U.S. House Race Becoming Closer

The probability of a Republican clean sweep has jumped to a 25% probability, which could see a future President Trump go beyond renewing 2017 lapsing tax cuts. It could also increase the odds of tariffs being increased to fund extra tax cuts! This would likely curtail the Fed easing cycle and push government bond yields higher and produce more of a correction in the U.S. equity market.

Financial markets have not reacted to the approach of the November 5 U.S. election, as the presidential race has been close and on assumption of a divided Congress. If polls shift in the next three weeks, then what can be the market reaction?

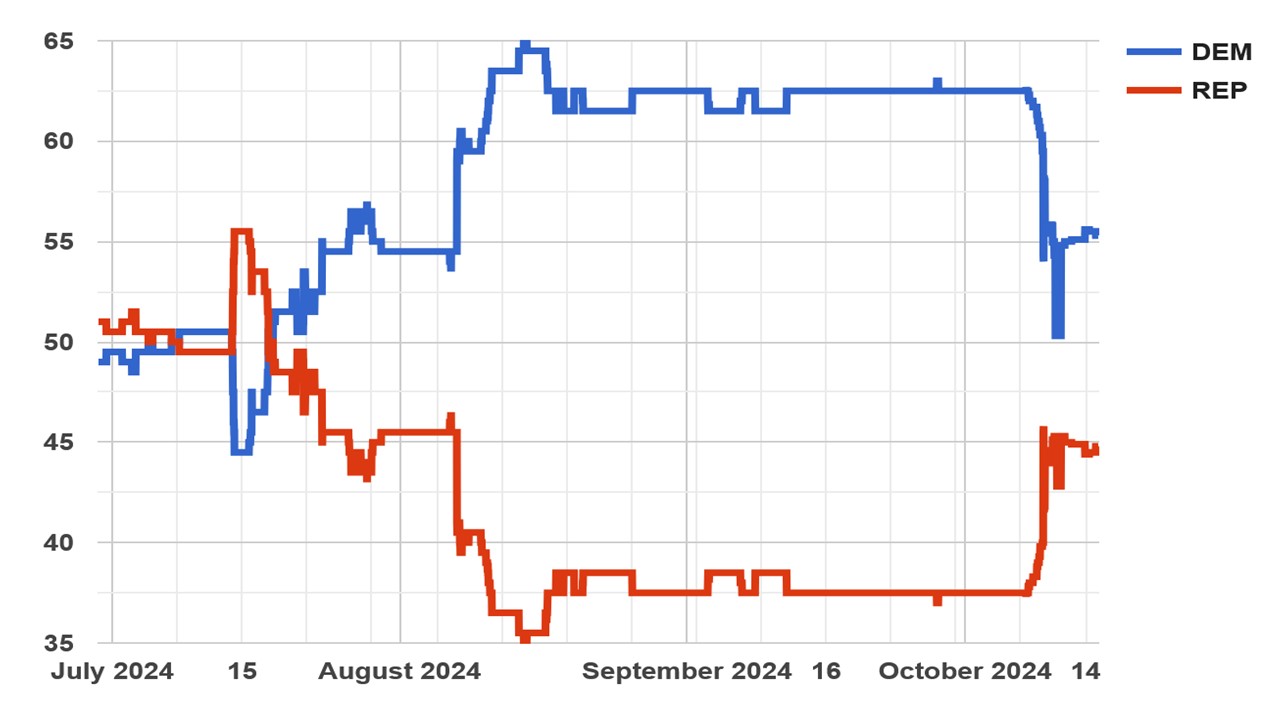

Figure 1: Betting Odds for U.S. House of Representatives (%)

Source: election betting odds.com

Financial markets have been watching but not reacting to the approach of the U.S. presidential election, both as the race was very close and as a divided Congress was expected and this would restrict policy changes for either president. However, recent opinion polls and betting odds have shown, both Trump opening a small gap versus Harris (more in electoral college calculations than the popular vote) and less certainty about the Democrats winning the House (Figure 1) – expectations remain high of a narrow Senate victory for the Republicans. Most close Senate races are closely tracked by the polls. Polling is limited for the individual races in the House.

In reality, the presidential race is still very close, as it will come down to the swing states for the Electoral College. A Harris victory would most likely be with the Republicans gaining the Senate and Democrats the House (35% probability), which would curtail Harris’s aspirations to increase taxes for expenditure programs – a Democrat clean sweep is low probability. A Trump victory with the Democrats taking the House and the Republicans the Senate is also a high probability scenario (30%), which would curtail Trump cutting corporate taxes or enacting some of the tax promises from the campaign trial. However, Trump would still have a fair chance of renewing most of the 2017 tax cuts and avoid them lapsing and also avoiding fiscal tightening, given the Democrats desire to renew some of these tax cuts. In this scenario, we feel that in 2025 a President Trump would likely focus most on immigration and renewing the 2017 tax cuts, with jawboning on China tariffs and restraint on funding for Ukraine – plus pressure on Ukraine to end the war. The caveat is that Trump unpredictable nature means that surprises could still happen. These two alternatives total 65% and on the fiscal front are unlikely to mean a major crisis (here), though we would still see a 20bps rise in 10yr yields into Q1 and a mild correction in the U.S. equity market (here).

However, the House race is becoming somewhat closer and we feel that the odds of Republican clean sweep have moved up from low to moderate (25%). A president Trump under a clean sweep would then be less restrained in certain areas. The two key focal points for financial markets would be fiscal policy and tariffs. If Congress is pushed by Trump to do substantive tax cuts beyond renewing the 2017 tax cuts, then it would threaten to widen the budget deficit and increase the risks of a rating downgrade. It would also help boost the economy into 2026 and potentially restrain the scope of Fed rate cuts in 2025. A dominant Trump could also push the idea of earlier tariff increases, which he could argue fund some tax cuts! While we see tariffs causing a one off boost to inflation, it would complicate the Fed job and could bring the easing cycle to a pause into the spring. This would push government bond yields higher and cause more of a correction in the U.S. equity market. It is not certain that Trump would be more activist however, both as he could bask in the glory of victory beyond the key policy goals and also as he is sensitive to the U.S. stock market’s performance. Even so, a Republican clean sweep would likely produce more volatility for U.S. and global financial markets.