U.S. Retail Sales and PPI over October and November not far from expectations

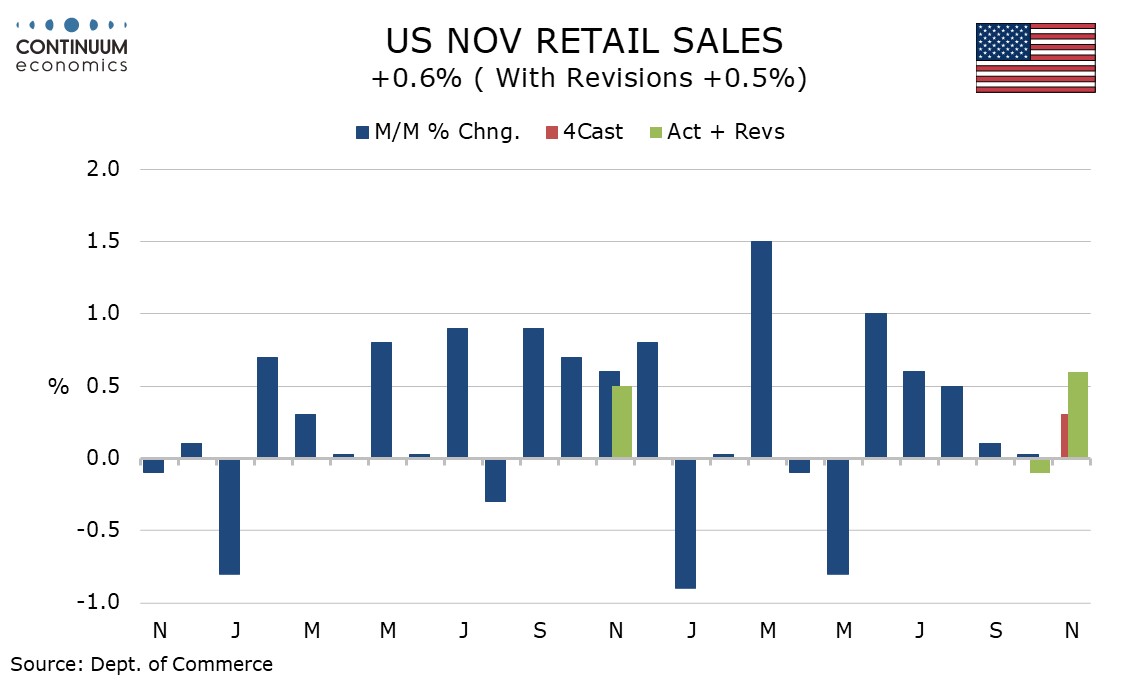

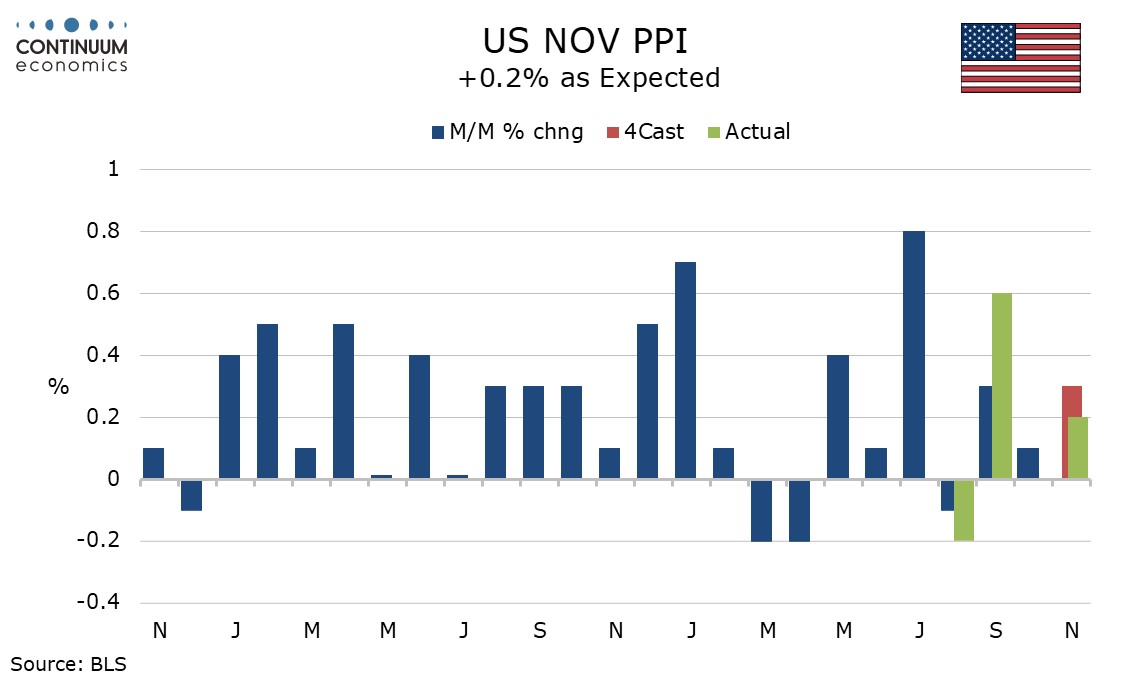

November retail sales with a rise of 0.6% are marginally stronger than expected but the data is close to expectations net of modest negative back month revisions. PPI has been released for both October and November, also net in line with expectations, with October on the firm side in the core rate followed by a more subdued November.

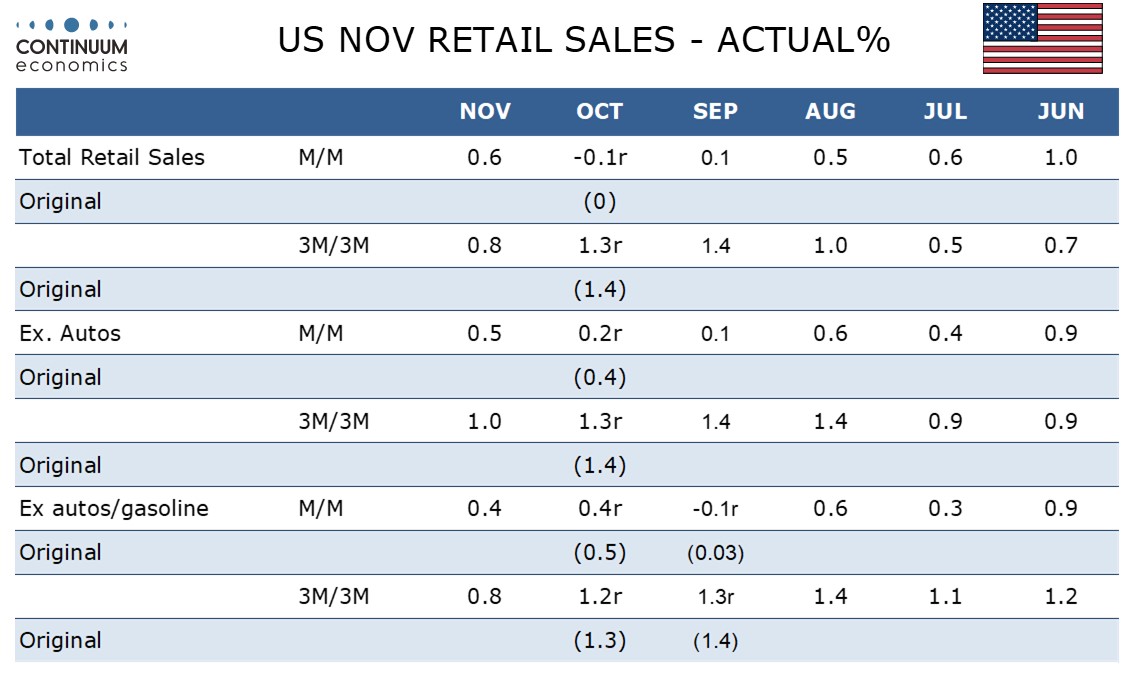

November retail sales rise by 0.6% but with October revised down to -0.1% from unchanged the net gain is 0.5%, Ex autos November sales rise by 0.5% but with October revised to a 0.2% increase from 0.4%. Ex auto and gasoline the November gain was 0.4%, with both October and September revised down by 0.1% to a 0.4% increase and a 0.1% decline respectively .

The 3 month/3 month changes (not annualized) are 0.8% overall and 1.0% ex autos, both the lowest since July but far from weak. Ex autos and gasoline the 3 month/3 month change is 0.8%, this the slowest since March but implying only a moderate loss of consumer momentum. Some of the slowing will reflect slower price gains, though November gasoline prices picked up from a dip in October.

Auto sales rose by 1.0% after a 1.6% October decline that coincided with the ending of a tax credit for electric vehicle purchases. December data from the auto industry suggests a further bounce in autos sales, suggesting that Q4, while likely to see some slowing, is not going to be weak. In addition to autos and gasoline, building materials and eating and drinking places saw rebounds from October slippage. Clothing saw a second straight solid gain.

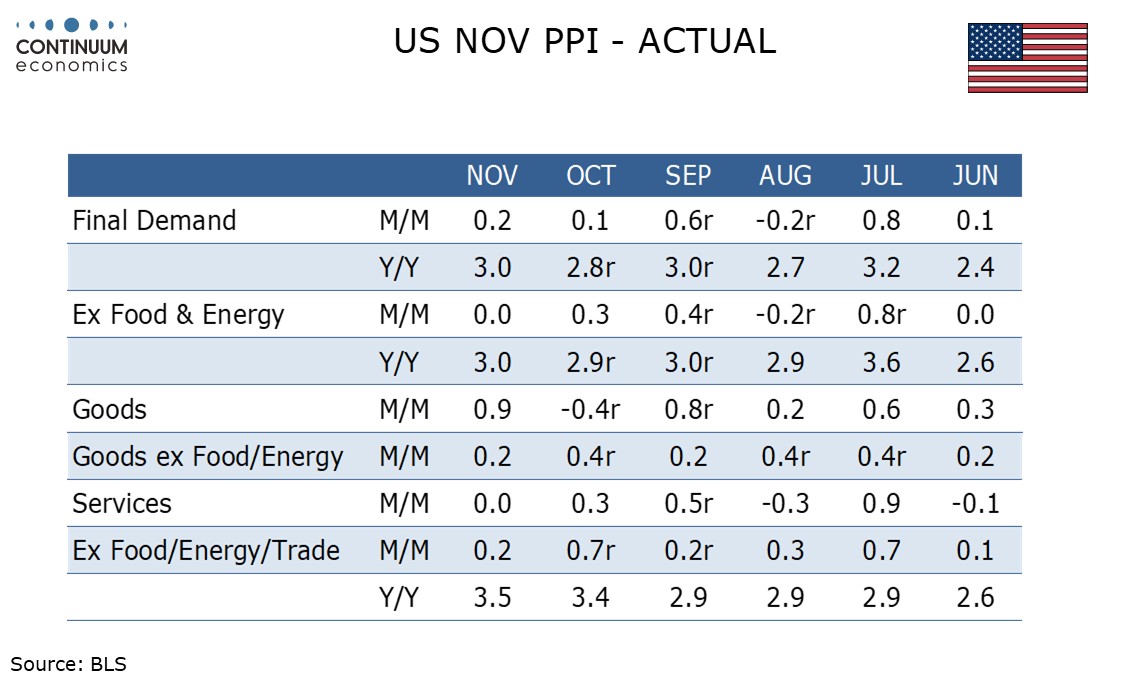

PPI with a 0.2% November rise after a 0.1% increase in October looks quite subdued, as does the ex food and energy rate which was unchanged in November after a 0.3% increase in October. Ex food, energy and trade however looks quite strong, up by 0.2% in November after a strong 0.7% rise in October. Two straight declines in trade prices more than fully erase a September increase.

Yr/yr PPI at 3.0% is unchanged from September with a 2.8% rise in October in between. PPI ex food, energy and trade however looks quite strong, at 3.5% in November versus 3.4% in October and 3.0% in September is the strongest since March. PPI ex food and energy rise by 3.0% yr/yr in November and 2.9% in October, similar to overall PPI but slower than ex food, energy and trade.

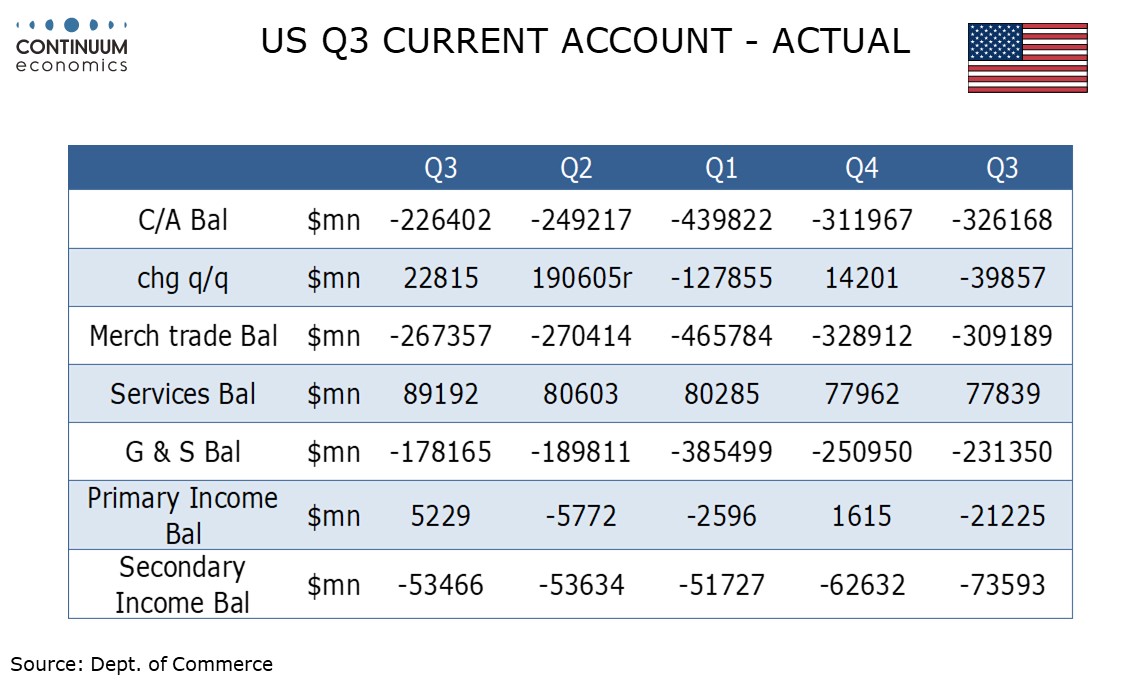

Q3’s current account deficit of $226.4bn from $249.2bn in Q2 was the narrowest since Q3 2022. Improvements in the goods and services balances were already known. Additional support came from a return to surplus in the investment income balance at $5.2bn versus a $5.8bn deficit in Q2.