U.S. December Employment - Non-Farm Payrolls disappoint but Unemployment down

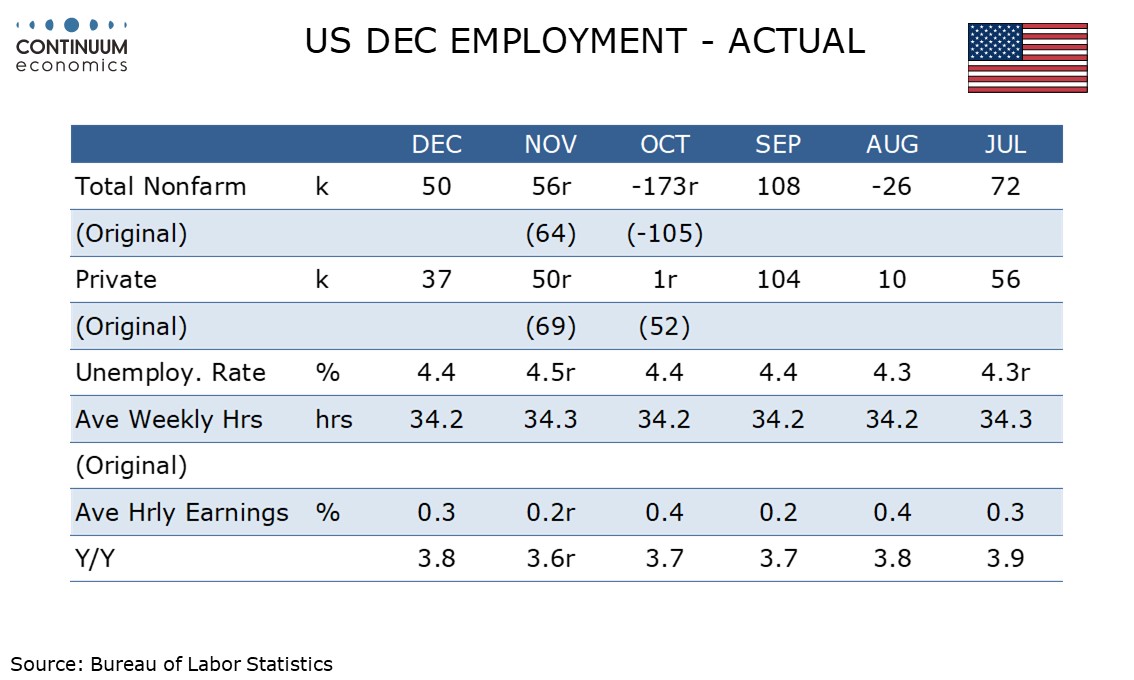

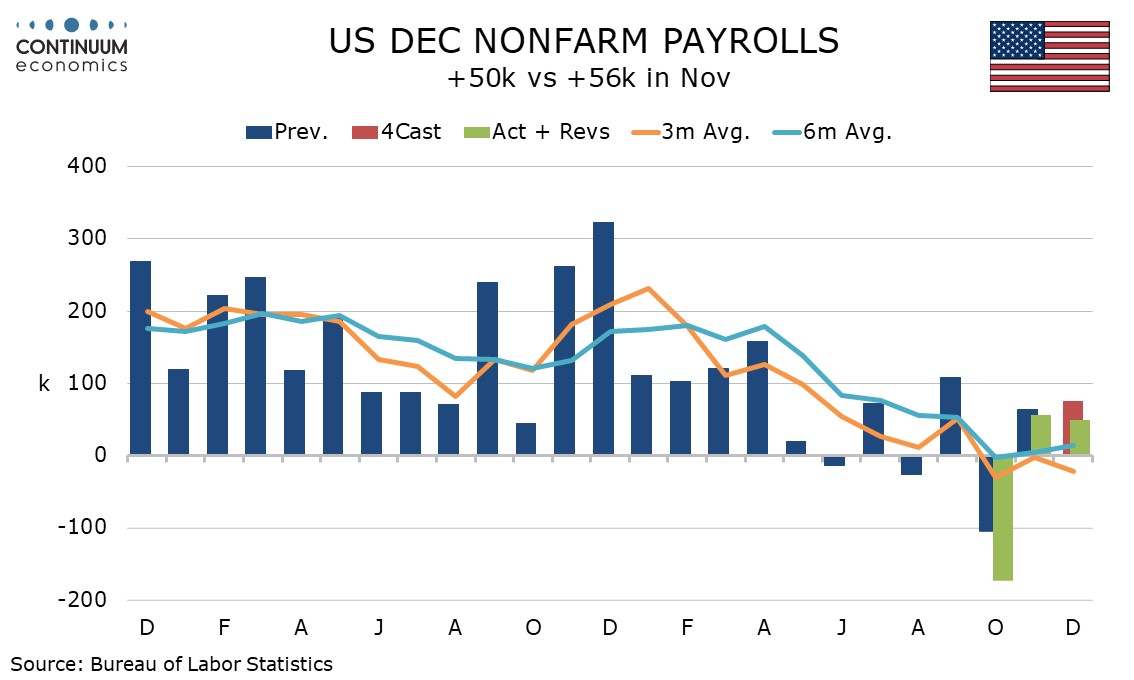

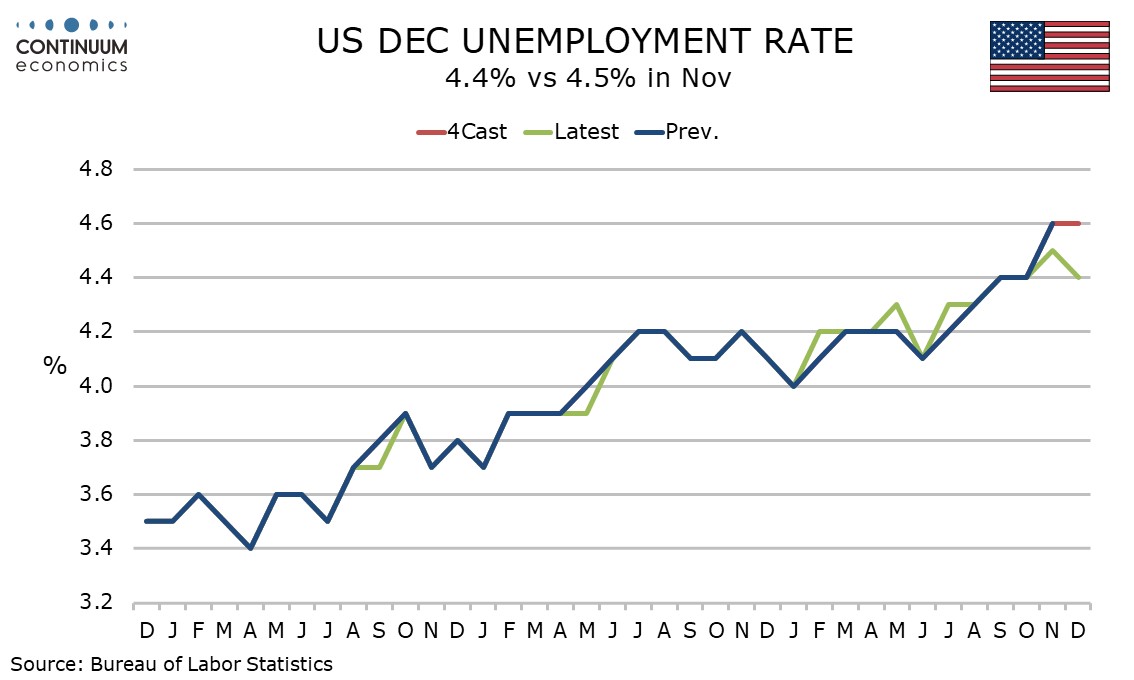

December’s non-non-farm payroll at 50k is marginally softer than expected, and a net negative given a substantial net downward revision of 76k to October and November, with the bulk of the revision coming in October when the government shutdown made measurement more challenging. Unemployment however fell to 4.4% from 4.5% in November, which was revised down from 4.6%.

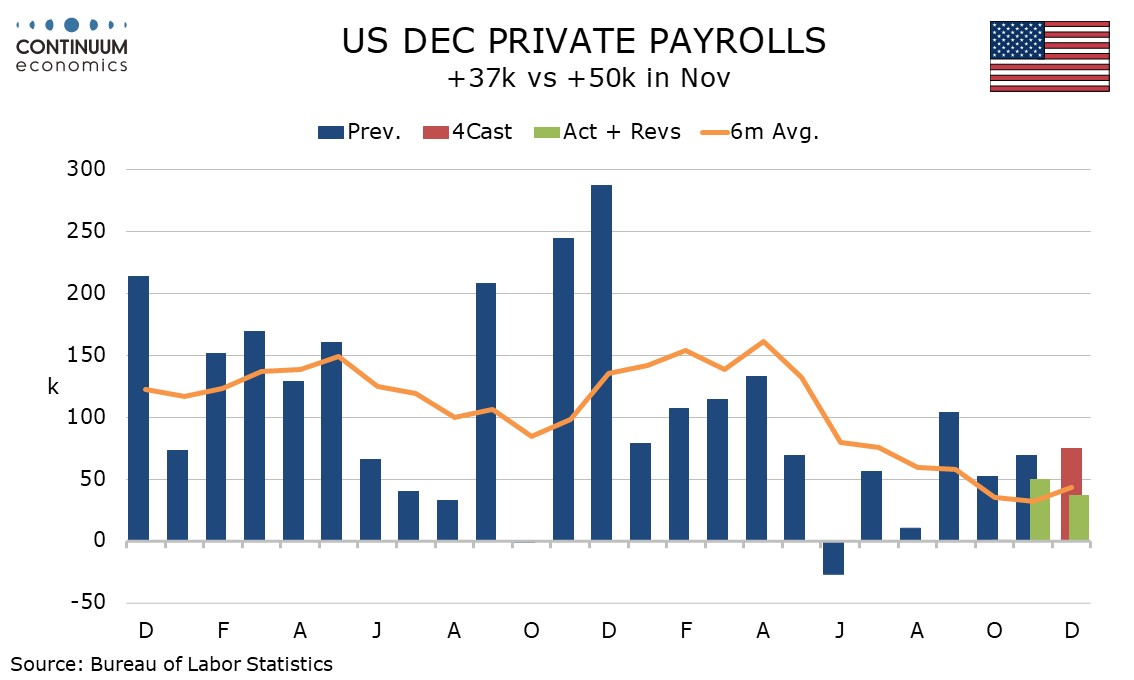

November’s payroll was revised only marginally lower, by 8k to 56k, but October was revised down by 68k to -173k. Private payrolls rose by only 37k in December, while November was revised down by 19k to 50k, while October private payrolls were revised down by 51k to 1k. October’s public sector plunge reflected DOGE layoffs and not the shutdown. Workers impacted by the shutdown were counted as employed as they were paid, albeit later than scheduled.

The latest data contrasts positive signals from initial and continued claims data in showing no improvement from November, while the subdued payroll picture since May contrasts a strong Q3 GDP rise, as well as hints from October’s trade data that GDP will hold up in Q4.

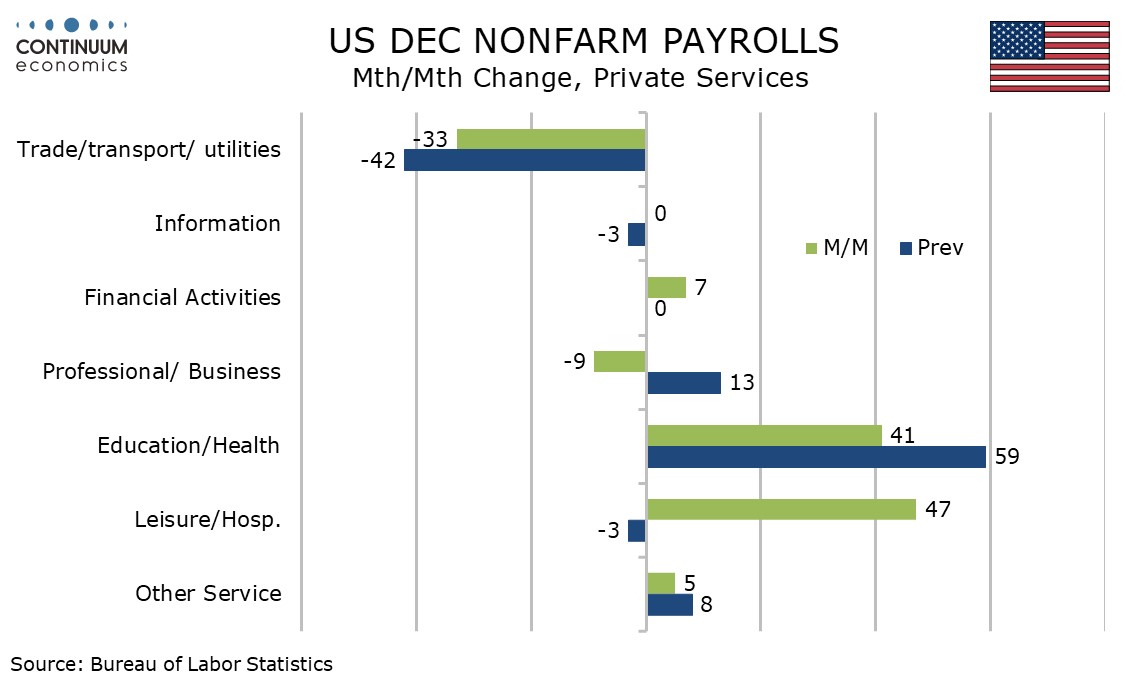

Within the payrolls breakdown leisure and hospitality at 47k did bounce from a November dip as we expected, and even overtook education and health, which rose by a slower 41k, as the strongest individual component. Retail was weak at -25k, possibly signaling weaker consumer spending though it is also possible that it reflects labor supply issues.

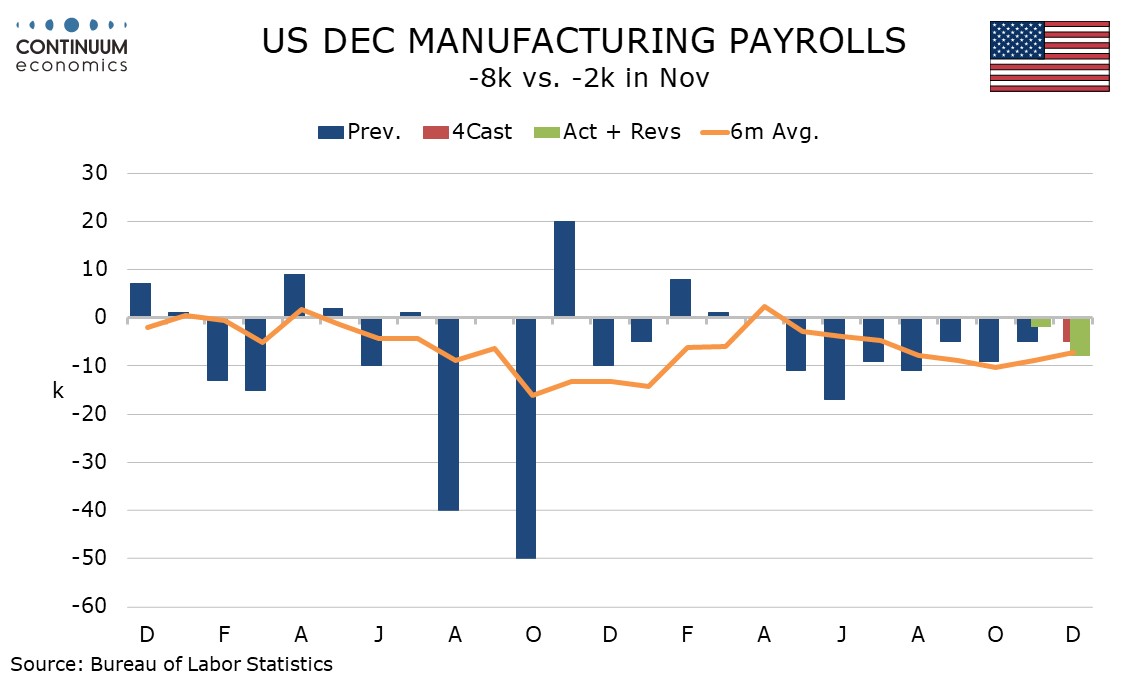

Manufacturing and construction were both marginally negative at -8k and -11k respectively, the latter more disappointing given signs of improvement in housing demand.

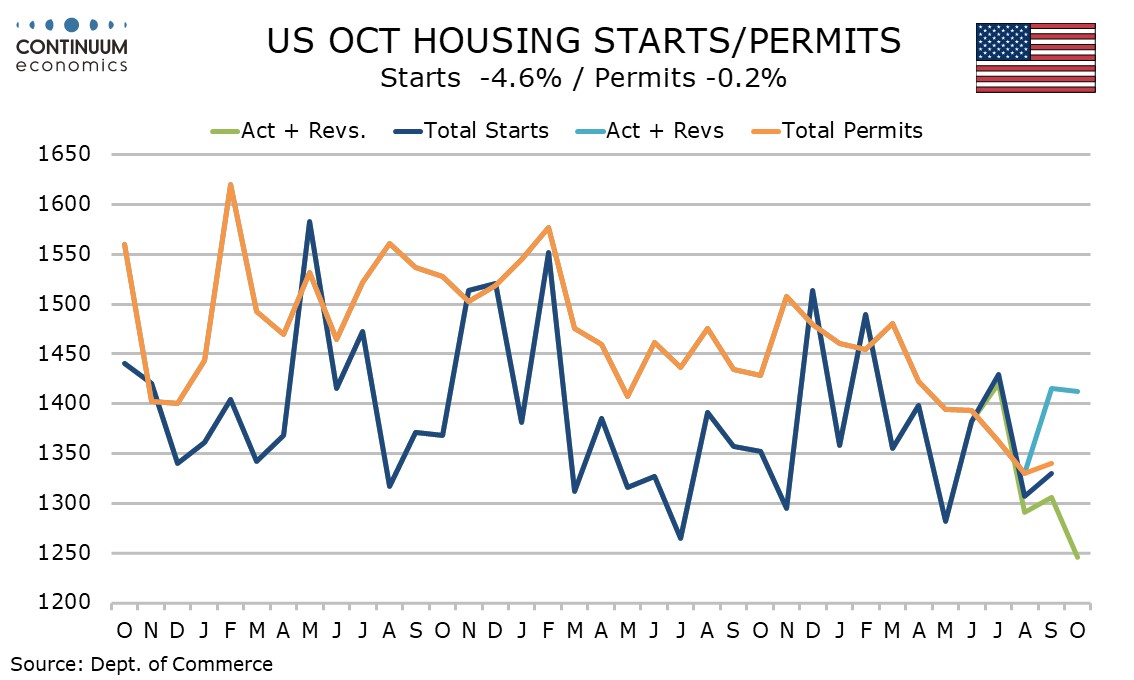

In data released alongside payrolls October housing starts at 1246k were weaker than permits at 1412k, so there may be scope for some pick up in housing construction by early 2026. The starts disappointment came in the volatile multiples sector.

Unemployment fell to 4.375% before rounding from 4.536%, which was revised down from 4.56%. The unemployment rate saw annual historical revisions which were generally marginal. November was the only month in 2025 to see the rate revised down. February, may and July’s rates were revised up by 0.1%.

December’s household survey, which calculates the unemployment rate, showed employment up by 232k, sharply exceeding the payroll and the 6-month average in the household survey of 111k is well above 14.5k as seen in the payroll. The labor force fell by 46k in December, and in being the first decline since June is not a clear signal of weakness caused by reduced immigration.

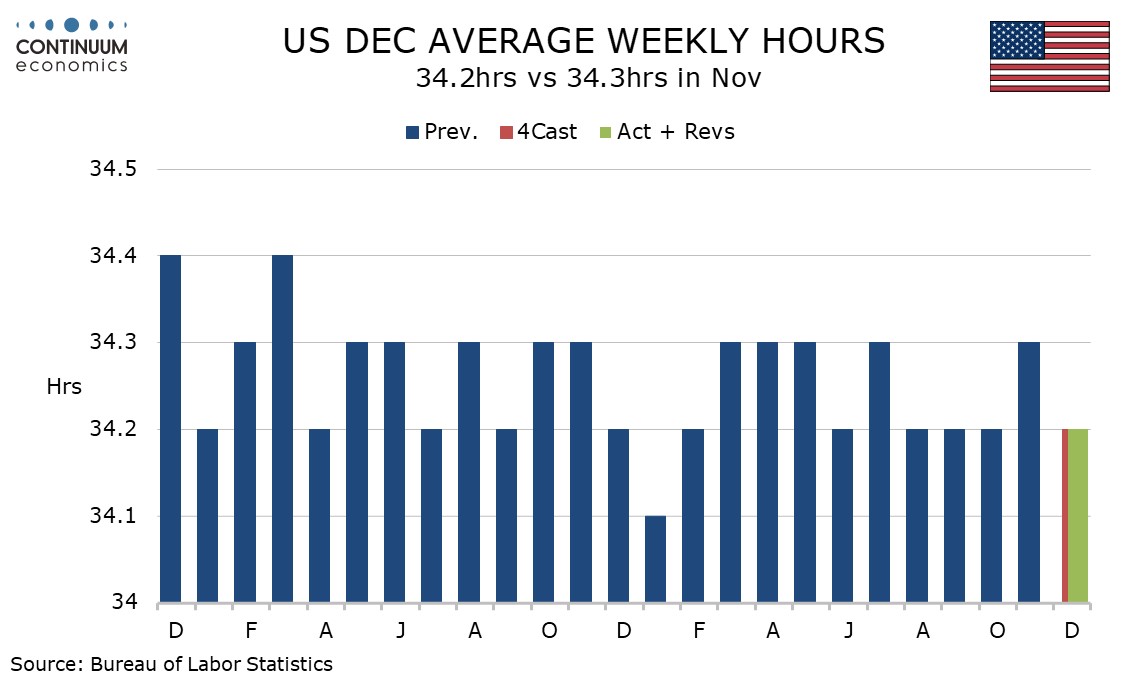

The workweek slipped back to 34.2 hours after increasing to 34.3 in November, leaving aggregate hours worked down by 0.3% in the month, and up by a modest 0.5% annualized in Q4. Q4 is still stronger than an unchanged Q3, which did not prevent a strong GDP gain as productivity picked up.

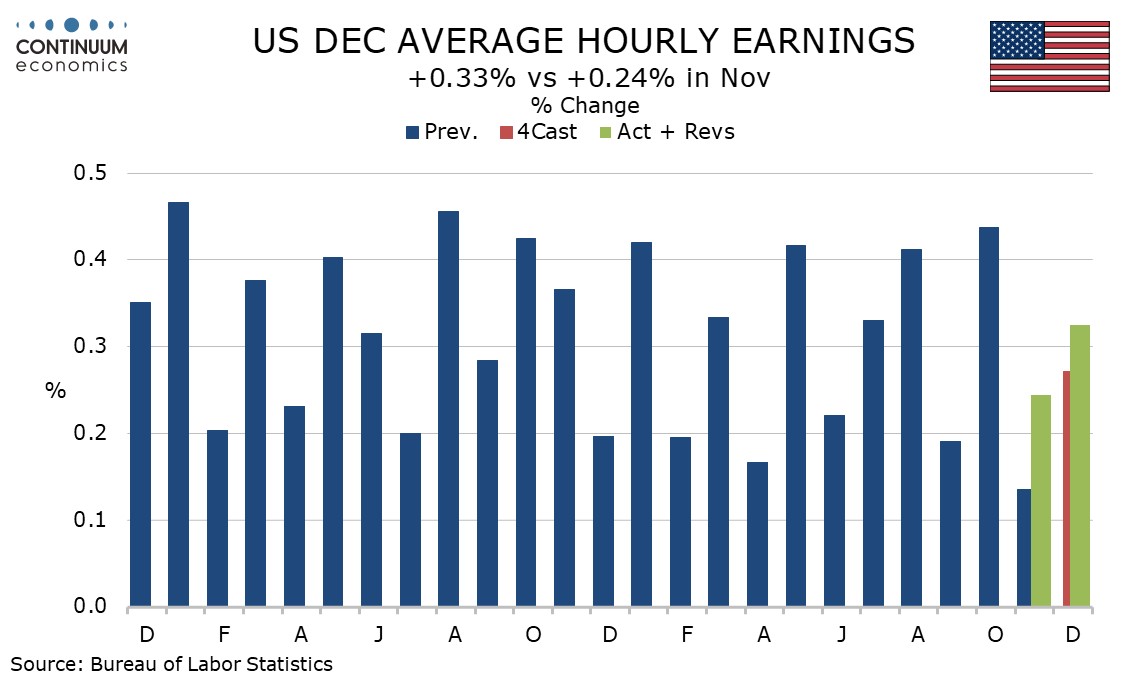

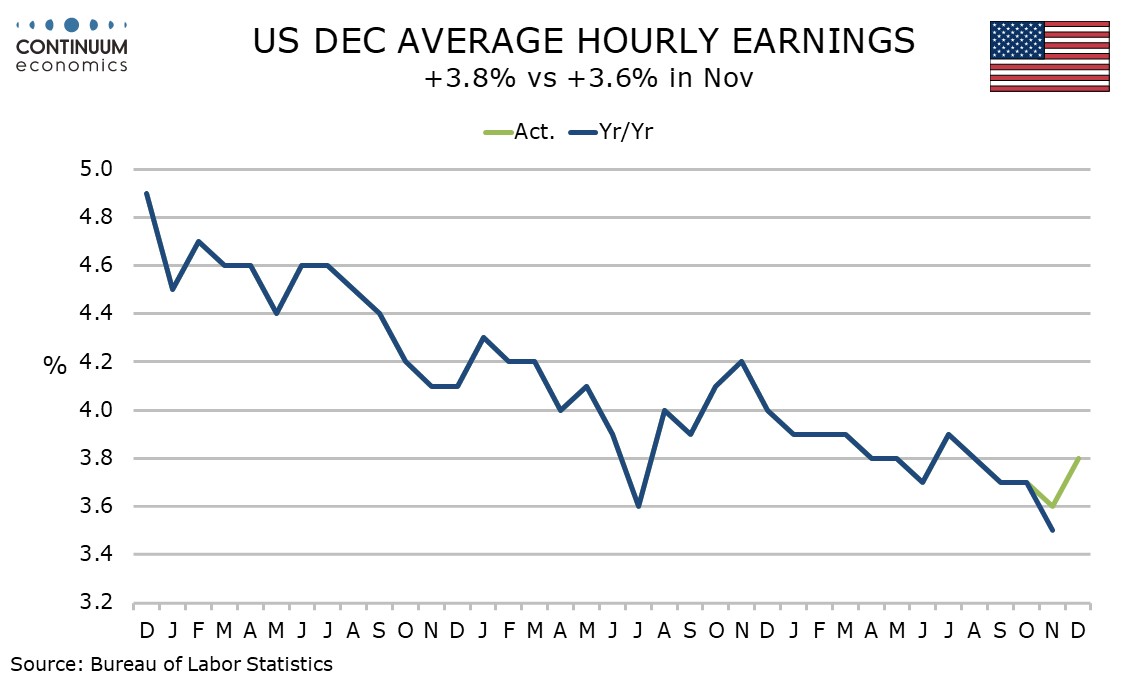

Average hourly earnings rose by 0.33% before rounding after an upwardly revised 0.24% in November. Yr/yr growth of 3.8% is up from 3.6% in November and has been fairly stable through 2025.

The latest report is a mixed one and probably does not make much difference to the Fed, which expects to ease rates at some point in 2026 but with no sense of urgency to act in January. The data does give the Fed scope to ease if inflation moves closer to target.