President Trump: Filling in the Blanks

While the new executive orders from president Trump were focused on immigration and energy issues, the threat of 25% tariffs against Mexico and Canada by Feb 1 raises the stakes in North America negotiations in the coming weeks. China tariff threats will likely become more concreate in Q1, though progress on an overarching budget bill will likely take until the late summer to land on the president table.

Figure 1: Chronology of U.S./China Trade War

The flurry of President Trump’s executive orders as expected have been wide ranging with focus on immigration and energy, but with uncertainty still hanging over trade and budget issues. A couple of points are worth mentioning.

• Mexico/Canada tariff threats. President Trump did indicate that he intends to impose 25% tariffs on Mexico and Canada, but has now specified that this could be from February 1. This is linked to illegal immigration and control of illegal opioid. Trump 1.0 saw similar tactics of general threats; time dependent threats and then either partial or full implementation or delay for negotiations (Figure 1). Mexico and Canada are willing to help the U.S. on these issues, but President Trump wants urgent action and thus negotiations will likely go into high gear in the next week but the specifics will be fluid. Mexico is also showing willingness to restrict the percentage of China content in Mexican exports to the U.S., which could open the way to a rule of origin amendments the USMCA. It could be that the implementation threat is delayed for 1 month to allow an agreement to be reached, but the threat of tariffs will still hang over Mexico and Canada and remain a test case for Trump 2.0.

• China next? Financial markets elsewhere have taken some relief that a congress based universal tariff approach does not appear an urgent priority. Indeed, with President Trump direct threat on Mexico and Canada it appears that trade policy will largely be driven by the President and be transactional. Big picture this is less threatening for inflation and global trade flows, despite the uncertainty that specific disputes could trigger. This does not however mean that China can relax. President Trump first day shows he is being true to his beliefs and China trade surplus is high on his list. Review of the phase 1 trade deal from 2018 will show that it failed to deliver prior to the outbreak of COVID and the next step in the coming weeks/months will likely be tariff threats against China unless it agrees to a phase 2 trade deal. Trump has also yesterday threatened to impose tariffs on China, if it blocked a sale of Tik Tok U.S. (here).

• EU and others. The EU and Germany also remains at risk as well, especially the EU auto sector that President Trump is keen to restrict and oil/gas exports to encourage to Europe. Whether this comes through in the coming months is less certain and the EU will likely try to use Trump’s good relationship with Italian PM Meloni to slow tariffs and/or negotiate with the U.S. We also still feel that Vietnam is at risk of tariffs, given that some exports to the U.S. have a high China content.

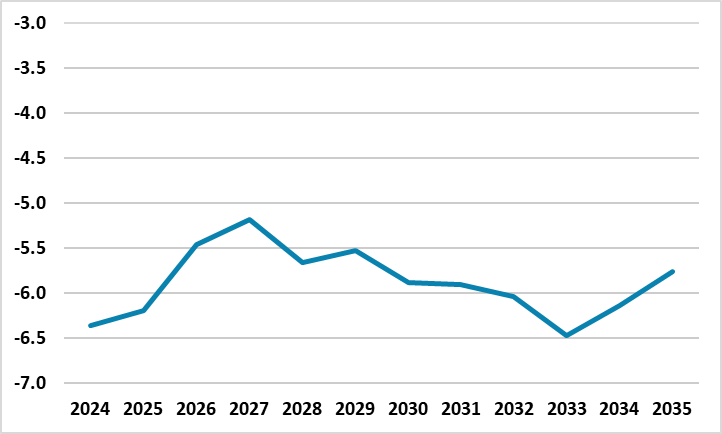

• Budget problems. U.S. budgetary policy has so far not been in the spotlight as much and reports still suggest that the slim majority for House Republicans will likely mean differences of opinion over the scale of tax cuts and partial offset from expenditure cuts (here). Though the House Speaker appears to be aiming for one overarching bill by June, the view around congress is that this will be difficult to achieve. This means that funding for the immigration fight could be given priority in any March drama over government funding, which could mean that the main budget bill gets delayed until late summer/early autumn. We also remain skeptical that attempts to cut discretionary expenditure significantly given the president desire not to cut Medicare. Independent think tanks are penciling in circa USD100bln per annum of expenditure cuts. Meanwhile, if president Trump follows a transactional approach on tariffs, it is likely to raise less revenue than universal tariffs. We still feel that the 2026 U.S. budget deficit will be wider than the 5.5% of GDP forecast by the CBO on Jan 17 (Figure 2).

Figure 2: U.S Budget Deficit to GDP (%)

Source: CBO Jan 2025 (here)

Source: CBO Jan 2025 (here)