Russia’s Inflation Remained Steady at 7.7% in March

Bottom Line: After hitting 7.4% YoY in January and December, the inflation rate remained stable at a one-year peak of 7.7% YoY in March after February. We think stubborn price pressures continue to be strong due to high military spending, currency weakening particularly after March 11, tight labour market, fiscal policy igniting domestic demand.

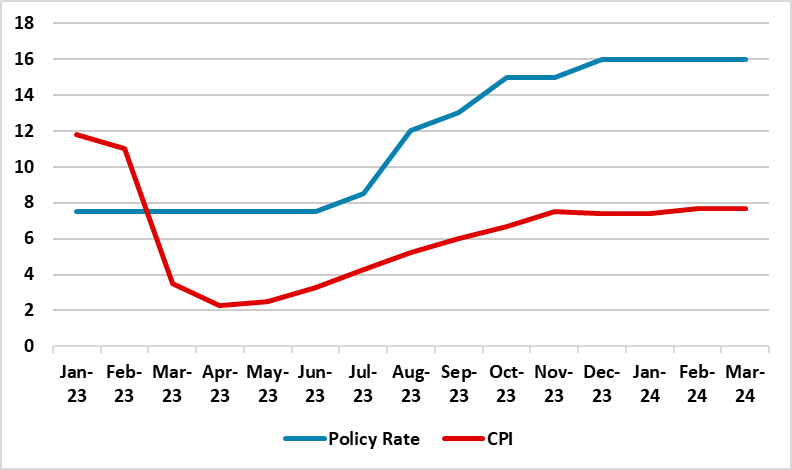

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2023 – March 2024

Source: Continuum Economics

According to Rosstat figures on April 10, the inflation rate remained stable at a one-year peak of 7.7% YoY in March after February while prices of food, non-food products and services rose by 8.1%, 6.7% and 8.3% on an annual basis, respectively. The consumer price index (CPI) shot up by 0.4% on a monthly basis, slowing from a 0.7% gain in February. The core inflation rate increased to 7.8% YoY marking the highest reading over a year.

We think the inflationary pressures remained strong basically due high military spending, strong fiscal policy, lagged feedthrough of the weak Ruble (RUB) and tight labor market. (Note: On the currency front, the weakening of RUB accelerated particularly after March 11 as the currency lost 2.4% of its value against the USD between March 11 and April 10).

March’s 7.7% YoY inflation remained far above the Central Bank of Russia’s (CBR) 2024 forecast range of 4% - 4.5%, and CBR’s medium term target of 4%. Despite relatively high reading, CBR Governor Elvira Nabiullina said during a plenary meeting of the State Duma on April 10 that Russia has passed peak inflation owing to tight monetary policy. Nabiullina added that "We are already seeing the first results of our policy, that peak inflation is behind us (…) If we had not hiked the key rate, then inflation would have been much higher than the 7.4% that we had at the end of last year. Moreover, it would have continued to accelerate today."

CBR held the key rate constant at 16% in Q1, and we expect CBR will leave the policy rate unchanged at 16% on next MPC scheduled at April 26 as strongly signaled by Nabiullina on April 10. (Note: The Governor indicated that the regulator will start to lower the policy rate once the slowdown in inflation has reached the required speed).

Taking into account CBR’s determination, we predict high rates can suppress demand and imports and squeeze lending particularly in 2H of 2024, but only gradually with lagged effects. In line with this, we do not expect any rate cuts from CBR in Q2, and we foresee that CBR will likely consider cutting rates in Q3, if the inflation trajectory allows. The risks to the outlook remain strong as the fiscal policy making a big contribution to domestic demand coupled with high military spending due to ongoing war in Ukraine. The risk is even higher as military analysts foresee Russian offensive operations in Ukraine will likely intensify in the upcoming months, probably late May or June.