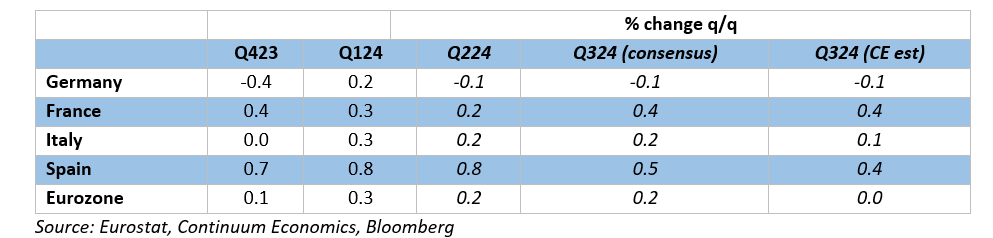

Eurozone Q3 GDP Preview (Oct 30): (Near) Stagnation?

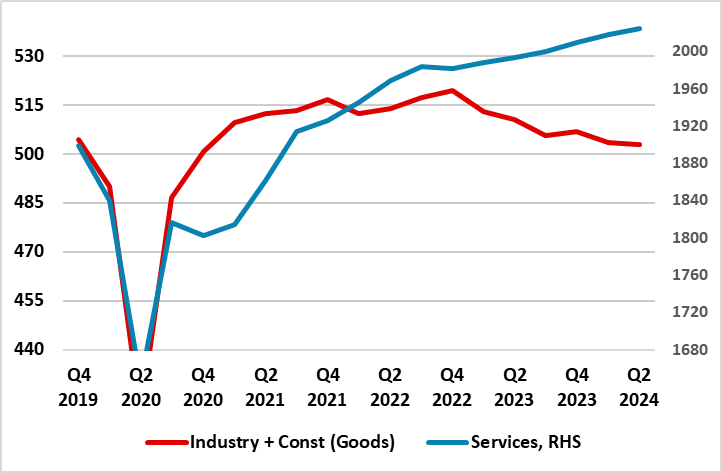

At best, the EZ economy is diverging ever more clearly as Germany falters while Spain prospers. However, the risks are that the whole of the EZ is weakening. Indeed, in contrast to ECB and consensus thinking of a second successive quarter of 0.2% q/q GDP growth, we see a clear risk that the EZ economy failed to grow in Q3. Thus would accentuate the slowing seen in the previous quarter, even though the various economies will again still see contrasting fortunes (Figure 1). This contrast reflects the varying size of the industrial sectors in these economies with those with the larger services (eg Spain) prospering more than those more reliant on recession-bound manufacturing (eg Germany). But even hitherto solid services seem to be slowing meaning that the very unusual divergence seen between it and EZ manufacturing may be coming to an end (Figure 2). This is the message of business surveys which also highlight continuing construction sector distress. Indeed, the extent and breadth of the slowing in survey data, most notably the PMIs, has clearly perturbed the ECB, both by signalling downside risk to real activity that may actually be materializing but also in highlighting sharp falls in cost and price pressures that suggest official inflation forecasts needed to be pruned back. While there is talk of whether the EZ sees a soft landing or not, perhaps the more relevant question is whether there has actually been a take-off!

Figure 1: Divergent EZ GDP Picture Continues Amid Weaker Q3?

Are Services Following Manufacturing Lower?

GDP growth in Q2 was revised down to an even clearer sub-trend type result of 0.2%, thereby a notch lower than the Q1 outcome. Regardless, while Q2 GDP was only 0.1 ppt below ECB thinking, the details have clearly worried the ECB, not least the weakening in both investment and consumer spending, the latter occurring despite a recovery in real disposable income that has instead seen household savings rate shoot up to well-above pre-pandemic levels.

Indeed, the weakness in domestic demand persisted, if not deepened, in Q2, despite faster government spending, the later partly offsetting further inventory shrinkage – we think the latter is normalizing in the holding of stocks rather than presaging any intentional inventory rebuild into H2, this supported by survey data. . Indeed, domestic demand has shrunk for four successive quarters and by almost a cumulative 1% and this despite the government sector having grown by 2.5% in that four-quarter period.

As a result, the data in Q1 and Q2 reflected marked divergences among the EZ economies, most notably among the ‘Big 4’. Spanish GDP growth stayed at an upbeat 0.8% q/q. This contrast reflects the varying size of the industrial sectors in these economies with those with the larger services (eg Spain) prospering more than those more reliant on recession-bound manufacturing (eg Germany). But the fact that Q3 may see Germany seeing further contraction begs the question as to how any such trends spill over into the rest of 2024 – and beyond. In addition, the divergence between goods and services output (Figure 2) chimes with that in HICP data, albeit hinting that is services growth slows than prices in the sector may follow suit.

This can be partly answered by looking at recent actual monthly data for Q3. They very much suggest continuing weakness and declines in (admittedly volatile) manufacturing and construction, but with momentum evident in services also less clear, with three m/m falls in the last five months of data. But clearer weakness is something certainly suggested by business survey data whether they be PMI numbers or those offered by the European Commission, with a clear loss of GDP momentum being signalled into Q3, much of which is based around softer services activity. But with orders and exports sagging according to survey data, the omens overall are not that promising

Such a backdrop is seemingly perturbing some Council members who may still be wary that the ECB’s recently downgraded growth forecasts are still too optimistic, they being reliant on annualized growth of well nearly 1.5% through H2 2024.

ECB Optimism Ebbing

Indeed, we remain of the view that the ECB is still too optimistic regarding real economy prospects, where we see the ECB outlook of 0.8% this year and 1.3% 2025 look like being undershot. But it does seem as if the ECB is reassessing its growth and inflation outlook and where real economy considerations have become as important as those regarding prices in shaping policy. But there are some positive straws in the wind, most recently from the ECB’s latest Bank Lending Survey. While still suggesting banks remain cautious about lending, the data suggested a clear improvement in the demand for loans and very much reflecting an increasing perception that interest rates have started to fall and have further to go. On the consumer side, with households having built hefty savings afresh of late in reaction to higher interest rates, more signs of easing to come may start to unlock those savings and provide a much needed boost to demand – just as policy easing is supposed to do! Importantly, the full impact of recent tightening has yet to feed trough fully, but this does suggest that even the modest cuts to date and the prospect of more to come has started to have a tangible effect. Thus, risks to the economy continue to be biased to the downside, not least that amid increasing pressure for fiscal consolidation in some EZ countries the boost seen of late from government spending may not just fade but go into sharp reverse. But some upside risks may now be emerging too! Without these emerging upside risks we may very have considered revising our growth outlook lower from the current below-consensus picture envisaging 0.6% GDP growth this year and only 1% next!

Figure 2: Marked Divergence in Sector Growth

Source: Eurostat, Euro billions

Flash GDP in Perspective

Amid a paucity of reliable data, but as we have underlined before, it is important to recognize that there are clear shortcomings to the flash estimate for EZ GDP. No details come with these flashes and they are prone to clear revisions, where even a 0.1 ppt change can be very meaningful when the economy is hardly growing. They are based on incomplete activity numbers with usually on one monthly vale for services and two for construction and manufacturing. This may be why the ECB is openly more focused on survey data, especially as it is more timely. Time will tell whether the Q2 flash numbers will tell any more authoritative a story! Regardless, the apparent resilience in overall GDP makes the sharp and broad fall in inflation all the more likely to have been driven more by supply factors than demand. But with demand now seemingly buckling (the PMI noted that new orders fell for the second month running and business confidence dropped to a six-month low, leading firms to halt a spell of hiring which began at the start of 2024) the disinflation process may have much further to run.