EZ HICP Review (Jul 2): Disinflation Resumes Amid Services Resilience – July Cut Off Table?

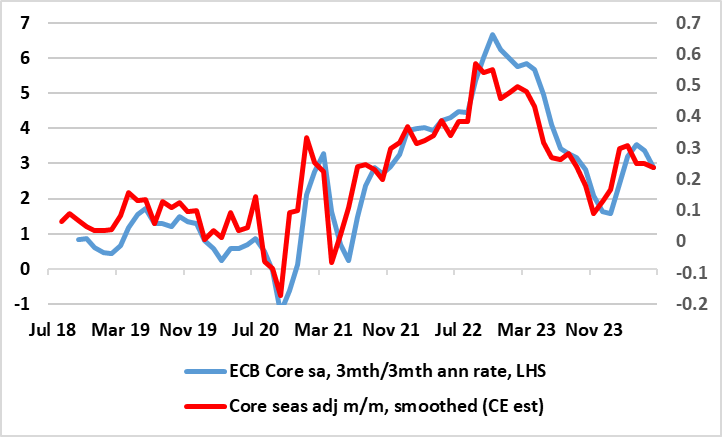

The clear disinflation trend was still evident even after higher and higher-than-expected May numbers, where the headline moved up from 2.4% to a three-month high of 2.6%. That trend looks more discernible after the partial drop back to 2.5% seen in the June flash HICP, albeit with some far from reassuring signs of resilience in a stable core of 2.9%, partly driven by stable services inflation at 4.1% (Figure 1). The data are a little higher than we anticipated, but partly reflect unfavourable base effects. Indeed, it is perhaps more notable is that these data are consistent with a fresh slowing in shorter-term price dynamics as monthly seasonally adjusted numbers may be softer on both a core and services basis (Figure 2).

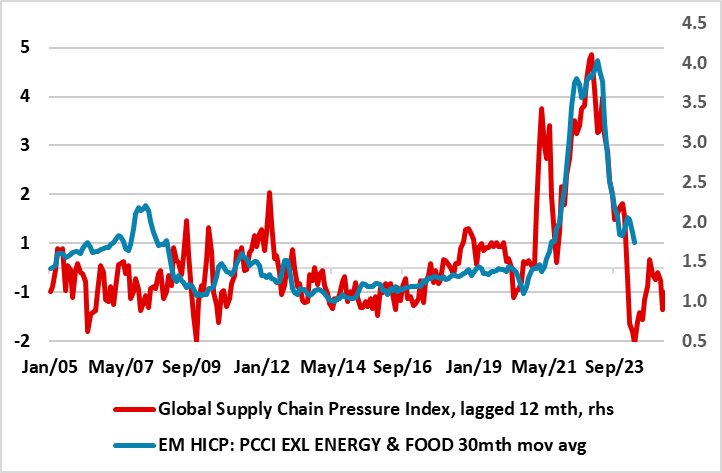

Very clearly these HICP data will not have much impact on ECB thinking, at least in easing lingering price persistent worries. But much of this is also related to part of the discussion at the current ECB Forum on Central Banking in Sintra, Portugal where we side with an ECB view that suggests recent inflation pressures have been driven much more by supply than demand (Figure 3).

Figure 1: Headline Falls Afresh?

Source: Eurostat, % chg y/y unless suggested otherwise

Regardless, anticipating these HICP numbers, Chief Economist Lane suggested that the data implied the ECB still had questions on services inflation, this in turn adding to hints that he was not going to push for a further rate cut at the looming July 18 Council meeting - if he ever was! He did note that the economy would instead dominate discussion at that meeting. In this regard, weaker money and credit data and more mixed to soft business survey data will make for an interesting n discussion.

Supply or Demand?

Lane was speaking from the ECB Monetary Forum in Sintra. One topic here and one mentioned in a speech yesterday by President Lagarde was the extent to which the recent inflation surge was more supply or instead demand determined. This is still a topic of big debate and disagreement, partly depending upon what art of the global economy one is more guided by. Indeed, economists at the IMF influenced more by matters-USA seem to think that inflation has been demand driven while an ECB paper suggest the opposite. Indeed, it notes that ‘shocks linked to global supply chains and to gas prices have exhibited a much larger influence than in the past. Overall, supply shocks can explain the bulk of the post-pandemic inflation surge, also for core inflation’.

Figure 2: Short-Run Core Inflation Pressures Do Fall Afresh?

Source: Eurostat, ECB, CE

This latter view is one with which we agree and can provide evidence to substantiate. Notably ECB Chief Economist Lane has very much underscored that the Persistent and Common Component of Inflation (PCCI) is the best predictor of inflation one and two years ahead and this is all the more notable as this measures have eased to below 2% of late and stayed there. Given its correlation with what are clearly (easing) global supply pressures, the former’s fall may yet continue (Figure 3).

Figure 3: Persistent Price Pressures Have Ebbed Further Amid Softer Supply Pressures

Source: ECB, New York Fed - PCCI is Persistent and Common Component of Inflation

Indeed, actually suggesting not only below target price pressures even on an overall basis but also at the core level with the latest PCCI core outcome at 1.7% this being only a few notches above its pre-pandemic average and having fallen of late as fast it rose previously. Furthermore, the PCCI measure very much offers lead properties, having repeatedly foreshadowed HICP inflation turning points in the past. An added reassurance comes from the fact that its recent slowing is an indication that price pressures are not broadening out, the very opposite. This is because the PCCI captures widespread developments across the HICP basket that are persistent (hence the name), this being all more crucial as the ECB hawks apparent focus is on preventing the recent inflation surge becoming embedded.

Below-Target Inflation Blip Still Looming in H2

On the basis of the only slightly softer headline reading for June, it HICP inflation averaged 2.5% in Q2, chiming with ECB projections made this month. These envisage that the headline rate will slip below target in early-2005 but drop to 1.8% by end-2026, the lowest end-target HICP projection made by the ECB since December 2021. But given the wage, underlying HICP and PCCI dynamics, we still think an undershoot may even occur later this summer, albeit amid late-year volatility but where a more durable drop below 2% is on the cards for 2025 – and beyond.