EZ HICP Review: Headline Higher?

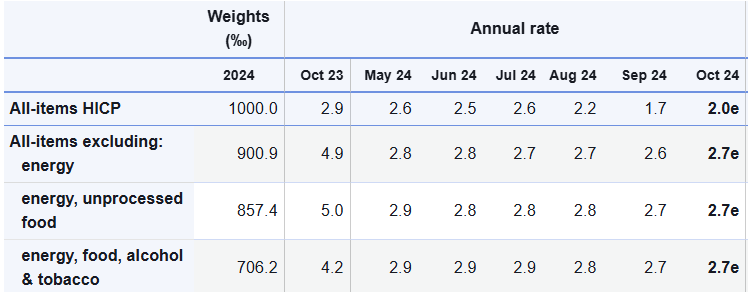

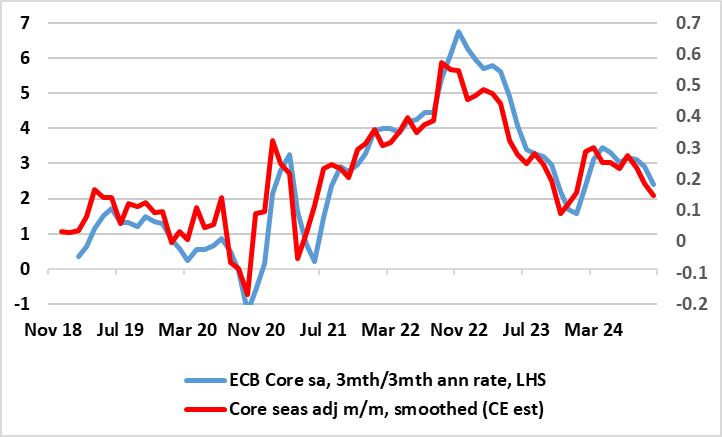

Slightly higher energy costs were the main factor behind the rise back in HICP inflation in October to 2.0% having fallen to a well-below target 1.7% in the previous month (Figure 1). The outcome was a little higher than expected, not least with another apparently resilient services inflation reading; it stayed at 3.9%, something that helped keep the core rate at 2.7% a six-month low. Regardless, shorter-term price momentum data (ie adjusted m/m data) already suggest that core inflation on this basis is running around target (Figure 2) and given sharp, falls in wage tracker data, services inflation may succumb more clearly soon. This backdrop has persuaded the recalcitrant ECB into a reassessment. In fact, the ECB has brought forward inflation hitting target durably now to be in the course of next year as opposed to late 2025 as suggested in the September projections. But amid tentative signs of consumer recovery and resilient services, it would be premature to expect anything more than 25 bp at the December Council meeting.

Figure 1: Headline Rises Back as Services Fail to Fall

Source: Eurostat, CE

Below target inflation may yet be short-lived given adverse base effects later this year before a more sustained fall below 2% occurs through 2025. But for us, and seemingly now the ECB, recent survey data, rather than just inflation, may be increasingly influential. Such data are pointing not only to more real economy weakness but also to significant falls in cost and output price pressures and retailers price expectations. These considerations are all the more important as the ECB hierarchy has made clear policy will be shaped by an array of data rather than any particular data points. Indeed, this survey weakness remains the main reason we expect a further 75 bp of cuts by next summer.

Figure 2: Core Inflation Near Target Too?

Source: Eurostat, European Commission

This services rate though is still well below that seen in many other DM environments and in August was probably boosted by the impact that the Olympics had in France, implying some softening back down hereafter. Even so, while headline inflation may slip to/below 2%, it may perk back towards 2.5% by end-year due to energy base effects. The ECB hawks on the Council will point to still apparently resilient services inflation, but where the doves may counter by pointing to what is a much earlier than expected drop below target as well as recent much softer wage inflation news, most recently in terms of a sharp drop in the monthly Indeed Wage tracker (at 3.1% is the lowest since early 2022), something that augurs well for lower services inflation in due course.