BoE Review: Explicit Gradualism

The expected unchanged MPC decision came with what some may regard was a lack of any major dissent beyond that from arch-dove, Swati Dhingra. But that 8:1 vote is very much a reaction to the closeness of the MPC vote last month to cut Bank Rate by 25 bp to 5.0%. It is also preference from the MPC majority to pursue gradual easing, this laid out more formally this time around suggesting overtly that ‘a gradual approach to removing policy restraint remains appropriate’. This slightly more explicit policy guidance also reflects moderate differences within the MPC principally over how quickly current restrictive policy stance will temper underlying domestic inflationary pressures. Clearly, a further cut is on the cards for the November meeting which will have fresh forecasts which should reiterate the inflation undershoot projected in August. But that may now be the only further move this year but with over 100 bp of easing anticipated in 2025 when the MPC may be a little less ‘gradual’.

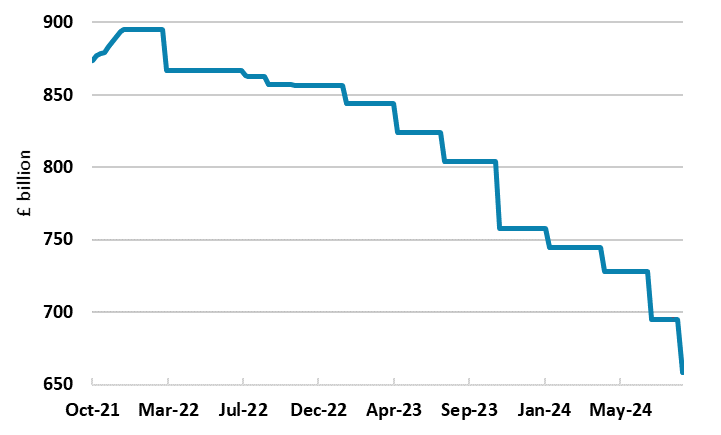

Figure 1: BoE QT Extended as Expected

Source: BoE , change in the BoE Asset Purchase Facility

Hawks vs Doves

Indeed, in August, Bank Rate cuts to around 3.7% by 2026 saw an inflation outlook undershooting target at both the 2-year and 3-year forecast horizons, this showing the impact of a policy stance in restrictive territory is largely seen to have. But it is clear that the hawks on the MPC are more circumspect, their influence still palpable even with the loss of Haskel from their midst. This reflects what are clearly a range of views among MPC members. Firstly, there difference over the degree to which the unwinding of past global shocks, the normalisation in inflation expectations and the current restrictive policy stance would lead underlying domestic inflationary pressures continuing to unwind. Secondly, whether these pressures could prove more entrenched, possibly as a result of more structural factors or greater momentum in demand.

Gradualism=Compromise

Indeed, it appears that some members think the economy may have undergone structural shifts such as changes in wage and price-setting following the major supply shocks experienced over recent years. If so, their worry is that the degree of restrictiveness of monetary policy may be less than embodied in the Committee’s central assessment, meaning that monetary policy would have to remain tighter for longer. As a result, the hawks see risks that a period of economic slack, in which GDP falls below potential and the labour market eases further, may be required in order for pay and price-setting dynamics to normalise fully.

This line of thinking is puzzling to us, not least as conventional policy is being buttressed by QT (see below) and where other European central banks main worry is that the transmission mechanism of monetary policy may prove to be much stronger than both previous cycle and current central thinking.

Against these differences of view, the current policy stance was judged to be appropriate and the gradual policy guidance is surely a compromise. Wi this in mind we think the MPC is likely to echo ECB thinking in occurring rates quarterly and in tandem with its MPR meetings. But given the below-consensus outlook we envisage, there may be an additional move so that over 100 bp of easing may occur

QT Decision as Expected

The MPC updated its thinking on QT at this meeting in September, involving what the reduction in the stock of UK government bonds held for monetary policy (QT) purposes will be over the 12-month period from October 2024 to September 2025. The MPC is kept the pace of QT unchanged, again setting it at £ 100 bn. That would leave the asset purchase facility (APF) stock at end-September 2025 at just over £ 550 bn given that at the conclusion of the current 12-month gilt reduction at the end of this month, it will stand at £ 658 bn (Figure 1). As far as its impact is concerned, the BoE continues to say it remained hard to measure precisely the marginal effect of quantitative tightening on the economy.

Notably, that end-Sep 2025 assumed figure would be very close to what the BoE thinks what UK banks require. This so-called Preferred Minimum Range of Reserve (the level of liquid reserves banks needed both to meet regulatory requirements and to ensure they can meet daily payments) is estimated by the BoE to be somewhere between £ 345 bn to £ 490 bn. However, this does not mean that an end to QT is in sight toward the end of next year, as Governor Bailey wants to go further with QT, ensuring that as the level of reserves falls below the amount banks desire, they meet their needs by borrowing from the BoE against pledged collateral. Importantly, for the BoE, this desire to change the composition of its balance sheet, would leave it with less interest rate risk.