Eurozone GDP Review: Conflicting Signals?

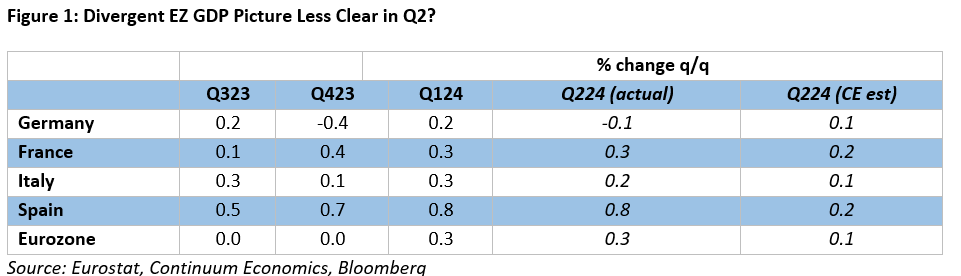

At best, the EZ economy is diverging ever more clearly as Germany falters while Spain prospers more discernibly. But while EZ GDP may have shown a sub-trend type result of 0.3%, thereby matching the Q1 outcome, there are questions about momentum, with survey data suggesting it is both feeble and probably flagging. Indeed, chiming with weaker PMI data, European Commission survey data today suggested continued below-trend activity at the start of the current (ie third) quarter and will ill omens regarding orders. Regardless, while Q2 GDP was largely as expected, but a notch below ECB thinking, the details so far available continue to suggest that net trade was the main supportive factor as domestic demand continued to labour, at least outside of Italy. This may explain why disinflation signals continue even in apparently-solid growing growth economies such as Spain. But it will be the survey data that will be the more influential news for the likes of the ECB both as it is more up to date and also has more details, most if which suggest continued fragility.

Geographical Disparity Continuing?

The weakness in domestic demand persisted, if not deepened, in Q1, with a drop in imports masking a small drop in government spending and further inventory shrinkage – we think the latter is normalizing in the holding of stocks rather than presaging any intentional inventory rebuild into H2, this supported by survey data. As a result, we would not read too much into any apparent ‘strength’ in the Q1 GDP numbers or these Q2 numbers – even in Spain. As an aside, the data in Q1 and now in Q2 reflected marked divergences among the EZ economies, most notably among the ‘Big 4’. Spanish GDP growth stayed at an upbeat 0.8% q/q. But the fact that Q2 saw Germany returning to contraction begs the question as to how any such trends spill over into the rest of 2024 – and beyond.

This can be partly answered by looking at recent actual monthly data for Q2 and (at least for survey numbers) into the current quarter. They very much suggest continuing weakness and declines in manufacturing and construction, but with momentum evident in services. Indeed, official data on services output suggest a very upbeat Q2 outcome, but this is purely on the basis of April data which may have been boosted by aberrant factors such as the timing of Easter. This is something certainly suggested by business survey data whether they be PMI numbers or those offered by the European Commission, with a clear loss of GDP momentum being signaled into Q3, much of which is based around softer services activity. But with orders and exports sagging according to survey data, the omens overall are not that promising

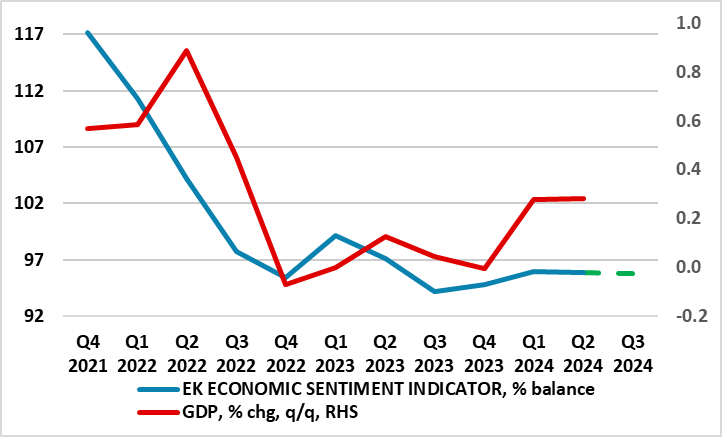

Such a backdrop may perturb some Council members who may still be wary that the ECB’s recently upgraded growth forecasts are still too optimistic, they being reliant on annualized growth of well over 1.5% through H2 2024. Admittedly, we have repeatedly cautioned about taking much from PMI readings not least given the misleading picture it has offered in the past regarding actual EZ GDP swings and its conflict with much and persistently weaker European Commission survey data but the latter also suggest the GDP picture is misleadingly upbeat (Figure 2). Indeed, the broader based European Commission business and consumer survey data is telling a much different story, having slipped afresh and remains much more within contraction territory. Admittedly, there are positives in the survey data, mainly is less weak consumer confidence albeit where this may reflect households having even weaker and below average inflation expectations. In addition, the weakness in domestic demand (most notable in the form a fresh drop in Germany) is important as it accentuates the disinflation backdrop still coming through. This clearer disinflationary backdrop, is, however, something that the business survey data also highlight – the recent July PMI numbers noting ‘companies raised their selling prices at a softer pace. In fact, the pace of charge inflation was the slowest since last October’. And the European Commission survey data show clear signs of elevated services price pressures ebbing

ECB Optimism Overdone

Thus we remain of the view that the ECB is still too optimistic regarding real economy prospects, even though our existing 2024 GDP estimate of 0.7% has been upgraded, but where we see the ECB outlook of 0.9% this year and 1.5% 2025 look like being undershot. This reflects not least as nowhere near the full extent of its policy tightening has filtered through yet, this formal hiking being accentuated both by the ECB balance sheet shrinkage and by credit standards being raised by the banking sector. But the ECB has been very aware of a still very weak credit and bank deposit backdrop, this very much being compounded by fiscal consolidation. Indeed, the European Commission is suggesting both more and faster such consolidation it having out several EU counties under excessive deficit surveillance. Furthermore, on the monetary side, the continued planned shrinkage in the ECB monetary policy asset portfolio will have a further negative impact on banks’ financing conditions and liquidity position, resulting in a moderate tightening of terms and conditions and a negative effect on lending volumes. Importantly, continued weakness in consumer borrowing (still running at just 0.3% y/y and very negative in real terms) is hardly evidence of the consumer recovery that is the mainstay of ECB growth thinking.

Figure 2: Business Surveys Suggest Flagging Momentum

Source: Eurostat, European Commission

Policy Outlook

Regardless, we still feel that neither Fed policy, nor the US$, are likely to delay any further ECB move(s). Instead, and partly as the ECB remains focused on the labor costs updates, numbers produced quarterly, but also wants to amass a broad but fresh thrust of added insights, then subsequent rate cuts may only arrive in three-month intervals, ie September and December. This schedule also chimes with updated ECB projections. Hence, our long-standing view that the ECB may cut only a further 50 bp this year and we see 100 bp further easing through 2025, with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into a clear expansionary stance. But if the slowing economy backdrop becomes more discernible, then the ECB may ci faster and more sizably!