UK CPI & BoE Preview (Dec 18-19): Benign Inflation Signals But BoE Still Cautious

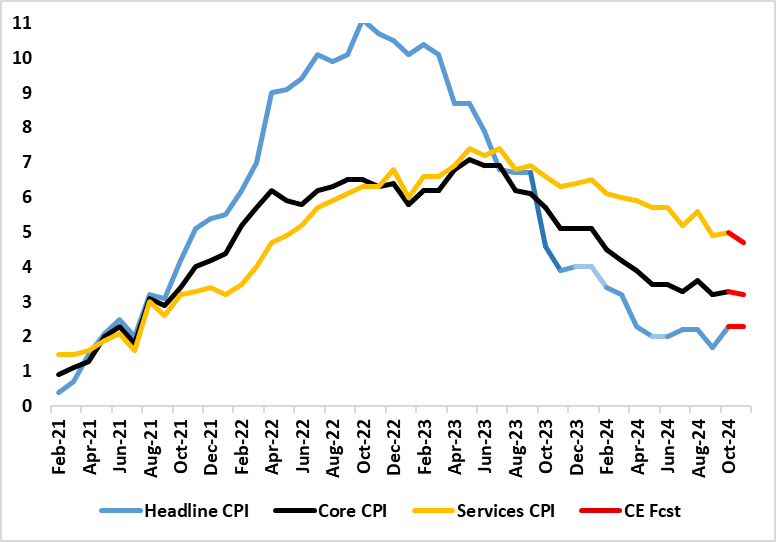

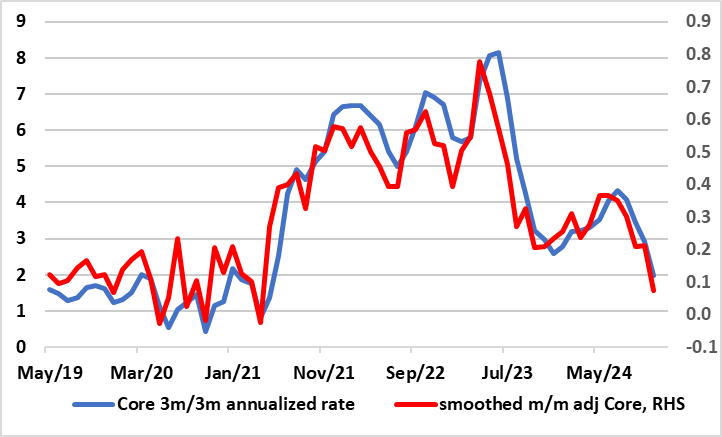

While they may not affect the overall BoE verdict on Dec 19, which looks very likely to be a pause after last month’s 25 bp cut (to 4.75%), forthcoming data may very well influence the MPC vote and the message in the updated Monetary Policy Summary. In particular, CPI data (Dec 18) may have some influence as we think that a stable 2.3% y/y reading (Figure 1) may mask short-term adjusted details that suggest core inflation may already be hovering around target (Figure 2). Overall, we see the BoE vote having at least one dissent, but with the MPC largely adhering to its new scenario strategy with a central view that has allowed Governor Bailey to flag around four 25 bp cuts next year. We see a little more than that still in the coming year!

Figure 1: Services Inflation to Slow?

Source: ONS, Continuum Economics

Gradualism Still the MPC Watchword

In what was something of a more hawkish assessment and outlook, the BoE nevertheless delivered the expected further 25 bp Bank Rate cut to 4.75% last month with only one (expected) dissent against. But after what had been hints of a possibly more policy activism from Governor Bailey prior to the decision, the MPC instead adhered to its the gradualist approach, thereby conforming with the caution long advocated by Chief Economist Pill. It does seem that the recent Budget has had a material impact on MPC thinking, to a degree that despite recent soft data and higher market rates, an inflation target undershoot is projected only from mid-2027 onwards.

But the other key development is the BoE is also trying to implement the Bernanke Review, ie to alter its strategy and communications. In this regard it has already highlighted more formal scenarios for the inflation outlook, an upside and downside and a central case, the latter used as the basis for the MPR projections and encompassing more price pressures than envisaged in August. We still think there are shortcomings not being met and we wonder whether what may be long drawn out review may actually handicap actual policy making as the MPC wrestles with an alternative policy outlooks and whether communication may thus suffer.

All of which made it unlikely that this looming December MPC meeting would see more easing. Regardless, given the below-consensus outlook we still envisage for both growth and inflation, we still see an additional 125 bp of easing by end-2025.

Figure 2: Clear Adjusted Core Inflation Drop Continues?

Source: ONS, Continuum Economics

The Inflation Picture – More Benign?

Thus the BoE has plenty of data to assess ahead of its decision next week. As for inflation, coming in higher than expected and a notch above BoE thinking, CPI inflation jumped to 2.3% in October, partly due a swing in airfares, amplified by base effects. The data also showed a fresh rise (of 0.1 ppt) in both the core and services inflation to 3.3% and 5.0% respectively (Figure 1), the latter up from a 28-mth low. Nevertheless, the CPI data backdrop is still consistent with underlying inflation still having fallen, especially when assessed in shorter-term dynamics (Figure 2) something we think will be repeated in these November data. The data will show some rise in fuel prices but we see a slip in services to rate (4.7%) below BoE thinking.

The MPC will probably get early access to the CPI data and possibly to labor market figures (Dec 17) which may show more signs of job losses, alongside little further drop in earnings. The data on payrolls is becoming ever more important, both given the repeated falls they have reported of late but also questioning the validity of the BoE’s interpretation of how tight the labor market actually is, as they suggest far less inactive workers than official ONS numbers. This Friday also sees GDP data that could undermine the BoE projections at least for the current quarter as may PMI data (Dec 16) which are already pointing to slumping business optimism. The BoE very clearly took the recent Budget as being unambiguously stimulative and it was in terms of the shift in the fiscal stance. But the emerging issue is whether the tax rises have accentuated what were already growing concerns that are now being flagged more clearly by the likes of business survey numbers. If so, the BoE may be getting complacent.