BoE Review: Getting Less Restrictive

Despite market thinking being split on the matter, but as we flagged, the BoE cut Bank Rate by 25 bp to 5.0% this month taking the rate from a 16-year high and ending an above-average policy pause of 11 months. We are a little surprised that the vote (5:4) was so close as the dissent of Chief Economist Pill seems odd against the continued undershoot of the inflation outlook he overseas – even with a return to these projections encompassing upside risks (Figure 1). Clearly, for the rate-cutters, the decision was finely balanced and (as we expected) the cut was framed as easing the degree of policy restrictiveness. No policy guidance was offered save to say decisions ahead will be made on a meeting-by-meeting basis but with no suggestion of moving quickly or sizeable. But the cuts to around 3.7% that the main inflation projections are based on suggest more to come and we think somewhat further than this with two more moves this year and 100 bp in 2025. If there is a fresh risk, we think this comes from better real economy numbers ahead which will not stop easing but instead slow the process.

NB: the MPC will update its thinking on QT at its next meeting in September, involving what the reduction in the stock of UK government bonds held for monetary policy purposes will be over the 12-month period from October 2024 to September 2025.

Figure 1: A Still-Clear Inflation Undershoot Even with Upside Risks

Source: BoE MPR

New Member Swing Voter

Of course, there will be more splits and the decision this month was in effect down to that of the newest MPC member. This reflects marked MPC personnel churning at the moment. Clare Lombardelli took part in her first MPC meeting this time around, her policy leanings still being unclear and her decision to cut may have been as much tactful than fundamental. Otherwise, it may be notable that policy hawk Haskel attends his final MPC meeting with his replacement yet to be named.

Fan Charts Still Influential

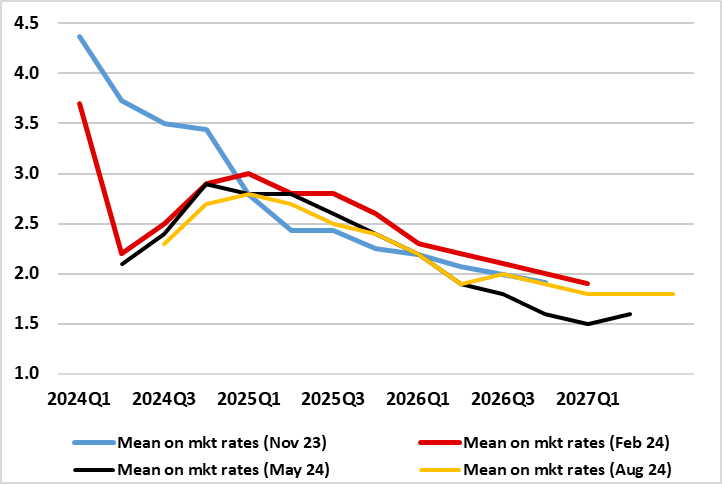

While the recent Bernanke Report recommended phasing out the so-called fan chart forecasts, their importance lingers, not least as they again point to a clear undershoot of the 2% target on a sustained basis in the latter part of the forecast horizon as seen in the Monetary Policy Report (MPR). That such projected undershoots have not triggered rate cuts hitherto is partly (to us) puzzling. As Figure 1 shows the undershoot appears to be less marked than in May but this is purely on a mean basis with the modal view actually a notch lower that in the May MPR at 1.5%, this encompassing an explicit upside risk embodies in the mean numbers (a so-called skew) to address price persistence risks.

Regardless, with the BoE underscoring that its allegiance to its target applies at all times, the fact that CPI inflation has been well above target has been the telling factor in recent decisions prior to this. But this is no longer the case and even amid modest upward growth projections, any rise from the current on-target inflation rate is seen still as temporary. Crucially in presentational terms, the move was framed as making policy less restrictive and we still think that the implied reduction in Bank Rate to 3.7% as markets are discounting would still leave policy very much in restrictive mode. This is one reason why we anticipate greater/faster easing.

We have for some time had issues with the manner in which the BoE’s fan charts are used and computed, most notably in regard to how the MPR has steadily increased the assessed degree of uncertainty. Indeed, the MPC August MPR envisages inflation at 1.5% at the end of its three-year formal forecast horizon (but as suggested above now with 0.3 ppt upside risk to account for worries about inflation persistence as opposed to global risks for the previous so-called skew). Regardless, this still encompasses an uncertainty parameter still of a very elevated 1.9%. In effect, this means that the MPC anticipates that (and with two-thirds probability attached) inflation will actually be in a range from -0.4% to 3.4%. This is a very wide target which implicitly is seen being missed one third of the time. This may be one reason that the recent Bernanke Report recommended reform: both in how the Bank of England’s Monetary Policy Committee operates, not least alternatives to the so-called fan charts. Notwithstanding Bernanke’s recommendation to downplay the baseline inflation forecast, for the time being they will remain crucial to how the BoE assesses the outlook for inflation persistence – and possible more so.

BoE Considerations

Otherwise, it is clear that real activity data are now having more of an impact on MPC thinking regarding how durable and sizeable is the disinflation process. Indeed, the GDP picture has been upgraded alone by 0.7 ppt for Q2 and Q3 combined. But this upgrade to 2024 is not matched with any upgrades beyond and with the projections implicitly suggesting that the strength of late has been as much supply and demand driven. Indeed, it is notable that the projections still suggest a sizeable and unchanged excess supply estimate for 2026 of 1.25% of potential GDP

Inter-related with this is the fiscal side. New Chancellor Reeves has already made spending cuts and now tax rises loom at the Oct 30 Budget. They add to what to us are still downside activity risks even amid better business surveys which to us more reflect improved confidence in political stability ahead. What remains the case is that these updated BoE projections validate the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves then seen through this year and a view that largely is still the case. This is something that chimes with the cumulative further reduction of up to 50 bp by year end we are now forecasting and with around a full ppt in 2025. We think that even such a rate cut profile would still leave policy restrictive and thus bearing down on inflation further.