FOMC Preview for November 7: A 25bps Easing, Outlook Unclear

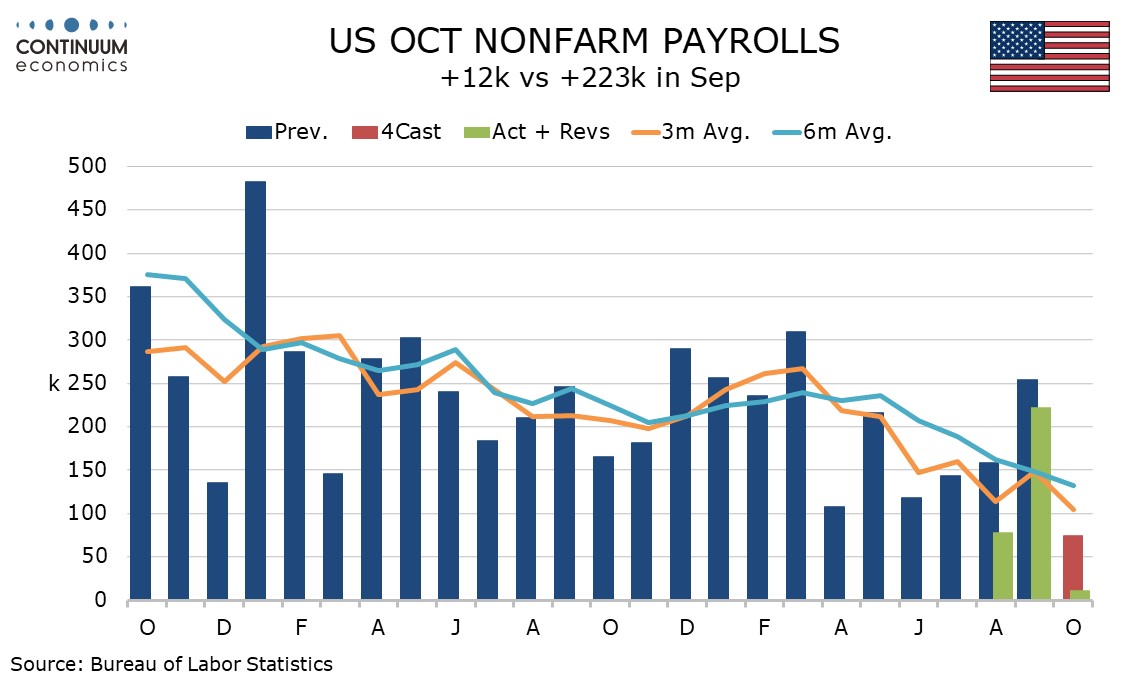

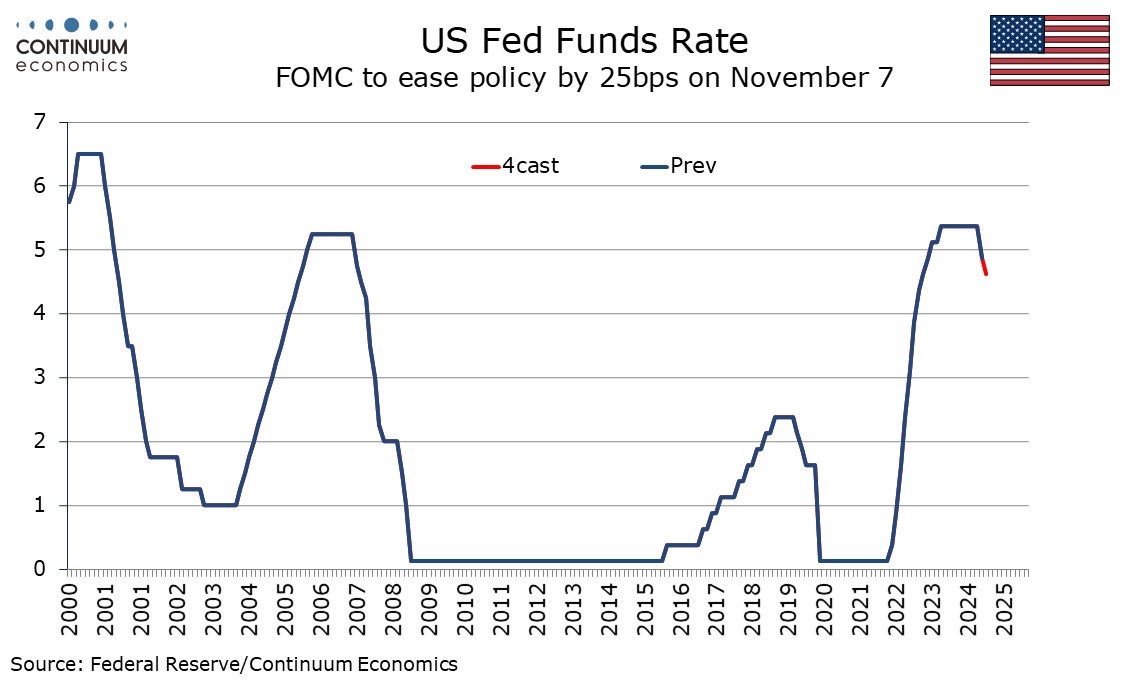

We expect a 25bps FOMC easing on November 7 to a 4.5% to 4.75% range. With the dots from the September 18 meeting relatively evenly split between one and two more 25bps easings this year and data since September 18 on balance being relatively firm the debate is likely to be between no change and a 25bps easing, but subdued October employment data suggests the latter will be chosen.

While September 18 saw the FOMC commence easing with a more aggressive 50bps move, the FOMC was clear that this did not signal the likely magnitude of future moves. The dots released with that meeting showed two respondents favoring no more moves this year, while seven favored only one more 25bps move. Nine favored two more 25bps moves, and one dove favored a total of 75bps in the year’s two remaining meetings.

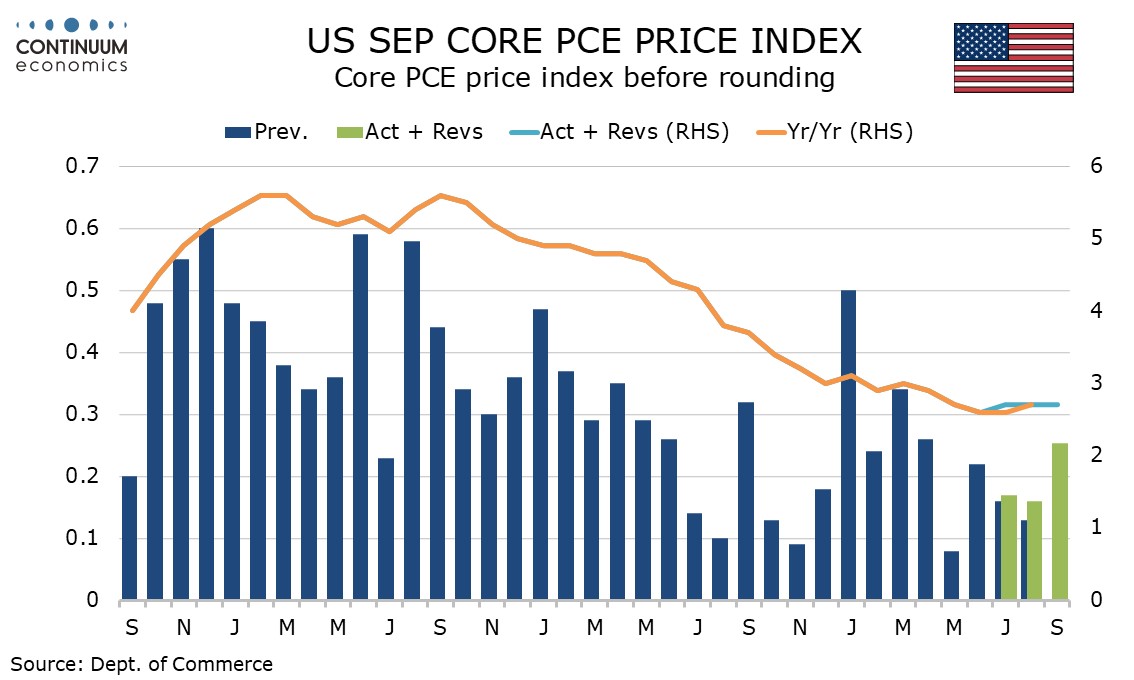

The dots will not be updated until December and we do not expect that the FOMC’s views have changed much since the September meeting, but if anything the data could be seen as on the firm side of expectations. Most significant were upward revisions to personal income in the annual GDP revisions on September 26, bringing income into line with spending and reducing downside risks to the latter. GDP maintained solid momentum in Q3, though was in line with Fed expectations outlined in September. Gains of 0.3% in September core CPI and core PCE prices were modest disappointments, as was a 2.2% annualized increase in the latter for Q3. Inflation, while lower, is not yet back to the 2.0% target.

The dots will not be updated until December and we do not expect that the FOMC’s views have changed much since the September meeting, but if anything the data could be seen as on the firm side of expectations. Most significant were upward revisions to personal income in the annual GDP revisions on September 26, bringing income into line with spending and reducing downside risks to the latter. GDP maintained solid momentum in Q3, though was in line with Fed expectations outlined in September. Gains of 0.3% in September core CPI and core PCE prices were modest disappointments, as was a 2.2% annualized increase in the latter for Q3. Inflation, while lower, is not yet back to the 2.0% target.

The Fed’s September move was also influenced by disappointing employment data for August, seeing focus moving towards the employment side of its dual mandate. Strong September data eased those fears. A weak October employment report probably saw a substantial negative impact from Hurricanes Helene and Milton, but downward revisions to August and September will be noted. While the Fed may expect a bounce in employment growth in November, concerns about downside risk to employment will persist. Some of those who favor only one more 25 bps move in 2024 may argue for a pause now before renewed easing in December, but most will probably agree to a move now and leaving December’s choice data-dependent.

The Fed’s September move was also influenced by disappointing employment data for August, seeing focus moving towards the employment side of its dual mandate. Strong September data eased those fears. A weak October employment report probably saw a substantial negative impact from Hurricanes Helene and Milton, but downward revisions to August and September will be noted. While the Fed may expect a bounce in employment growth in November, concerns about downside risk to employment will persist. Some of those who favor only one more 25 bps move in 2024 may argue for a pause now before renewed easing in December, but most will probably agree to a move now and leaving December’s choice data-dependent.