UK CPI Preview (Aug 14): Inflation to Rise on Energy But Services Less Resilient?

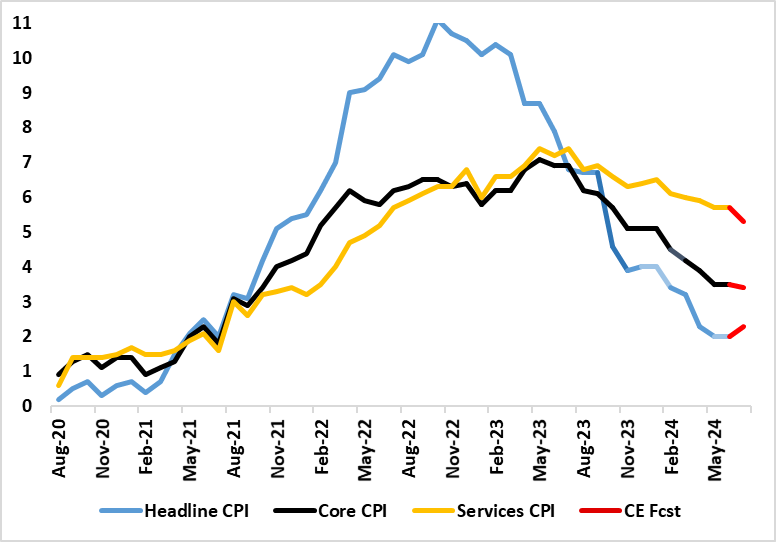

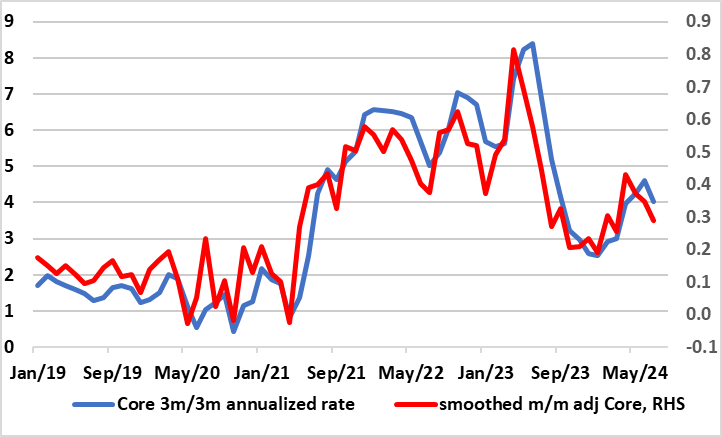

CPI inflation’s flirt with the 2% target is likely to be short-lived. We see the rate rising back up to 2.3% in July from 2.0%, this projection being a notch below BoE thinking, but with the core edging down to 3.4% (Figure 1). The rise is solely due to energy base effects related to the Ofgem price cap changes. Regardless, this underlines that headline CPI inflation having dropped back to the 2% target in May (for the first time in just over three years) and stayed there in June was important but far from definitive. Indeed, apparent service sector resilience is troubling the BoE (certainly the hawks) and will continue to do so, especially as some of this upward pressure reflects indexing and regulated price changes in the last few months which will not drop out of the y/y rate until Q2 2025. This makes any assessment using shorter-term adjusted measures are the more compelling. In this regard we, note that the July data may see fresh softer price dynamics on this basis both for services and the core (Figure 2).

Figure 1: Headline and Core Inflation to Diverge Afresh?

Source: ONS, Continuum Economics

As we expected, headline CPI inflation stayed at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services failing to ease by remaining at 5.7% (Figure 1) and thus some 0.6 ppt above then-BoE thinking. Thus, the data alone did not give a green light to the rate cut this month and explains the strong dissent to this actual easing. However, the narrow MPC majority were instead more swayed by the thrust of inflation news that has evolved of late and by the August Monetary Policy Report continuing to point to a clear inflation undershoot ahead even after readopting an upward risks bias. One part of this thrust of data comes from services PPI, this a solid lead indicator for the CPI services. Indeed, services producer prices rose by 3.1% y/y in Q2 (Apr to June) 2024, down from 3.7% in Q1. In addition, and in spite of services price resilience (which is relatively widespread, overall CPI inflation has fallen faster that it rose, averaging a drop of 0.48% per month since its peak in Oct 22 largely due to goods price weakness. Indeed, it could be asked why marked weakness in core goods is not a policy issue in the manner that services resilience is.

Figure 2: Adjusted Core CPI Pressures Falling Afresh?

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

Regardless, some of this services resilience is partly due to strong, if not record, rental inflation. Overall, this meant no change in the core rate, this stuck at 3.5% in June, but where this is still being held up by base effects. Indeed, this outcome implied a m/m adjusted reading increasingly above a rate consistent with target and where the smoothed monthly basis and/or the 3-month annualized rate that some at the BoE favour have also risen of late. This we put down to the impact of annual indexing and regulated price changes which will continue to buttress the y/y core and services numbers but not the shorter-term measures. Indeed, we see both the smoothed monthly basis and/or the 3-month annualized rate falling back afresh in July (Figure 2). This will not provide much solace to the BoE hawks who will also note the sturdier real economy numbers that the UK has been showing of late. But of course by the time of the next BoE decision on Sep 19, the question is will stock market weakness still be a dominant factor.