CBRT Started the New Year with a 250 bps Rate Hike

Bottom Line: As we pencilled a 250 bps policy rate hike by Central Bank of Turkiye (CBRT) on January 25 MPC meeting, CBRT continued its monetary tightening cycle by lifting the key rate from 42.5% to 45%. This is the eighth straight rate hike by CBRT since May presidential elections, simply to fight against galloping inflation and weakening Turkish Lira (TRY). According to the statement published, CBRT remained concerned about the strong course of domestic demand, the stickiness of services inflation, and geopolitical risks that keep inflation pressures as the headline inflation in December roared back again. We expect CBRT to halt at 45% in the next MPC meeting, which is scheduled for February 22.

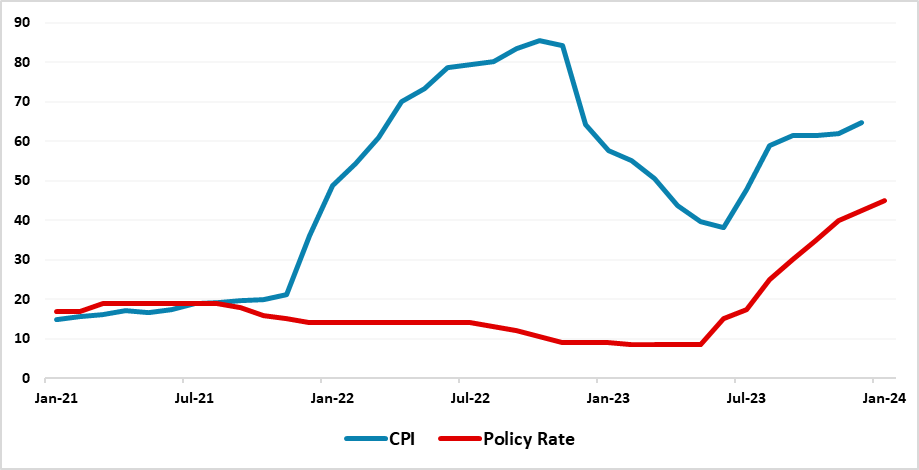

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2021 – January 2024

Source: Turkish Statistical Institute, Datastream, Continuum Economics

The CBRT raised the policy rate from 42.5% to 45% on January 25 MPC meeting to establish the disinflation course, to anchor inflation expectations, to control the deterioration in pricing behaviour and to squeeze demand, as inflation continues to bite with CPI surging to 64.8% annually and 2.9% monthly in December. CBRT emphasized on January 25 that headline inflation in December increased in line with the outlook presented in the last inflation report as the existing level of domestic demand, stickiness in services inflation, and geopolitical risks have kept inflation pressures alive.

According to CBRT, domestic demand continues to moderate in line with the projected disinflation process and pricing behaviour shows signs of improvement. CBRT also stated that external financing conditions are improving, foreign exchange reserves are increasing, and the rebalancing process of the current account balance continues, which demonstrate the effectiveness of the traditional monetary policy.

Despite this, analysing CBRT’s analytical balance sheet published on January 22, we expect gross reserves (including gold) to plummet by $1.7 billion to $138.1 billion, during the week which ended on January 19. We also foresee net international reserves to decrease by $5.9 billion to $23.6 billion. We think the fall in the net reserves could be linked with the recent fall in the gold prices along with CBRT supplying foreign currency liquidity to the markets.

MPC statement on January 25 was very significant as CBRT signalled it has completed tightening cycle as the current key rate level will be enough to establish the disinflation course in the near term. The statement said “Taking into account the lagged impact of monetary tightening, the Committee assesses that the monetary tightness required to establish the disinflation course is achieved and that this level will be maintained as long as needed. The Committee assesses that the current level of the policy rate will be maintained until there is a significant decline in the underlying trend of monthly inflation and until inflation expectations converge to the projected forecast range.”

Despite signs of improvement, we anticipate the inflation would continue to surge, particularly in the first half of 2024. We think the wage increases in January 2024 coupled with elevated upward pressures in services and weakening currency will push prices up further, particularly in Q1 2024. Upside risks like increasing energy prices, deteriorated pricing behaviour and expected hike in public spending before March 2024 local elections remain strong, which would also likely drive inflation in 1H of 2024, as the impacts of the monetary tightening are still feeding through. We foresee relative slowdown in the inflation trajectory in the second half of 2024 thanks to CBRT’s hawkish bias and contractionary fiscal policies.

Within this framework, we are of the view that Central Bank continues to regain credibility by pursuing traditional economic policies until the inflation is under better control, which will probably help attract foreign investments and improvement in the current account balance. Our projection is that policy rate will be held at 45% as soon as the inflation shows significant improvement.