Russia’s Inflation Remains High at 7.4% in January

Bottom Line: After increasing seven months in a row till December 2023, inflation remained unchanged at 7.4% YoY in January after December. We think stubborn price pressures continue to be strong due to high military spending, currency weakening, tight labour market, high salaries and benefits, and invigorating consumer demand.

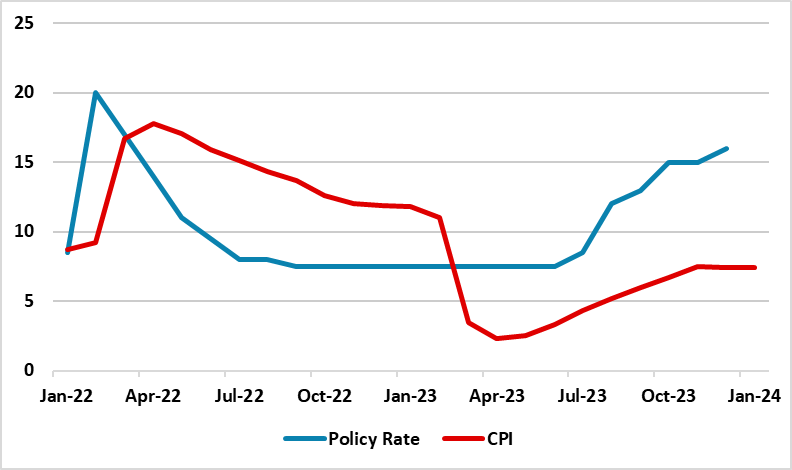

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2022 – January 2024

Source: Continuum Economics

According to Rosstat figures on February 14, prices of food, non-food products and services rose by 8.1%, 6.2% and 8.1% on an annual basis in January, respectively. The consumer price index (CPI) shot up by 0.9% on a monthly basis. Core inflation rate surged to 7.2% YoY from 6.8% in December, marking the highest figure since February 2023.

We think the inflationary pressures continue to remain sticky particularly due high military spending, lagged feedthrough of the weak Ruble (RUB) and tight labor market. On the currency front, RUB weakened by around 20% against the dollar in 2023 alone, while the currency lost 1.3% of its value against the USD in January. On the labor market end, the average annual unemployment rate stood at 3.2% as of the end of 2023, which was the lowest reading since 1992, General Director of the All-Russian Labor Research Institute Platygin told reporters on February 7.

January’s 7.4% YoY inflation is far above the Central Bank of Russia’s (CBR) 2024 forecast range of 4%-4.5%, and CBR’s medium term target of 4%, which is worrisome for Russian economy. According to a recent bulletin by the CBR’s research and forecasting department titled What Trends Say, the inflation rate continues to hover above the 4% annual target, which indicates the persistence of inflationary pressures in addition to the high inflation expectations among both the general population and businesses. On this matter, CBR Governor Elvira Nabiullina also affirmed that inflation outlook worsened due to weakening RUB, supply-side constraints and labor shortages.

In order to fight against sticky inflation, CBR increased policy rate to 16% on December 15 citing inflationary pressures remaining high, triggered by strong demand and lending. Speaking about the course of inflation, president Putin appeared expectant and applauded the actions by the government and the CBR as key rate hikes lead to a slight slowdown in lending in Russia. (Note: We expect CBR to hold the rates unchanged at 16% on MPC scheduled at February 16, considering slight deceleration in the inflation in the last two months has relieved the CBR).

Taking into account CBR’s determination in hiking the key rates, we predict this can suppress demand and imports and squeeze lending particularly in 2H of 2024, but only gradually with lagged effects. Despite CBR’s actions, we feel cooling off inflation will not be straightforward as it is likely that the inflation would remain higher than CBR’s expectations particularly in 1H of 2024, due to high military spending, weakening RUB, tight labor market and the presidential elections on March 17, risking the inflation to stay stronger for a longer period.