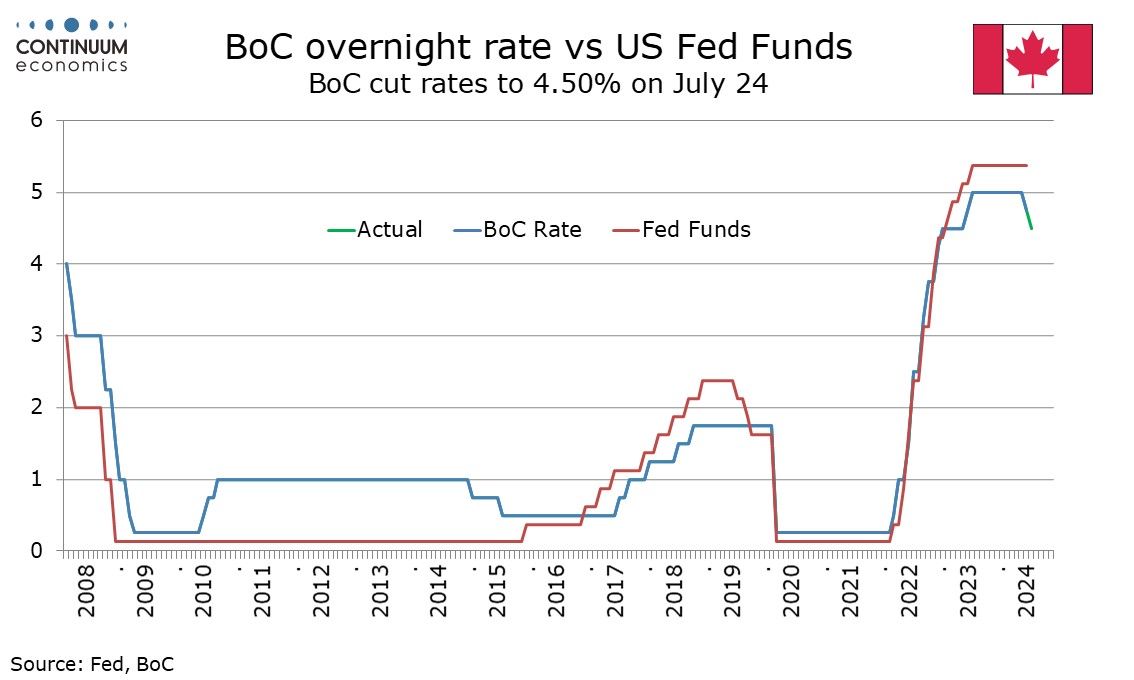

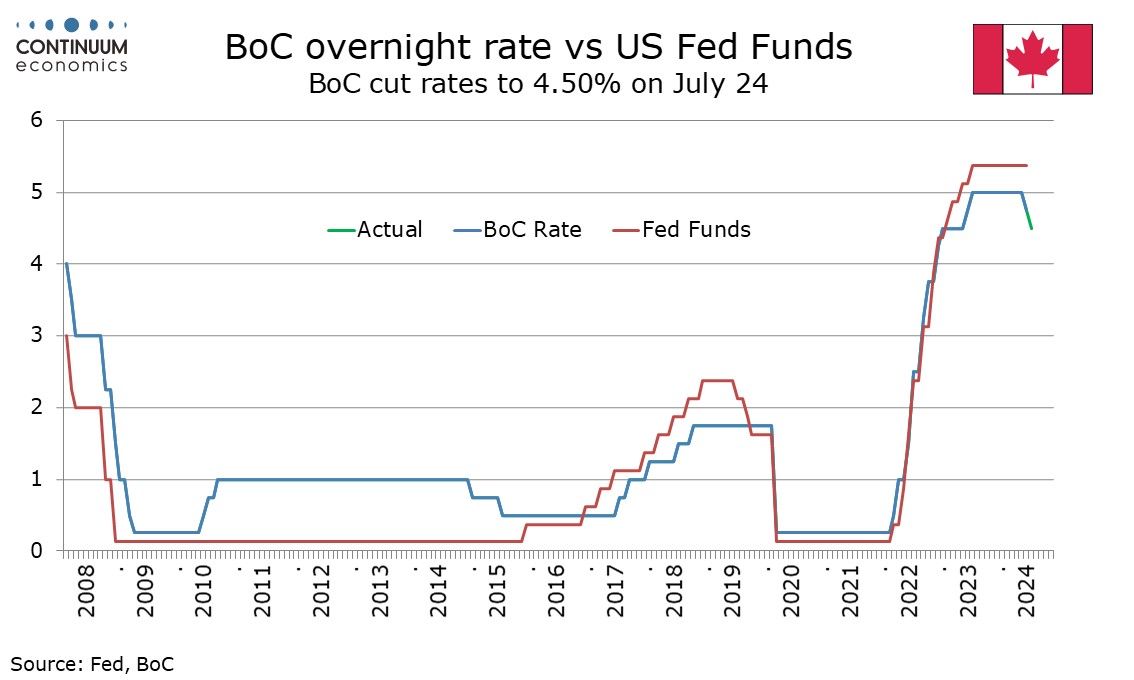

The Bank of Canada has delivered a second straight 25bps easing to 4.50% and Governor Tiff Macklem stated there was a clear consensus behind the decision. The BoC’s tone was generally dovish despite looking for stronger GDP growth going forward. We now expect 25bps easings at each of the remaining three meetings this year, and 100bps of easing in 2025, which would see the rate at a neutral 2.75% at the end of 2025.

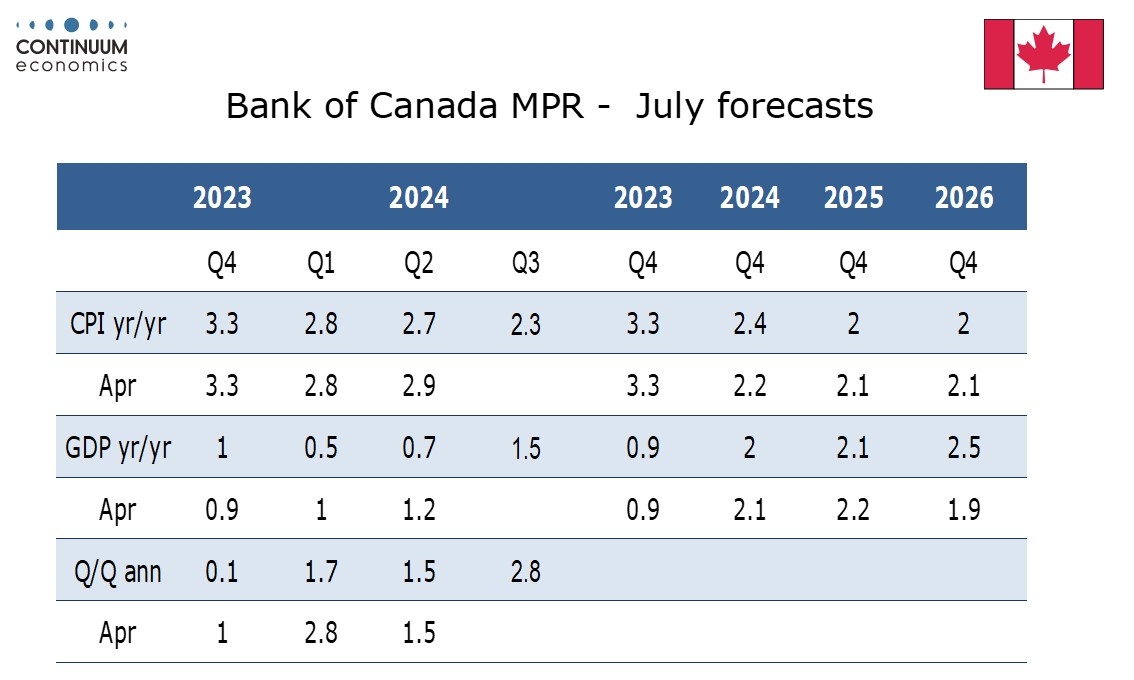

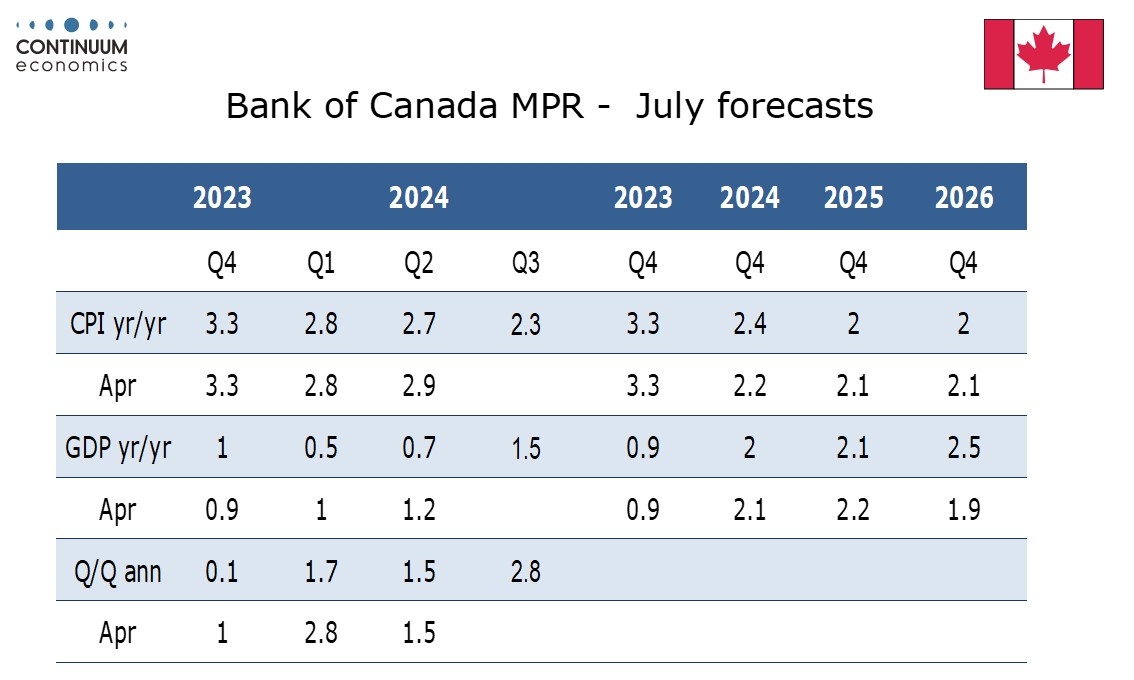

Despite the recent progress on inflation, the accompanying Monetary Policy Report forecasts CPI at 2.4% yr/yr in Q4 2024, up from a 2.2% forecast made in the last MPR released in April. 2025 and 2026 have however both been revised down to an on-target 2.0% from 2.1%. The BoC also added forecasts for core CPI, which match the headline CPI forecasts in each of the three years. It was known that GDP fell short of the BoC’s expectation for Q1 and the BoC has left its Q2 forecast at 1.5% annualized. However GDP has been revised only marginally lower to 2.0% yr/yr from 2.1% for Q4 2024, with Q3 seen at a strong 2.8% annualized, which implies a 2.0% annualized pace in Q4. 2025 is seen at a similar 2.1% from 2.2% Q4/Q4 but 2026 is seen at a healthy 2.5% rather than 1.9%.

The statement notes robust population growth of around 3% meaning that potential output is growing faster than GDP, increasing excess supply and producing signs of slack in the labor market. Governor Macklem stated that the economy has more room to grow without increasing inflationary pressures and with inflation getting closer to target upside risks to prices must be increasingly balanced against downside economic risks. While we see the risks of Canada falling into recession as having faded, the economy may struggle to match the BoC’s expectations in the second half of the year. That has us forecasting a 25bps easing in each of the three remaining meetings, which would take the rate to 3.75% at the end of 2024. The BoC is unlikely to continue easing at successive meetings in 2025. One 25bps easing in each quarter of 2025 would take the rate to 2.75%, which is the midpoint of the BoC’s estimate for the neutral range.

The statement notes robust population growth of around 3% meaning that potential output is growing faster than GDP, increasing excess supply and producing signs of slack in the labor market. Governor Macklem stated that the economy has more room to grow without increasing inflationary pressures and with inflation getting closer to target upside risks to prices must be increasingly balanced against downside economic risks. While we see the risks of Canada falling into recession as having faded, the economy may struggle to match the BoC’s expectations in the second half of the year. That has us forecasting a 25bps easing in each of the three remaining meetings, which would take the rate to 3.75% at the end of 2024. The BoC is unlikely to continue easing at successive meetings in 2025. One 25bps easing in each quarter of 2025 would take the rate to 2.75%, which is the midpoint of the BoC’s estimate for the neutral range.

On inflation, the BoC sees broad pressures as easing with the breadth of price increases near its historical norm. However pressure persists in shelter and services impacted by wages such as restaurants and health care. Wages are seen as moderating but remain elevated. However, Macklem stated that the BoC is increasingly confident that the ingredients to bring inflation back to target are in place, even if the decline is likely to be gradual and there could be setbacks along the way. One significant disappointment in inflation could be all that it takes to see the BoC pause at one meeting. There is only one CPI release (for July) due before the next BoC meeting on September 4.

On inflation, the BoC sees broad pressures as easing with the breadth of price increases near its historical norm. However pressure persists in shelter and services impacted by wages such as restaurants and health care. Wages are seen as moderating but remain elevated. However, Macklem stated that the BoC is increasingly confident that the ingredients to bring inflation back to target are in place, even if the decline is likely to be gradual and there could be setbacks along the way. One significant disappointment in inflation could be all that it takes to see the BoC pause at one meeting. There is only one CPI release (for July) due before the next BoC meeting on September 4.