China: January MTF and March RRR Cut?

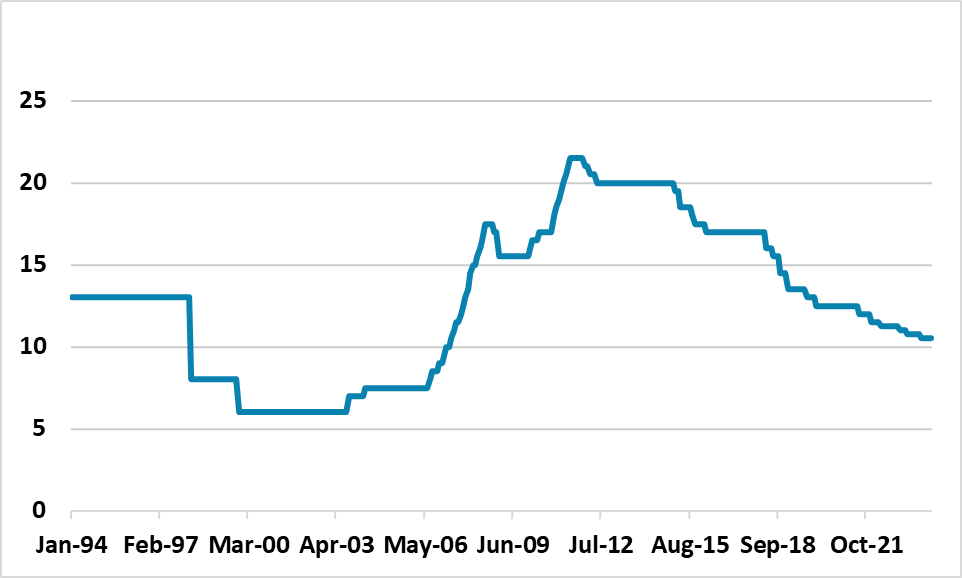

Pressure is growing for a medium-term Facility rate cut and a high chance exists on a 10bps cut on either January or February 15 to 2.40%. We also pencil in a PBOC RRR cut of 25bps for March. Currently negative inflation will swing positive, but only to 0.9% for 2024 and we also see GDP growth at 4.2% -- which is likely be below a 5% target that should be set in March.

Figure 1: China RRR (%)

Source: Datastream/Continuum Economics

A senior PBOC official has hinted at an RRR cut on Tuesday (here), given the desire to sustain credit growth. Similar comments were evident last July before the RRR cut in September. We would argue that further monetary easing is likely, given that inflation is way off desires for 3%. The December -0.3% for headline and core inflation stuck at +0.6% Yr/Yr. The market consensus of 1.4% for 2024 CPI inflation looks to be too high and we are forecasting 0.9%. The slowdown in export growth means that production is being directed domestically and this is keeping core inflation low – headline inflation is artificially low currently due to the fall in pork prices, which will likely partially unwind in 2024.

Add in the real sector side, where we forecast 4.2% 2024 GDP growth, as private residential investment continues to drag and as exports are hurt by the global economy and shift of supply chain away from China dominance. This means that nominal GDP will be around 5%, which is low for China. This also means that reducing debt by nominal GDP is impossible with debt growth outstripping nominal GDP – PBOC wants around 10% credit and M2 growth.

Additionally, remember that the PBOC role in China has been diminished, as last year the PBOC was put under the control of the central financial commission and the national administration of financial regulation has taken over 1600 PBOC branches and financial oversight (here). The PBOC traditional caution on monetary stimulus is being countered by other branches of the communist party that want reasonable quality growth and credit growth to support it.

Pressure is growing for a Medium-term Facility rate cut and a high chance exists on January or February 15 by 10bps to 2.40%. The odds probably favour January 15. We also pencil in a PBOC RRR cut of 25bps for March. This can be like the August MTF and September RRR cuts. However, with a debt overhang in parts of China economy, the effectiveness of monetary policy is reduced and this will likely spur official interest rate cuts but also more fiscal policy expansion.