FOMC Preview for January 29: A Cautious Hold

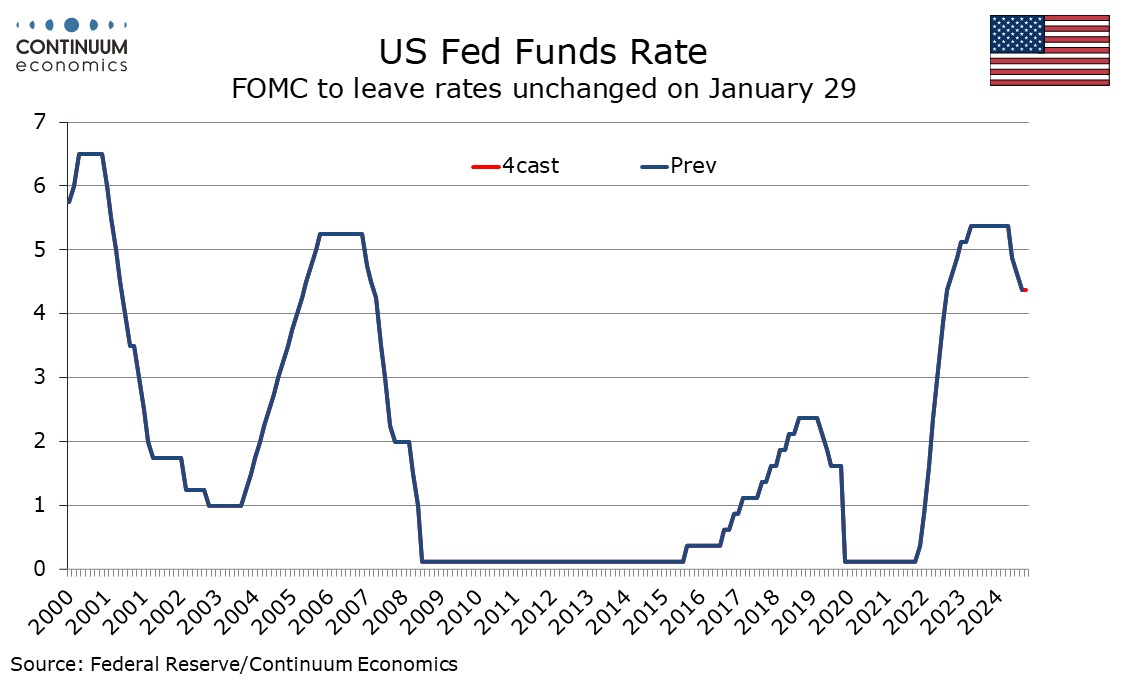

The FOMC looks set to keep rates on hold at 4.25-4.5% at its January 29 meeting. The statement is unlikely to give much away but the message is likely to be one of cautious optimism on inflation, suggesting further easing is likely but dependent on incoming data. Policy uncertainty under the incoming Trump administration will provide further justification for a cautious tone.

After December’s 25bps easing, which took the total easing in the final three meetings of 2024 to 100bps, Fed Chairman Jerome Powell stated that the Fed could now be more cautious, while the dots were adjusted in a more hawkish direction, seeing only 50bps of easing in 2025 rather than 100bps. Minutes from the meting showed some debate between keeping policy on hold and the 25bps easing that was delivered. The dots will not be adjusted at this meeting and we doubt the Fed has changed its view much from December, but the more cautious approach suggests a pause in January.

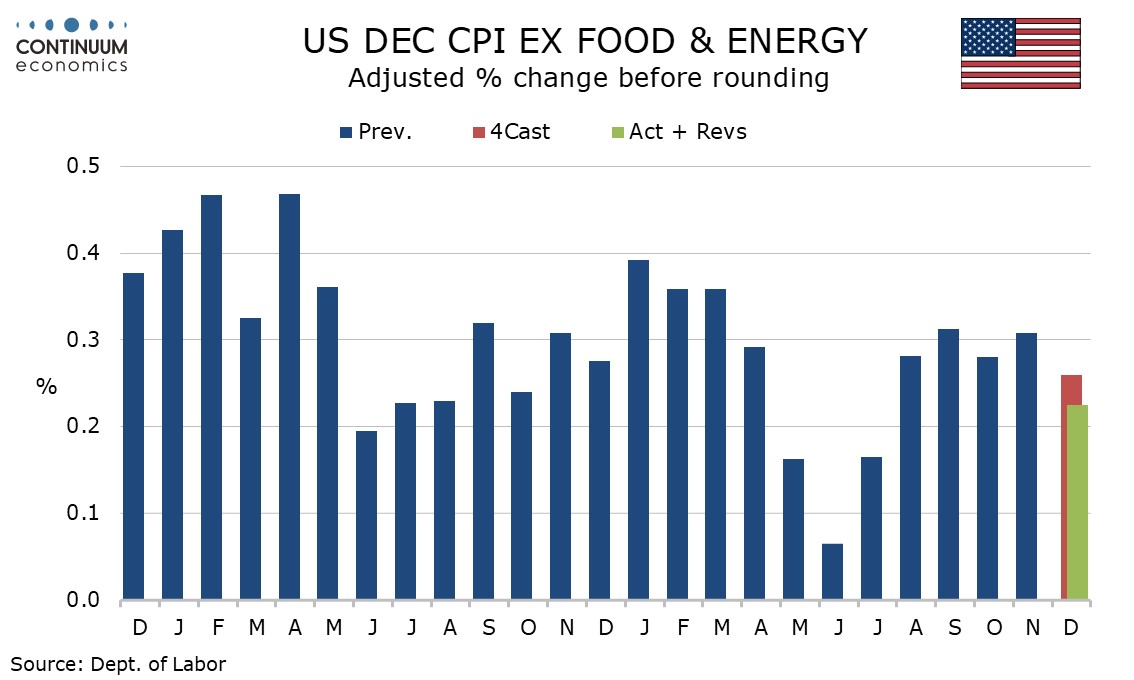

Since December’s meeting we have had encouraging data from November’s core PCE price index and December’s core CPI, but these followed slightly disappointing data going into December’s meeting and only limited further progress has been made on inflation in recent months. Even before the December CPI most Fed speakers were suggesting a central view of continued progress on inflation allowing further easing, albeit at a cautious pace. The Fed will be reluctant to make any strong conclusions before seeing early 2025 data. If that repeats the strength of early 2024 the Fed will be disappointed, but the more likely outcome is that as the early 2024 data drops out, yr/yr rates will fall.

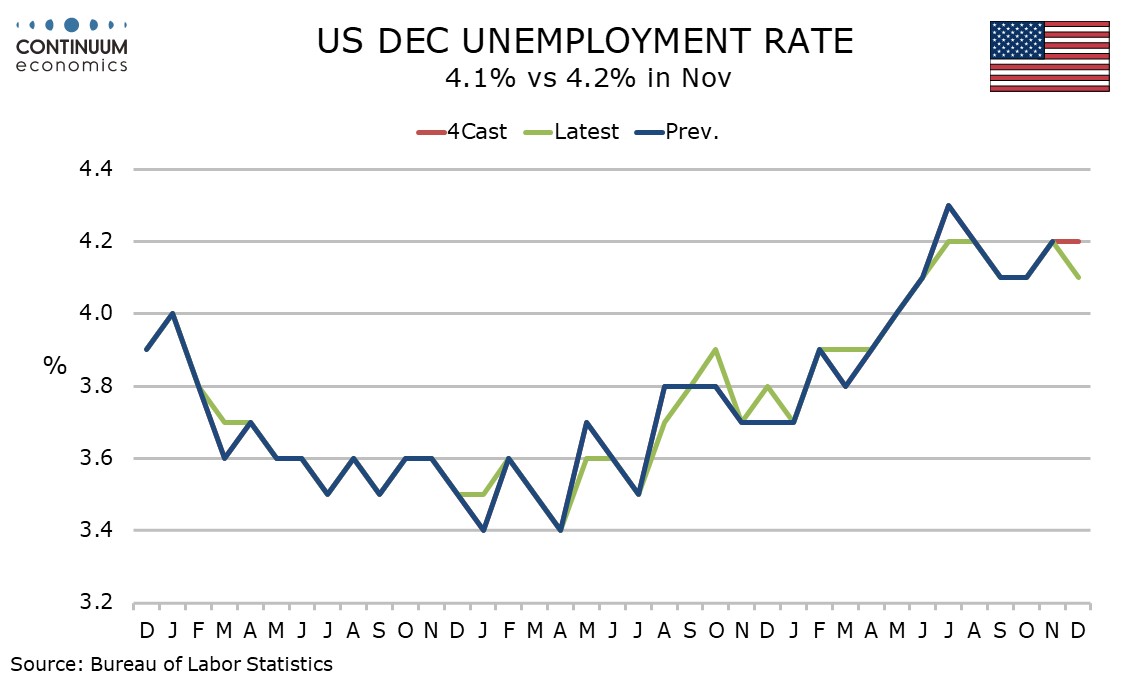

A surprisingly strong December employment report is likely to have ensured that even with the softer December core CPI, easing will not be seriously considered at this meeting. The Fed is not alarmed by the data, not seeing the labor market as increasing inflationary pressures. However, fears that the labor market was losing more momentum than was desirable, caused by a rising unemployment rate earlier in 2024, have eased as the rate has subsequently stabilized. The Fed’s statement is likely to be adjusted in a more hawkish direction, removing a reference to the unemployment rate moving up, though the view on inflation, that it has made progress towards to 2% objective but remains somewhat elevated, still looks valid.

On policy, December’s statement saw the language fine-tuned, adding the words “extent and timing” when discussing the consideration of further policy adjustments, which signaled a more cautious approach and this probably needs no further adjustment. Thus, we expect a statement with a hawkish fine tuning on the labor market but few other changes, and risks are still likely to be seen as roughly in balance. Powell in his press conference is unlikely to give much away, stressing policy will be data-dependent but a cautiously optimistic tone on inflation will leave a central expectation that easing is not yet done. He will be asked about policy risks under the incoming Trump administration. While his responses will be cautious, he will stress that any increase in inflationary pressure will be taken seriously by the Fed. Either tariffs on imports or a larger budget deficit would add to inflationary risk.