EUR, GBP, CHF, USD, JPY flows: PMIs in focus

PMI data in focus this morning with modest dip expected. EUR has scope to extend gains if data at or above consensus

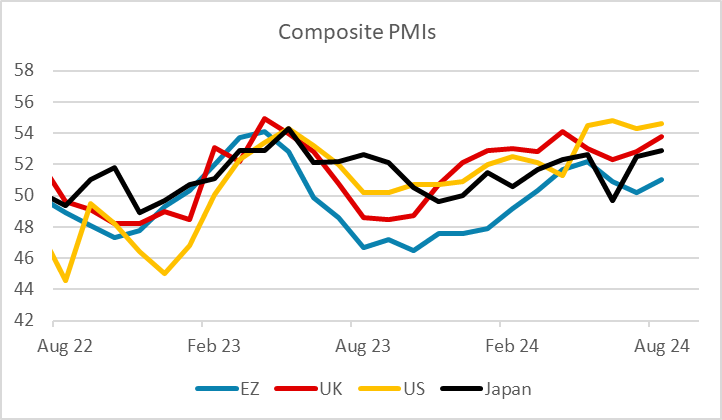

Focus today will be on the PMI data, with the European data up first. The market consensus is for a modest decline in both the Eurozone and the UK composite PMIs, partially reversing the slight improvement in August. The UK PMI has been particularly strong of late, with the UK manufacturing PMI showing a notably strong trend. But there is some doubt about its accuracy, since UK manufacturing output hasn’t matched its strength. Eurozone manufacturing has been much weaker, particularly Germany.

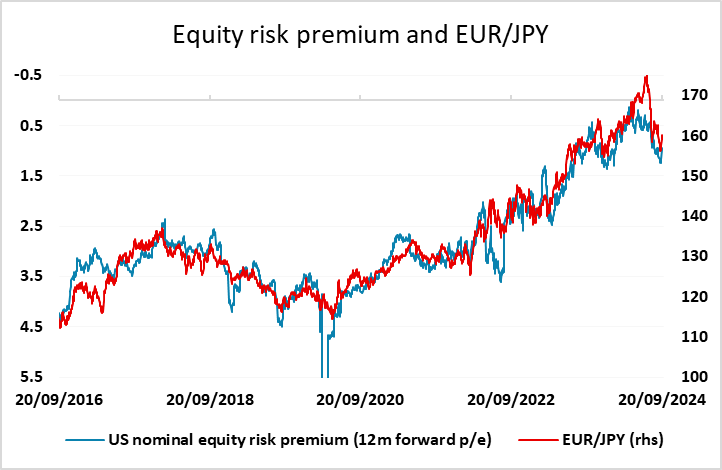

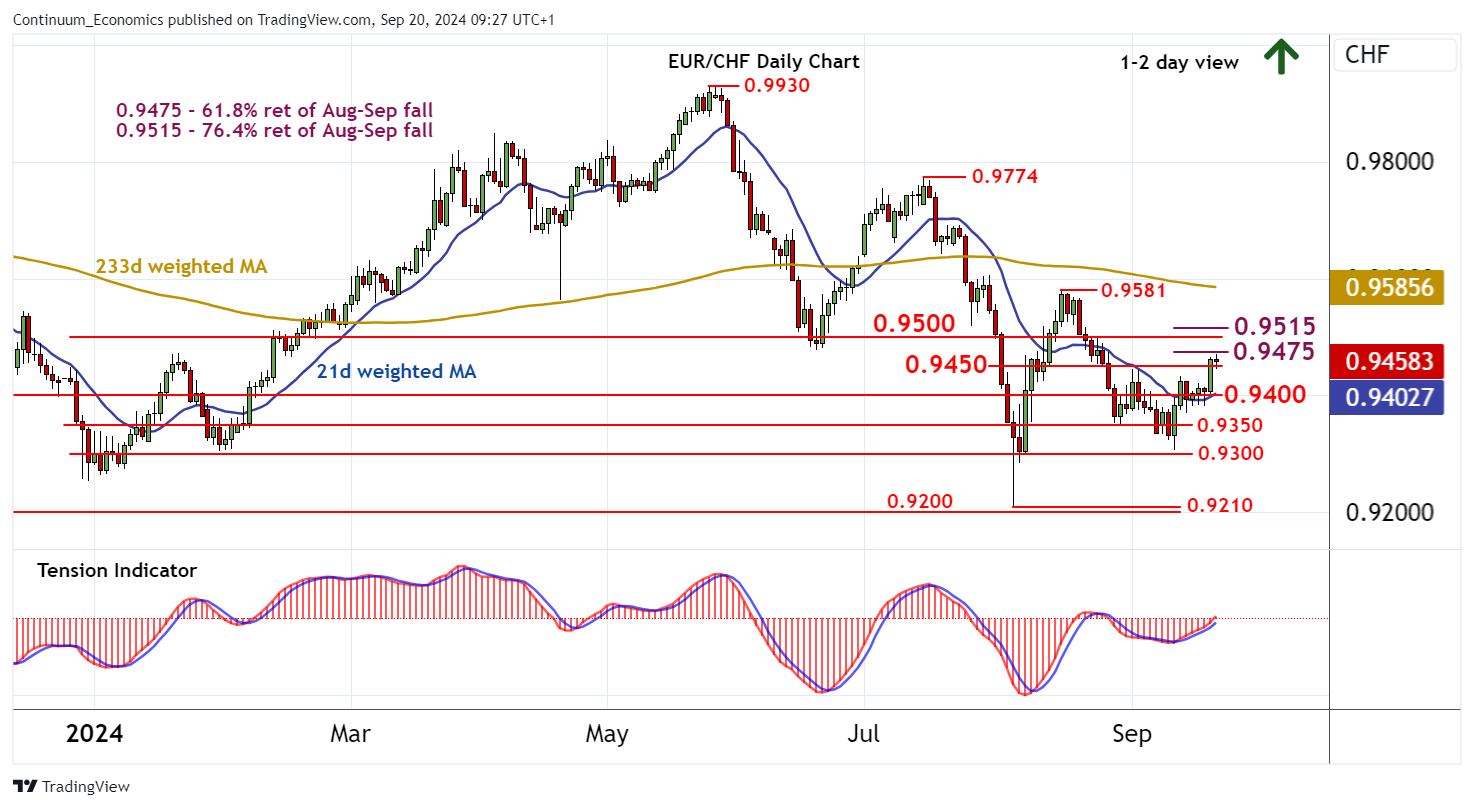

The risk positive tone of the last week was extended overnight, and if the PMIs are in line or better than expected this could continue this morning, with scope for further gains in EUR/USD, EUR/JPY and EUR/CHF. Of these, EUR/CHF may have the most scope for gains, with the CHF still trading at strong levels. EUR/JPY gains are starting to look a little stretched, having gained every day last week, so may be most vulnerable to weaker than expected data.