Preview: Due December 6 - U.S. November Employment (Non-Farm Payrolls) - Rebound from October's hurricanes and strike

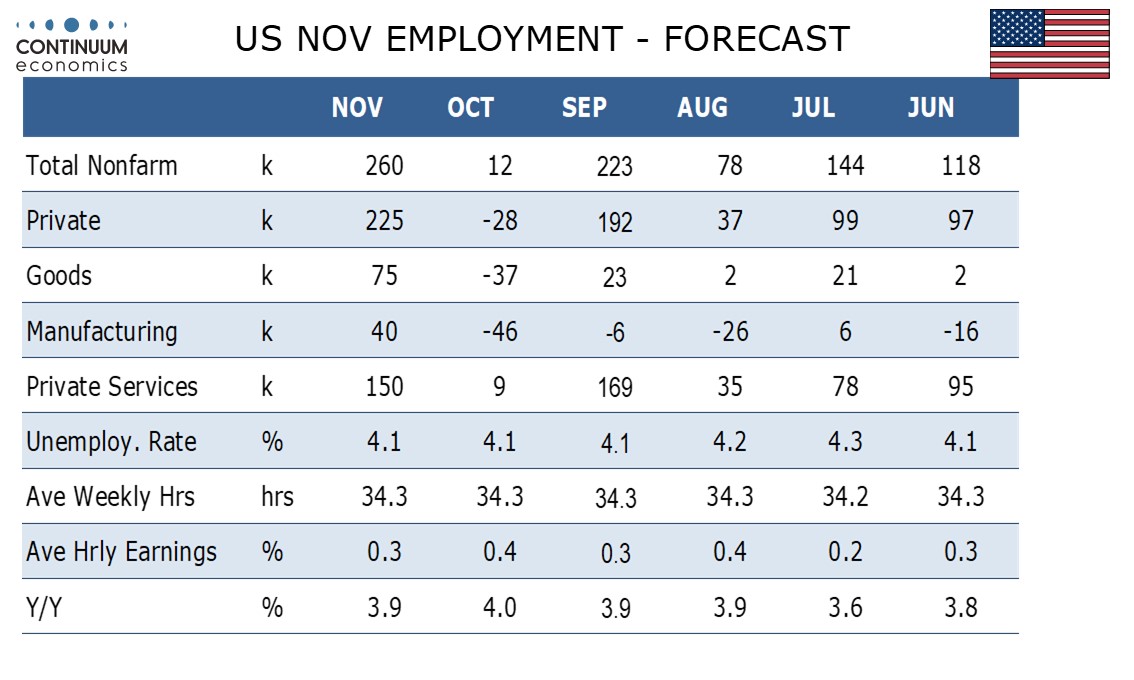

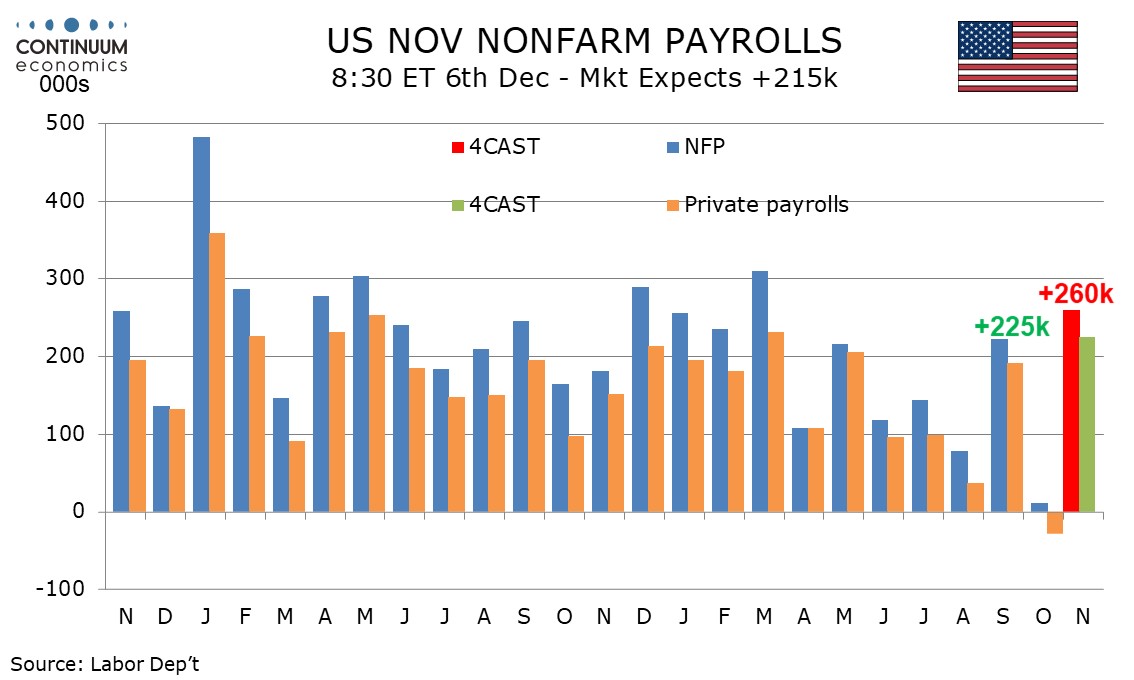

We expect an above trend 260k increase in November’s non-farm payroll, with 225k in the private sector. This will follow weak October outcomes of up 12k overall and down 28k in the private sector, depressed by two hurricanes and a strike at Boeing. We however expect unemployment to be unchanged at 4.1% for a third straight month and a slightly lower 0.3% increase in average hourly earnings.

The two month non-farm payroll averages would then stand at 136k overall and 98.5k in the private sector. In September the 3-month averages were slightly stronger than this, at 148k and 109k respectively. We expect manufacturing to increase by 40k after a 46k October decline that was largely due to a now settled strike at Boeing.

How much October’s payroll was influenced by Hurricanes Helene and Milton is hard to say, but initial claims saw a significant spike after Hurricane Helene in early October and Hurricane Milton arrived in the survey week for October’s non-farm payroll. Initial claims have since fallen to see their lowest level since April but continued claims have not seen a similar dip.

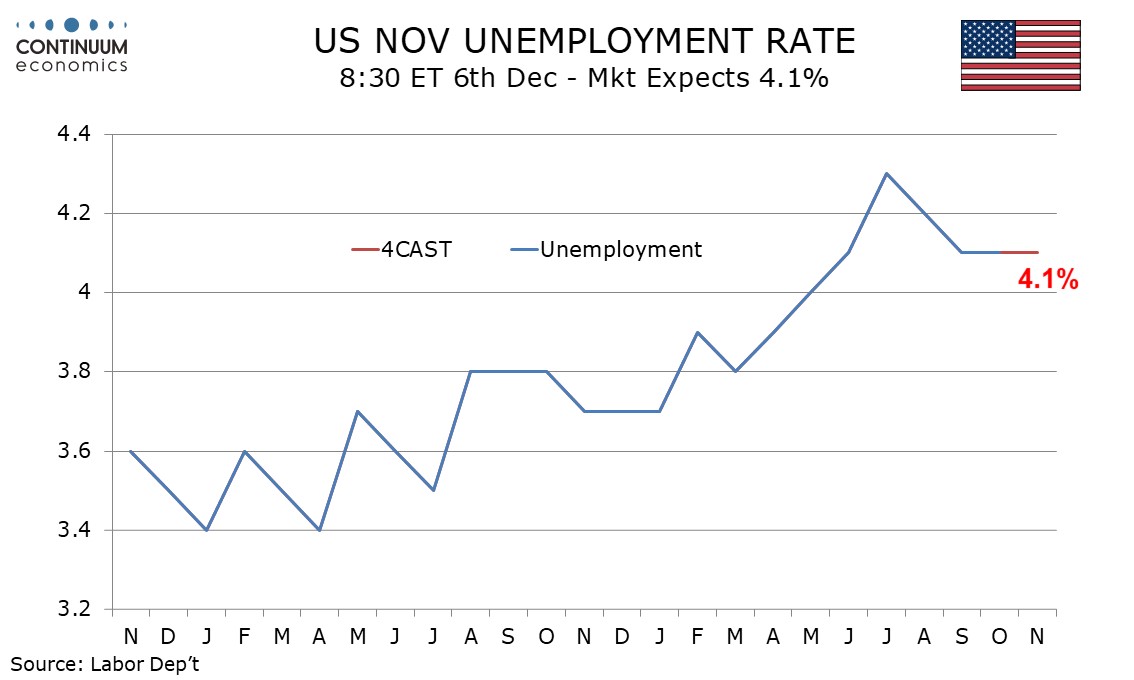

While the unemployment rate was unchanged at 4.1% in October both the labor force and employment saw significant dips, suggesting some impact from the hurricanes. We expect both series to bounce in November, though employment to rise by more. Before rounding we expect an unemployment rate of 4.11%, down from 4.145% in October but above September’s 4.052%.

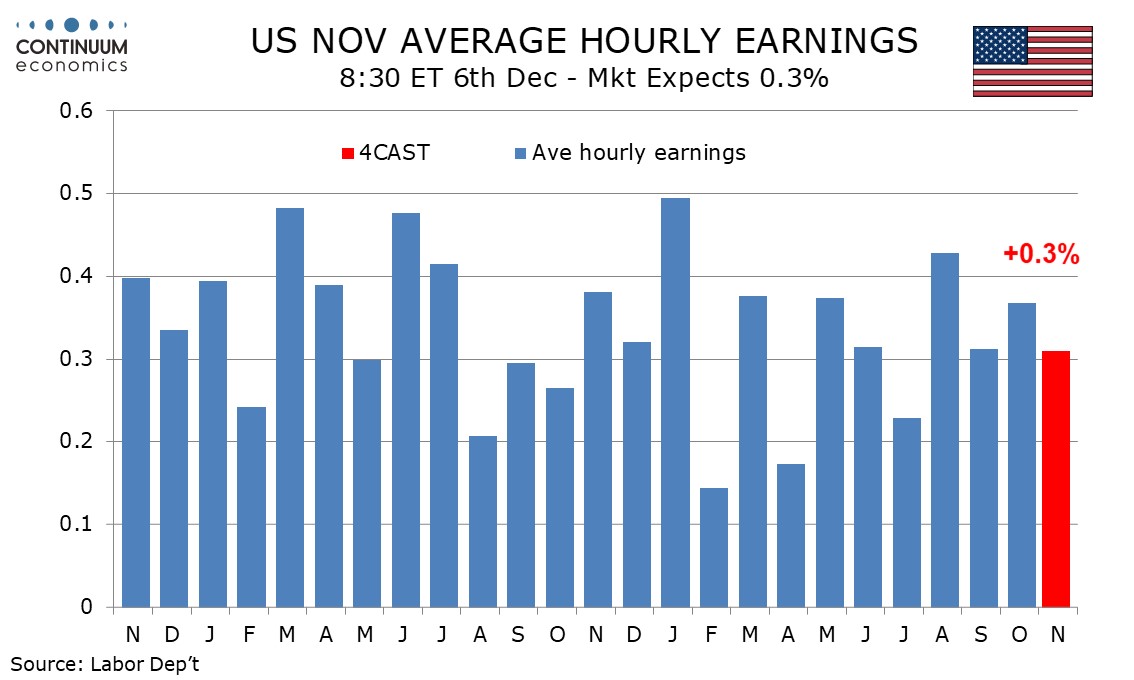

We expect average hourly earnings to rise by 0.31% before rounding after a slightly above trend 0.37% in October, seeing yr/yr growth slip to 3.9%, where it was in August and September, from 4.0% in October. Even a 4.0% yr/yr pace is consistent with a monthly pace closer to 0.3% than 0.4%. The 6-month average is 0.34%.

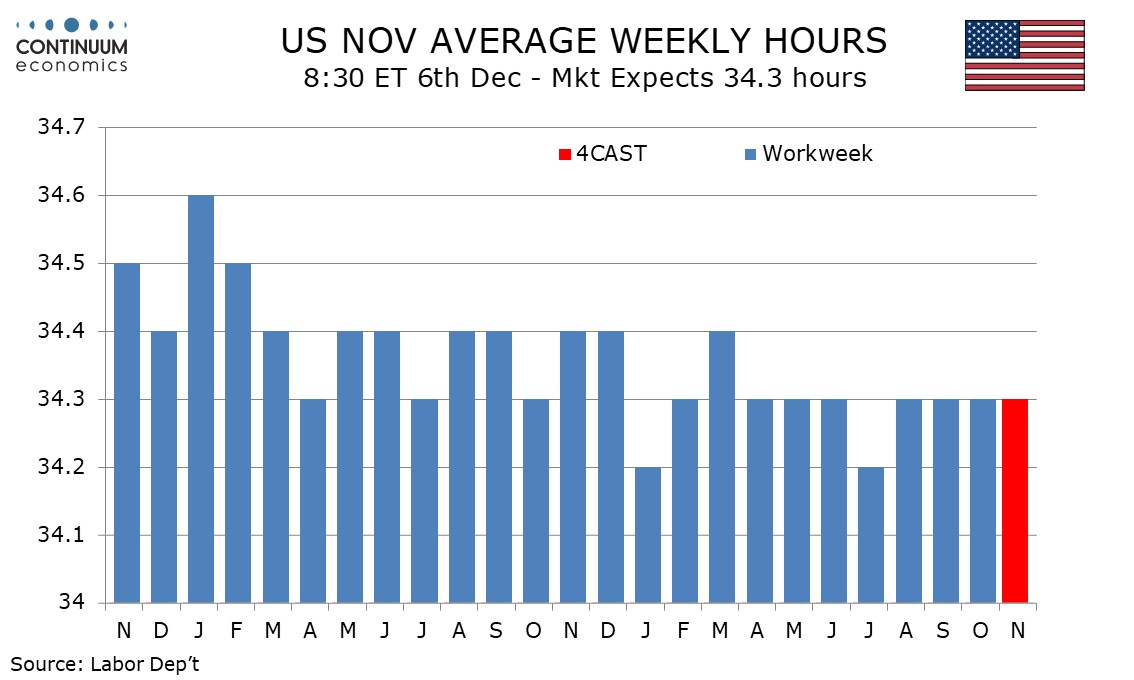

We expect the workweek to be unchanged at 34.3 hours for a fourth straight month. October’s unchanged outcome showed resilience to the hurricanes and that suggests risk for November is on the upside, though risk for October’s revision is on the downside.