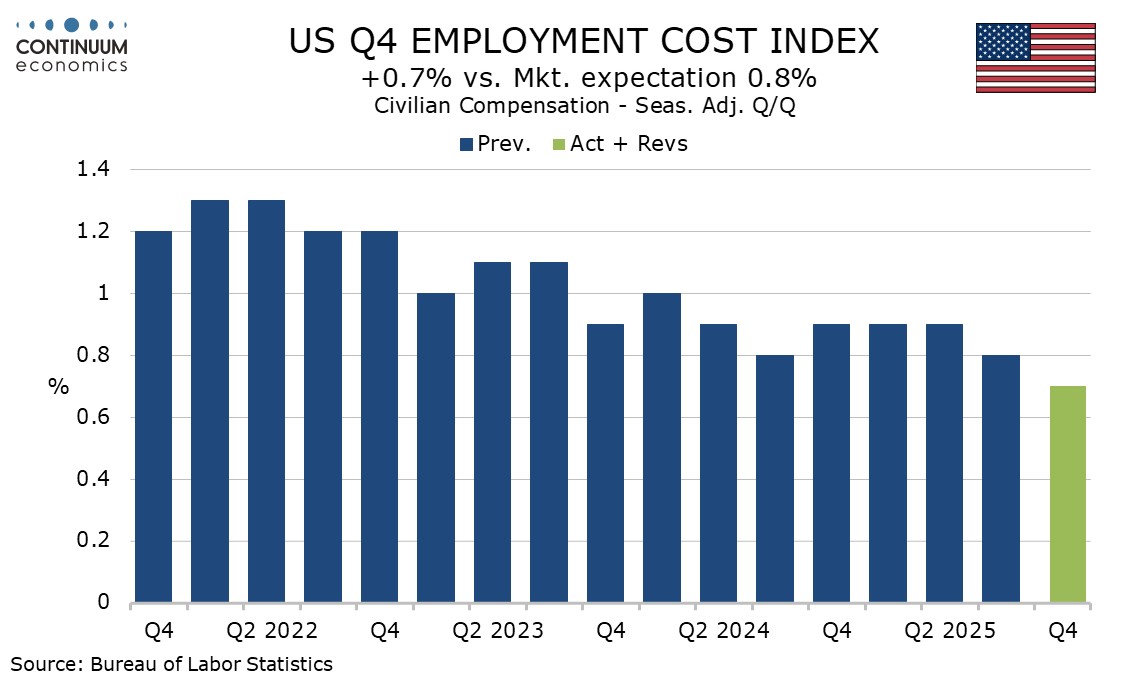

Q4’s Employment Cost Index with a rise of 0.7% is slightly softer than expected, and the slowest since Q2 2021. Both wages and salaries and benefits also rose by 0.7% on the quarter. Yr/yr growth at 3.4% from 3.5% is also the slowest since Q2 2021 when it was steady slightly below 3.0%.

The latest Employment Cost data suggests that trend may be returning to the steady picture of around 0.7% per quarter, slightly below 3.0% yr/yr that was seen before the pandemic, and hints that inflationary pressures may be normalizing outside the continued boost coming from tariffs.