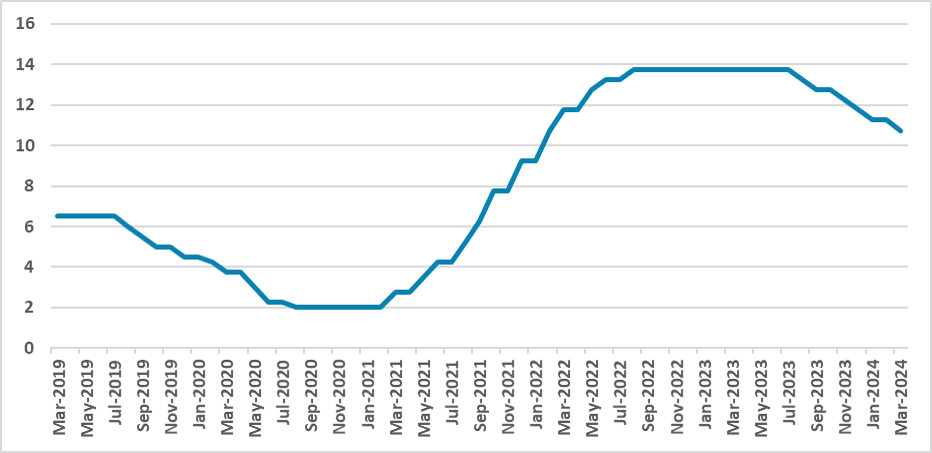

BCB Review: Forward Guidance Kept but Chance to be Taken Out Soon

The Central Bank (BCB) slashed the policy rate by 50bps to 10.75%, with further cuts anticipated. Medium-term easing hinges on inflation dynamics and economic factors. The BCB's forward guidance suggests a potential shift in communication and cut magnitude by June, changing the cut pace to 25bps from 50bps. Restrictive monetary policy will continue in 2024 even with the cuts and we see the cutting cycle ending in 2025 at 8.5%.

Figure 1: Brazil’s Policy Rate (%)

Source: BCB

Source: BCB

The Brazilian Central Bank (BCB) board met to decide on the policy rate. As widely expected, the BCB cut the policy rate by 50bps, lowering it to 10.75% from 11.25%. The decision was again unanimous among all the board members. However, the most important part of the communique was about the BCB’s forward guidance. The board advanced that if everything occurs as they expect, they will cut the policy rate by 50bps again, meaning they haven’t yet abandoned their usual 50bps cut forward guidance.

However, for the medium-term, the BCB stated that the total magnitude of the easing cycle over time will depend on the evolution of inflation dynamics, especially the components most sensitive to monetary policy and economic activity, inflation expectations, particularly longer-term ones, inflation projections, the output gap, and the balance of risks. We believe this is an indication that the BCB will change their communication in their next meeting, signaling a possible change in the magnitude of the cut in June.

Regarding domestic activity, the BCB stated that the recent deceleration was in line with the baseline scenario that the BCB expected. No mention was made about food inflation, which has risen recently, and the BCB only said that headline inflation continued to fall. They have kept the usual paragraphs about the disinflation process, which tends to be slower in this phase, and the importance of keeping and pursuing the fiscal targets set by the government.

In line with this communication, we believe that the BCB will slow down the pace of cutting only in June, with May's communique leaving open the magnitude of the next cut. The discussion for the BCB will now change to how far they wish to go with the cutting and how fast they want to get to the neutral rates. Looking into 2025, the BCB knows that expectations are not aligned, and therefore, monetary policy needs to be on restrictive terrain. We believe the BCB will continue to cut at a 25 bps pace in the second half and extend it a bit towards 2025, ending the cutting cycle at 8.5%.