UK Labor Market: Far Less Resilient Wage Pressures As Labor Market Loosens Further

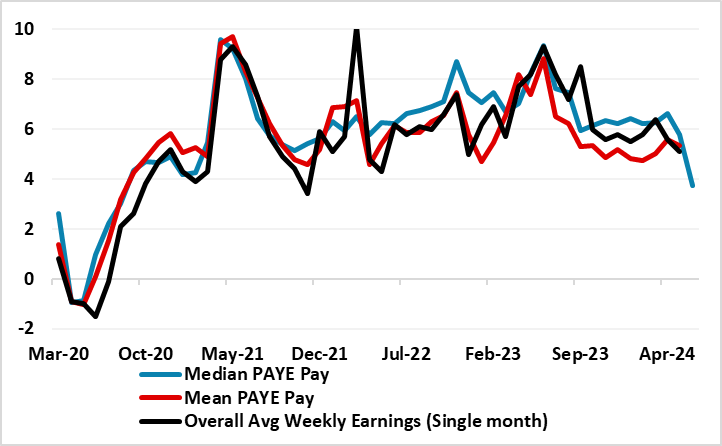

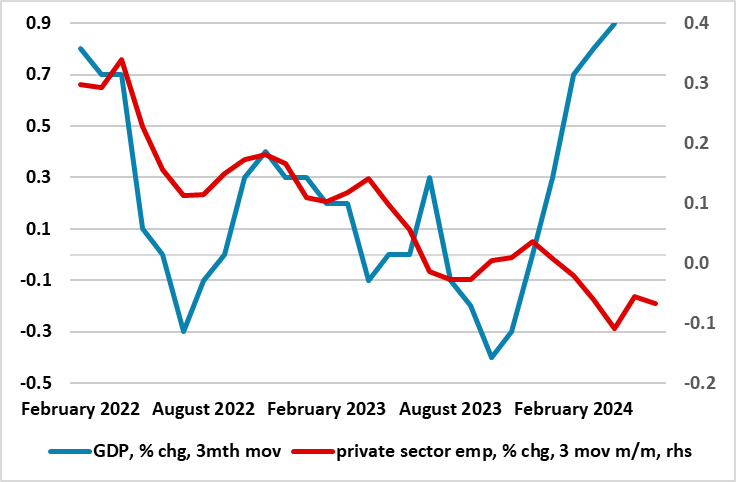

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more authoritative) wage data from the HMRC (the UK tax authority) are also showing far less resilient growth in mean and median pay as you earn (PAYE) growth (Figure 1). But this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of private sector employment contracting. Notably, the jobs data conflicts with the headline pick-up in GDP growth (Figure 2), albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. As a result, it can be argued that weaker jobs may take a toll on wage growth in due course, this coming alongside the marked base effects that would curb such growth in coming months including the next set of labor market numbers. The BoE may still ease in August as it anticipates official earnings growth of nearer 3% in coming months!

Figure 1: Wage Resilience Less Evident Across Range of Measures

Source: ONS, HMRC, % chg y/y

Wage Resilience – For Now?

Alongside and inter-related with services inflation, wage data will take center stage in any assessment of the latest UK labor market report. Headline (single-month) earnings fell to a lower-than expected 5.1% y/y in May with regular earnings ticking down to 5.2%. More recently, the ONS data, (handicapped by severe reservations about their authenticity due to poor survey take-up) have contrasted with PAYE data which have shown softer and slower growth in wages. This still seems to be the case (Figure 1) where median pay data actually hinting at even lower wage pressures and at under 4% is at a four-year low. The question is whether this is a fresh trend or more noise. More likely it is trend, not least as official data may benefit from base effects in showing single-month earnings nearer 3% in coming months.

Labor Market Loosening Clearly

Amid the new government’s economic priority to boost the trend or potential growth rate, any hint that this could be occurring would be welcome and important. With this in mind, it is notable that after the mild recession in H2 last year, the ‘recovery’ through this year is much clearer than any expected with GDP growth notably positive, and with less apparent volatility. Potential growth has two components, swings in the workforce and swings in productivity. In this regard, there are hints that this recent GDP recovery may be productivity driven given that it is coming alongside ever clearer falls in employment (Figure 2).

Figure 2: Weaker Jobs Picture Conflicts with GDP Surge

Source: ONS, HMRC

However, we are sceptical, instead thinking that the jobs weakness questions the validity and durability of the apparently solid GDP rebound, which we suggest has been driven by a recovery in average hours worked that continue, albeit less significantly. This notion is backed up by survey data that have taken a turn for the worse of late. Regardless, the data thus needs watching. But even if productivity is picking up, this is already assumed in the fiscal projections and thus will not provide improved budgetary leeway for new Chancellor Reeve.