U.S. January Retail Sales - Slippage likely to be weather-induced

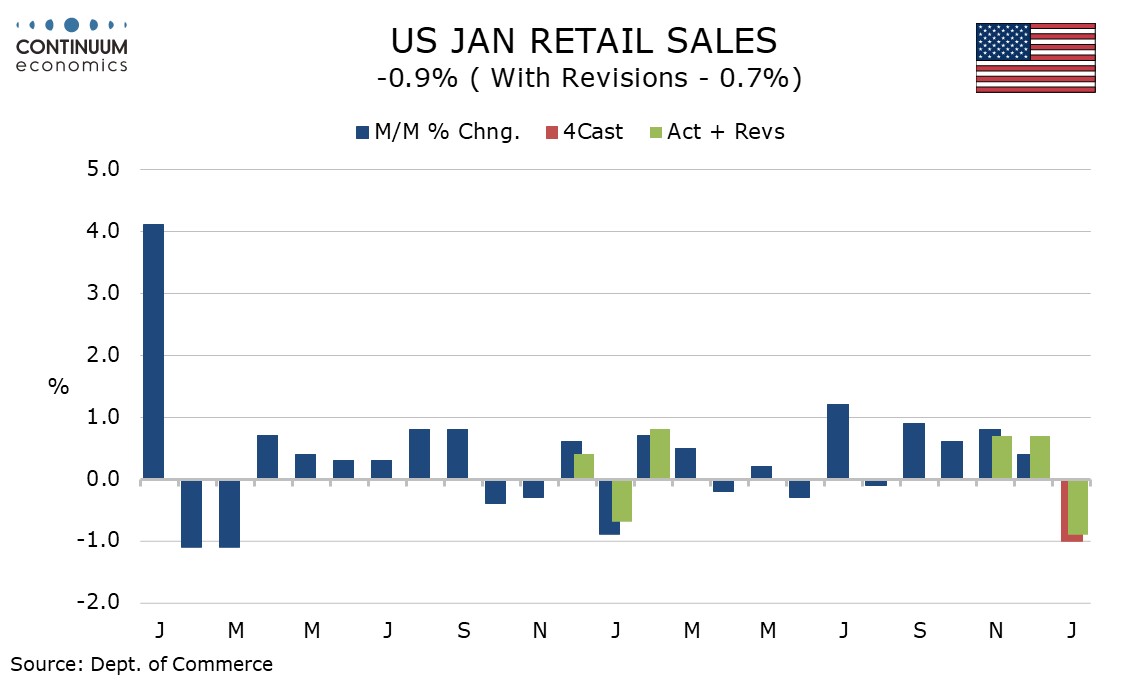

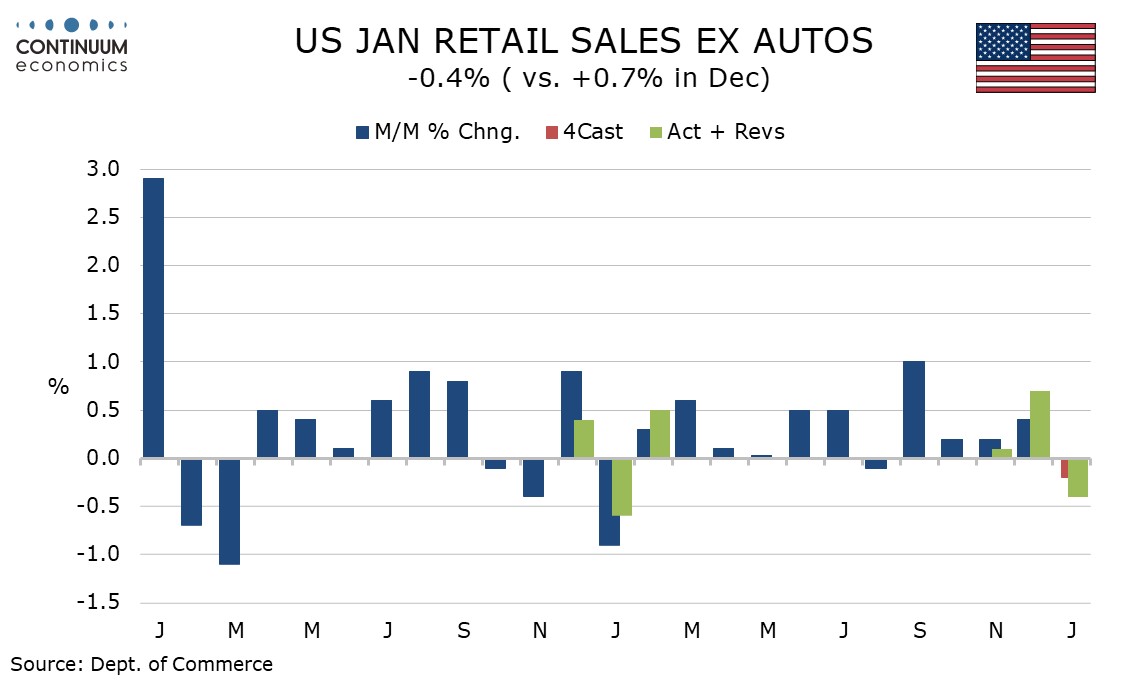

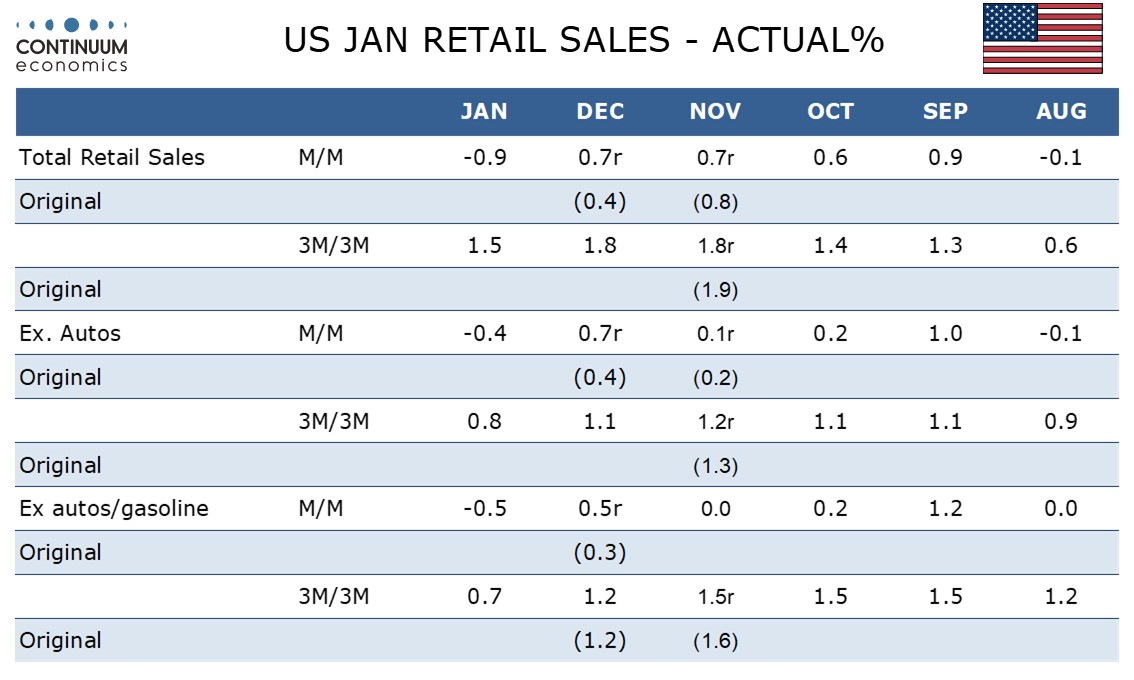

January retail sales at -0.9% saw a significant downside surprise, though we believe the main reason for weakness was bad weather, with a correction from strength in Q4 also likely to be a factor. The core rates were also weak, ex auto at -0.4%, ex auto and gas at -0.5%, and the control group that contributes to GDP at -0.8%, the latter fully reversing December’s gain.

December was revised up to a 0.7% increase from 0.4% but November was revised marginally lower to 0.7% from 0.8%. The net upward revision is modest in comparison to January’s decline.

The main reason for January’s decline is likely to be two bouts of exceptionally cold weather in much of the country, though the more localized Los Angeles fires are likely to have played some part too.

Given that the CPI showed commodity prices up by 0.5% in January (though PCE prices may be less firm) the January decline is significant in real terms and will weigh on GDP, though a substantial bounce is likely in February as weather improves.

The weakness was most pronounced in durables, with autos down sharply by 2.8% as industry data had suggested while both furniture and building materials fell by more than 1.0%. Positives came from gasoline at 0.9% lifted by prices, general merchandise at 0.5% and eating and drinking places at 0.9%. Food fell by 0.1% despite surging prices led by eggs.

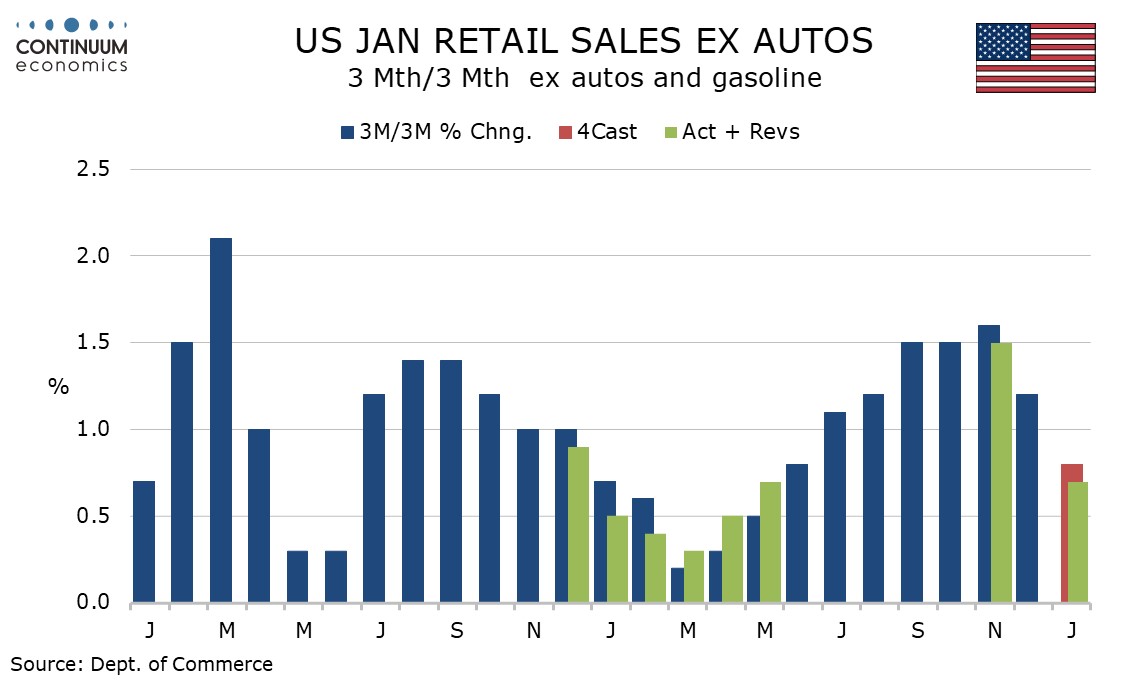

The 3m/3m pace (not annualized) of 1.5% is still strong if a three-month low, but gains of 0.8% ex autos and 0.7% ex autos and gas are moderate, given that prices will have made some contributions (though a modest one with commodity prices ex gasoline underperforming CPI).