Russia’s Inflation Softened to 17-Month Low in September

Bottom Line: Russian inflation continued its decreasing pattern in September, and hit the lowest in 17-months after with 7.98% y/y, particularly thanks to lagged impacts of previous aggressive monetary. According to Rosstat’s announcement on October 10, core inflation eased to 7.7% y/y from 8% y/y the previous month and prices rose at a softer pace for food items (9.5% in September vs 9.8% in August). Despite inflation edged down for the sixth straight month in September, we think inflation will continue to stay higher than Central Bank of Russia’s (CBR) 4% target in 2026 as the war in Ukraine continues to ignite military spending and fiscal support. Our 2025 average headline inflation projection stays at 9.1%.

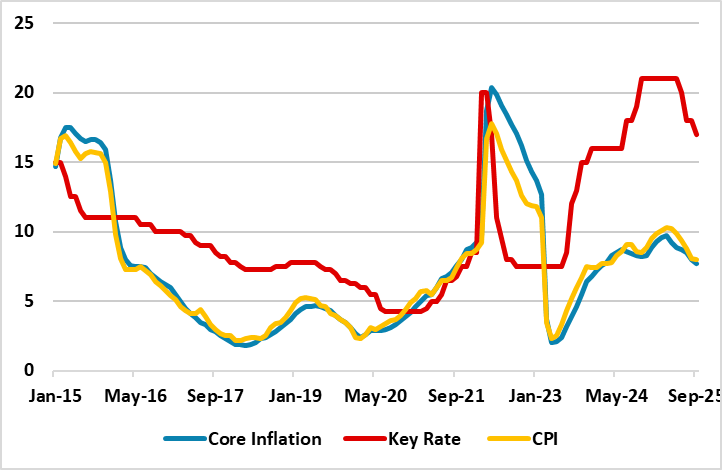

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – September 2025

Source: Continuum Economics

Rosstat announced on October 10 that Russian inflation hit the softest rate since April of 2024 with 7.98% y/y in September, particularly thanks to lagged impacts of previous aggressive monetary. Core inflation eased to 7.7% y/y from 8% y/y the previous month. Prices rose at a softer pace for food items (9.5% in September vs 9.8% in August). Food products prices surged by 0.03% m/m while prices for non-food products increased by 0.59% m/m, and services prices hiked by 0.47% when compared to August.

It is worth noting that inflation continued to soften as previous tight monetary policy affected bank lending and private consumption, and the RUB has shown relative resilience, particularly after June.

Taking about the inflation, CBR governor Elvira Nabiullina said that weekly inflation in Russia has slightly accelerated due to volatile components like fruits and gasoline. Nabiullina added that growth rates for stable components are approximately at the average for the summer months, perhaps even slightly lower than in August.

Under these circumstances, our 2025 average headline inflation projection stays at 9.1% since high military spending, global uncertainties, and rising wages do not signal a significant permanent inflation slowdown in the horizon yet despite inflation continued to soften the sixth straight month in September. We foresee inflation will stay higher than Central Bank of Russia’s (CBR) 4% target in 2026 since the country continues to be squeezed by the sanctions and the war in Ukraine. We believe reaching CBR’s target will be tough since cooling off inflation will take longer than CBR anticipates.

A peace deal in Ukraine would be the real key to ease pressure on inflation and alleviate demand-supply imbalances in Russia despite sealing a full-scale peace deal in Ukraine is very unlikely in 2025.