Tariffs and the Timing of FOMC Easing

While two Fed Governors. Waller and Bowman, have suggested a July easing could be appropriate, testimony from Chairman Powell suggests a move that early is unlikely, though September is possible if inflation data continues to show a lack of feed through from tariffs. We, and Powell, expect some acceleration in inflation in Q3, and we see expect Q4 as the more likely time for easing to resume.

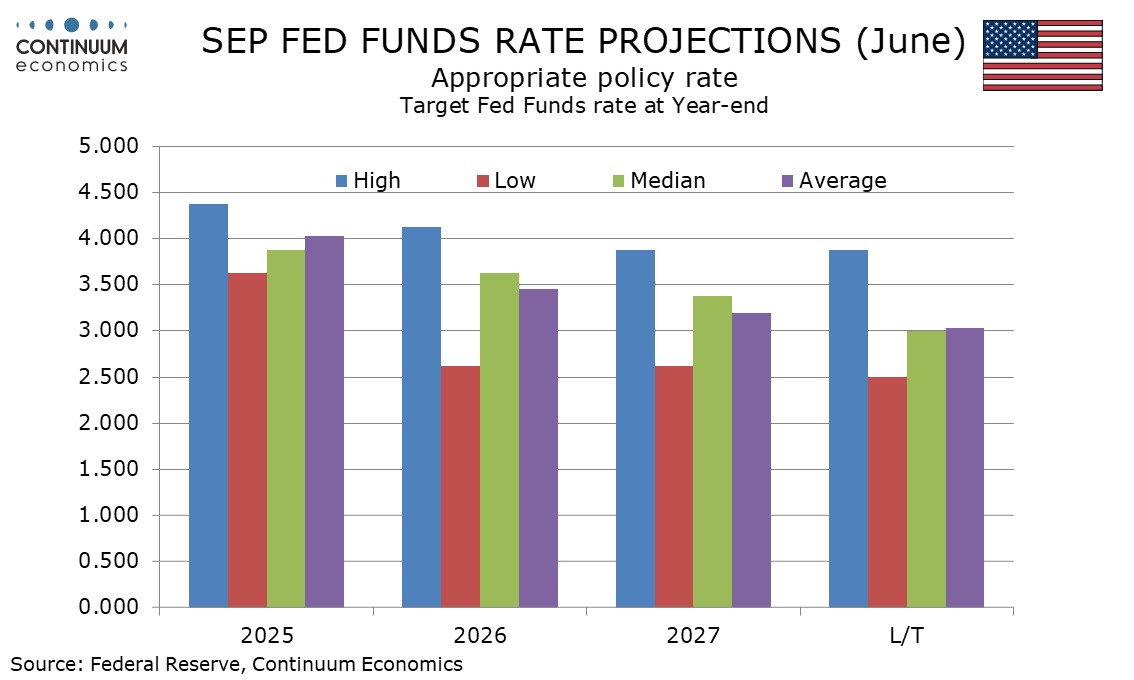

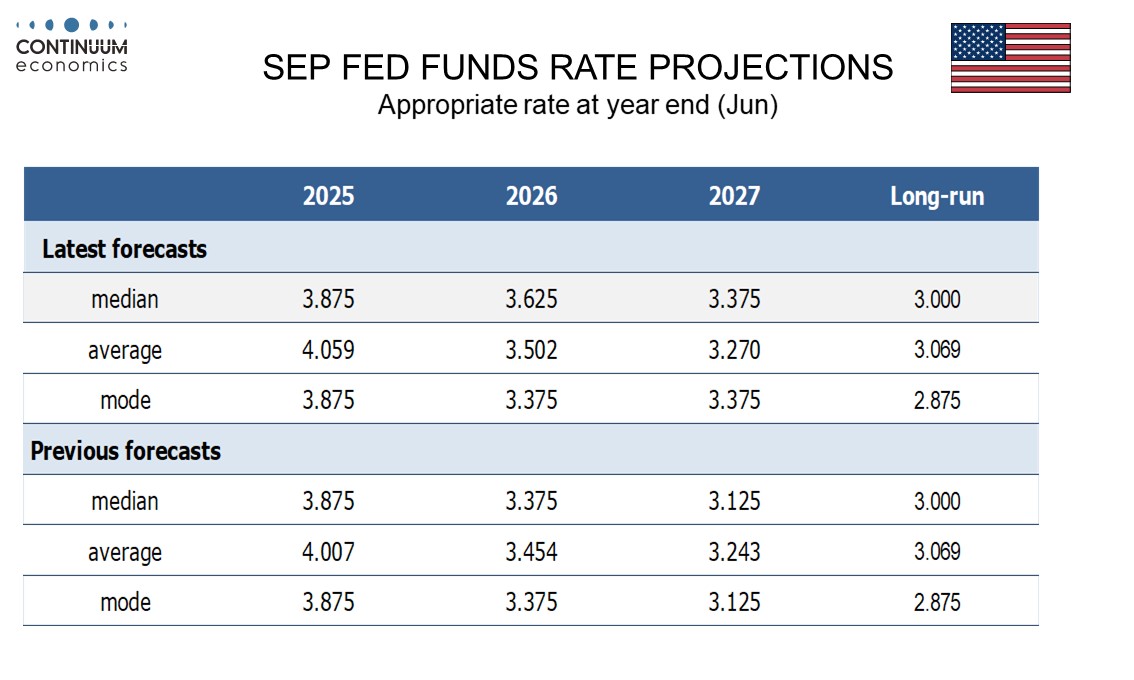

June Fed dots show seven participants seeing no easing at all in 2025 and hawkish recent comments suggests that includes Cleveland Fed President Hammack. Two, which Atlanta Fed President Bostic stated includes him, expect only one 25bps move. Eight are on the median expecting two moves and two expect three 25bps rate cuts. None have explicitly stated that three moves are appropriate but Governors Waller and Bowman have both suggested rates could be cut as early as July. Bowman, who was a hawk through 2024, was a surprising dove but has noted the lack of tariff pass-through in inflation data for April and May. Both Waller and Bowman were originally appointed to the FOMC by President Trump in his first term and may be under consideration as successors to Chairman Powell whose term expires in May 2026.

In his semi-annual testimony to the House Chairman Powell sated that the Fed was well positioned to wait and learn before moving rates. In the Q+A he stated that the reason rates were above neutral was that inflation is expected to rise in respond to tariffs but it is possible that inflation might come in lower than expected. Powell stated that he expects to see a pass through from tariffs in June, July and August data, for which CPI data for each will be visible before the FOMC meets in September. The FOMC will have seen only June CPI when it meets in July so it is likely that Powell will want to see more at that point, unless June’s non-farm payroll is shockingly weak. The tariff picture is unlikely to be clear at least until July 9 when the three month reduction in the “Liberation Day” tariffs is due to end. Waiting until September will give the Fed time to see how inflation responds to any July 9 decision.

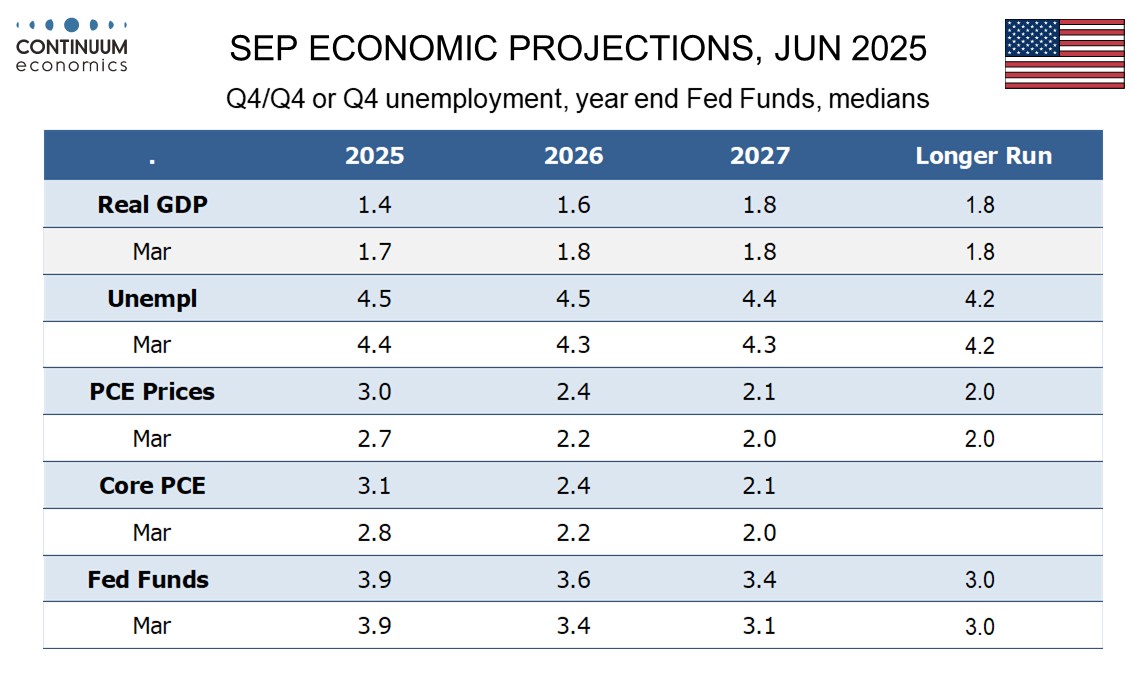

With Powell expressing comfort in the inflation picture excluding the tariff threat, a September easing is clearly possible if inflation continues to show a lack of tariff pass-through. However, we suspect Powell’s fear that inflation will pick up in the coming months, as inventories are depleted and the tariff picture becomes clearer, will prove correct, and this will delay easing to Q4. Even Q4 could be a close call with inflation still likely to be elevated, but we expect there will be sufficient signs of economic weakness to justify an easing should the tariff-induced lift to inflation be showing signs of peaking.

The Fed is clearly divided over when to start easing, and the minutes from the June meeting due on July 9 will make interesting reading. However the differences of opinion at the Fed are probably more on what inflation will do rather than how the Fed should respond to differing potential inflation outcomes. The Fed dots have a 75bps range for 2025. The same individuals have a median forecast for Q4 core PCE prices at 3.1% yr/yr, up from 2.8% in March, but a central tendency of 2.9-3.4% with a range of 2.5% to 3.5%. With the core PCE latest pace for April being 2.5% yr/yr, the majority at the FOMC are expecting inflation to pick up. Our forecast for Q4 2025 at 3.3% is near the upper end of this range.