USD, JPY, CHF, AUD, NOK flows: Safe havens surge, risk currencies plunge

The big risk unwind continued overnight, and safe haven currencies surged once again, with the JPY and CHF the best performers, while the commodity currencies suffered. From here much will depend on the US equity market peformance this afternoon. From a value perspective, JPY strength is justified, but CHF strength and AUD and NOK weakness look overdone.

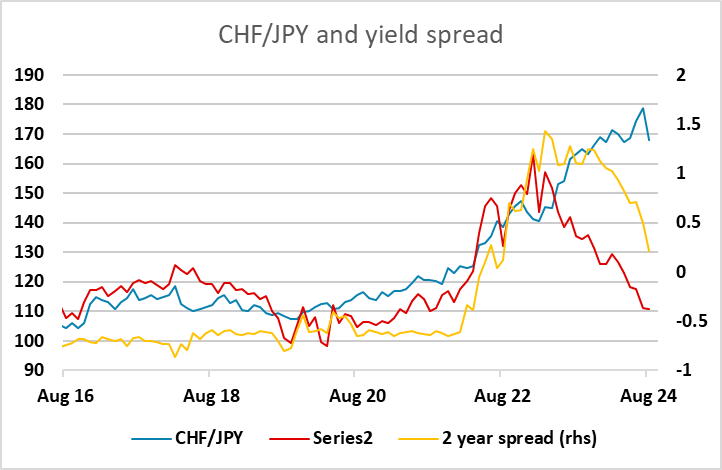

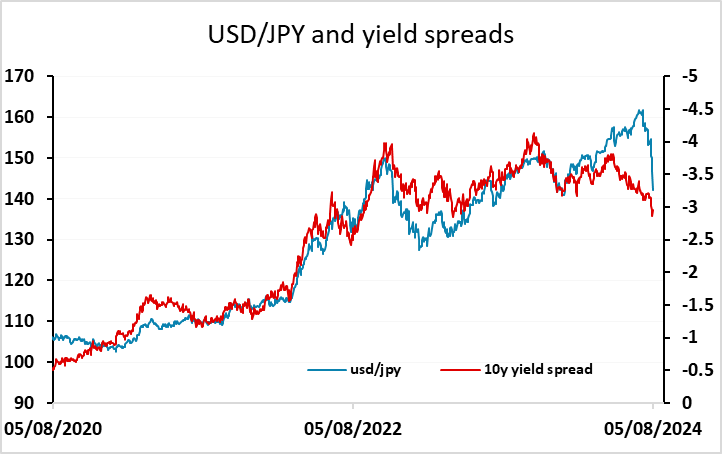

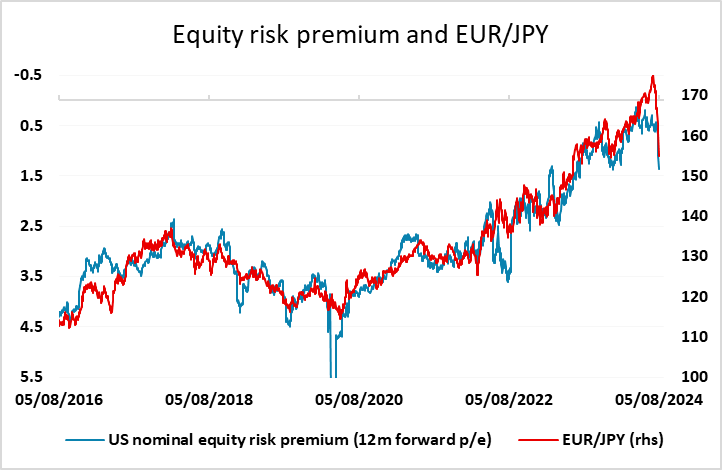

Carnage overnight in USD/JPY and EUR/CHF as equities plummet, with high yielders also generally getting sold heavily. The moves relate entirely to risk profile rather than underlying value. Thus, the JPY has benefited the most followed by the CHF, while EUR/USD has fallen back modestly and we have seen much sharper declines in AUD, NZD, NOK and GBP. The moves have taken us much closer to what we would call short term fair value in USD/JPY and EUR/JPY, USD/JPY being guided by the yield spread and EUR/USD by the equity risk premium. There may be a little further to go, but it is likely we have seen the majority of the initial move.

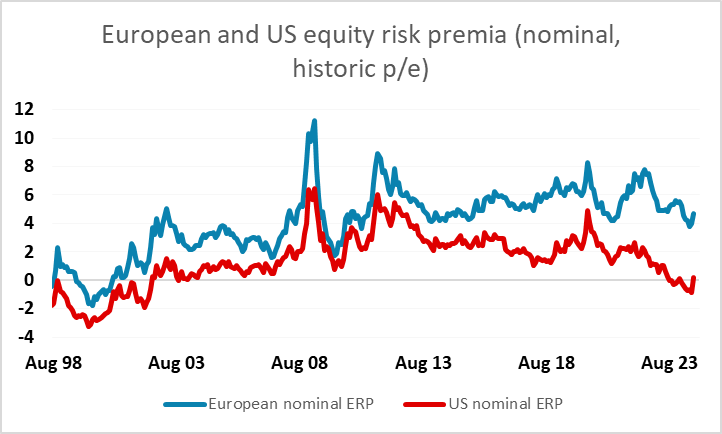

The outlook from here clearly depends on the extent to which we see further weakness in risk appetite. We have already erased all the year’s gains in the Nikkei, and the majority of the year’s gain in European equities, but the US market remains significantly up on the year despite being the most overvalued both in terms of p/e ratios and implied risk premia relative to history. Much with thus depend on the US equity market open this afternoon. We suspect that there will be an initial dip (in line with the 3% decline in futures overnight), but the news has not really been weak enough to justify a major decline at this stage, especially given the sharp decline we have seen in yields, so we would tentatively expect some stabilisation, but this is not a call that can be made with any confidence in these volatile markets.

For FX, there are still a lot of valuation anomalies in spite of the corrections we have seen to the risk positive trades seen through the year. In particular, the rise of the CHF looks hard to justify if risk sentiment stabilises, with the SNB likely to actively oppose the latest rise. The decline of the AUD and NOK are also out of line with the relatively strong performances seen in those economies and the mildly less dovish biases of their central banks, so both currencies look undervalued against the USD and EUR if risk stabilises. The JPY is likely to correct slightly lower on any risk stabilisation, but remains extremely undervalued from a long term perspective, so any losses are unlikely to be substantial. If the equity rout continues, so risk profiles of the currencies will remain dominant, but we would expect CHF gains to prove a lot more difficult.