USD, EUR, CHF, JPY flows: USD firm, risk appetite recovering, JPY weak

Market seeing Iran attack on Israel as less bad than feared, risk appetite edging up, JPY weakening

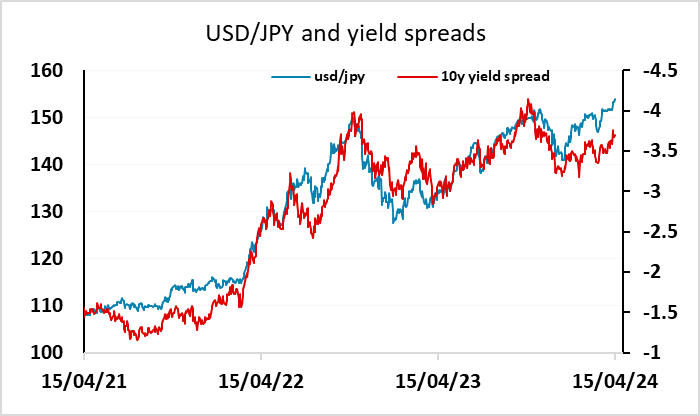

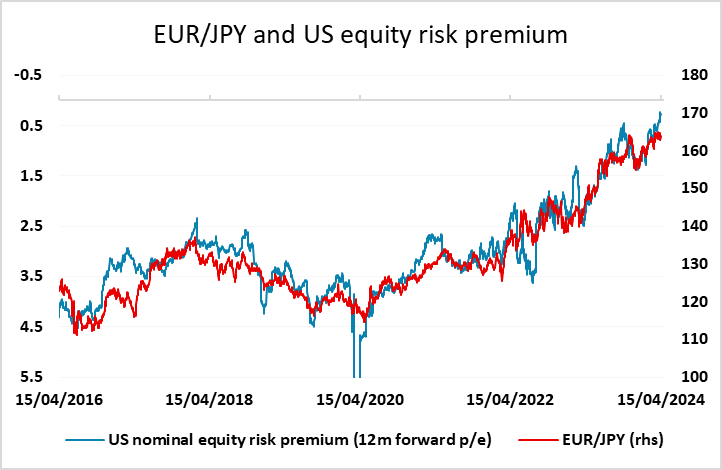

Markets seem to have taken the Iran attack on Israel as having turned out slightly better than might have been expected. Initial CHF gains against the EUR at the open in Asia have been reversed and equities are generally trading a little firmer, while yields are modestly higher and the JPY is weaker both against the USD and on the crosses. JPY weakness continues to look excessive relative to the moves in yield spreads, but could extend further if the correlation with equity risk premia holds up, as the resilience of equities in the face of the recent rise in yields has pushed risk premia to new lows. However, this sort of general JPY weakness, which sees the JPY fall back on the crosses as well as against the USD is much more likely to attract intervention from the Japanese authorities, so we would be wary of EUR/JPY gains beyond 164.

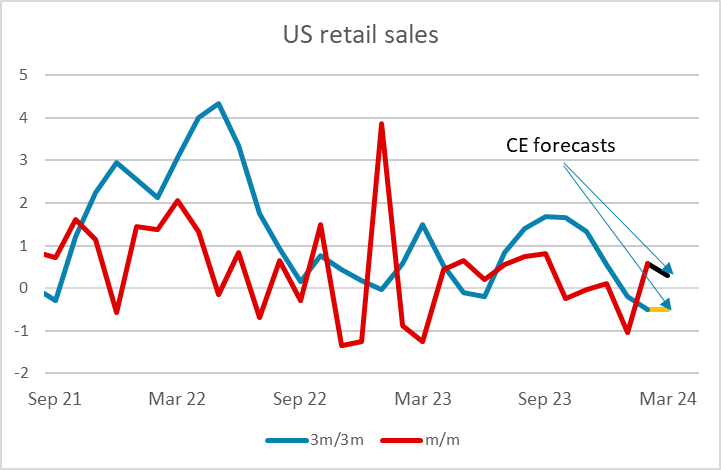

For today, US March retail sales is the main data. We expect a 0.3% increase (market consensus 0.4%), which after a 0.6% February increase would not fully erase January’s 1.1% decline that was blamed on bad weather. Ex autos however we expect a rise of 0.5% (consensus 0.5%), which after a 0.3% February increase would complete a reversal of a 0.8% decline in January. Even so, this would still translate into a soft Q1 outcome, the weakest since the pandemic, and might take the edge off USD strength.