China Equities: More of the Same or Game changing Policies

We remain strategically underweight China Equities in global and EM equity baskets, due to the structural slowing of growth and low EPS prospects. Event risk around the U.S. presidential election will also start to be considered. Further targeted policies from China authorities could cause intermittent trading driven short-covering, but aggressive game changing policy would be required to sustain a rally. With India now overvalued, we prefer EM Asia ex China.

We remain strategically underweight China Equities in global and EM equity baskets, due to the structural slowing of growth and low EPS prospects. Event risk around the U.S. presidential election will also start to be considered. Further targeted policies from China authorities could cause intermittent trading driven short-covering, but aggressive game changing policy would be required to sustain a rally. With India now overvalued, we prefer EM Asia ex China.

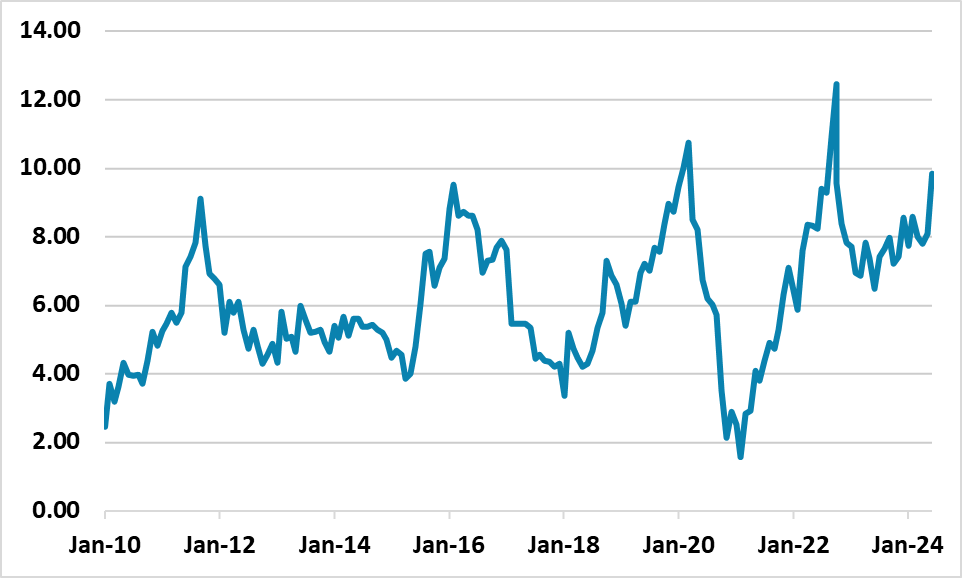

Figure 1: China CAPE Yield-10yr Real Bond Yield (%)

Source Continuum Economics

China equities are cheap on a valuation basis whether it is versus its own history or alternatively versus real government bond yields (Figure 1). However, valuation is not enough given the corporate and macro/policy backdrop. Chinese companies have a tendency to issue new shares which means that earnings growth turn into lower EPS growth. Secondly, economists are coming around to our type of view of 4.6% GDP in 2024 and 4.0% in 2025, as increasing concerns surround consumer spending as well as the well-known residential investment problem (here). Indeed, we feel that a 30% probability exists of a harder landing to around 3% in 2025-26 (here), which cause more of an earnings and EPS slowdown than our already downbeat view – baseline we are heading towards single digit earnings growth. CPI inflation also risks not recovering and going negative more persistently. This is not fully discounted in current equity only valuations. However, low nominal 10yr government bond yields do suggest some safety first and capital preservation behavior in China likel that seen in the U.S. during the GFC in 2008-09, though China 10yr real yields are still positive using CPI or GDP deflators. Thirdly, China authorities targeted polices are welcome, though are an insufficient scale given the real economy and aggressive disinflation pressures. This all means that the market is not impressed with low valuations in themselves.

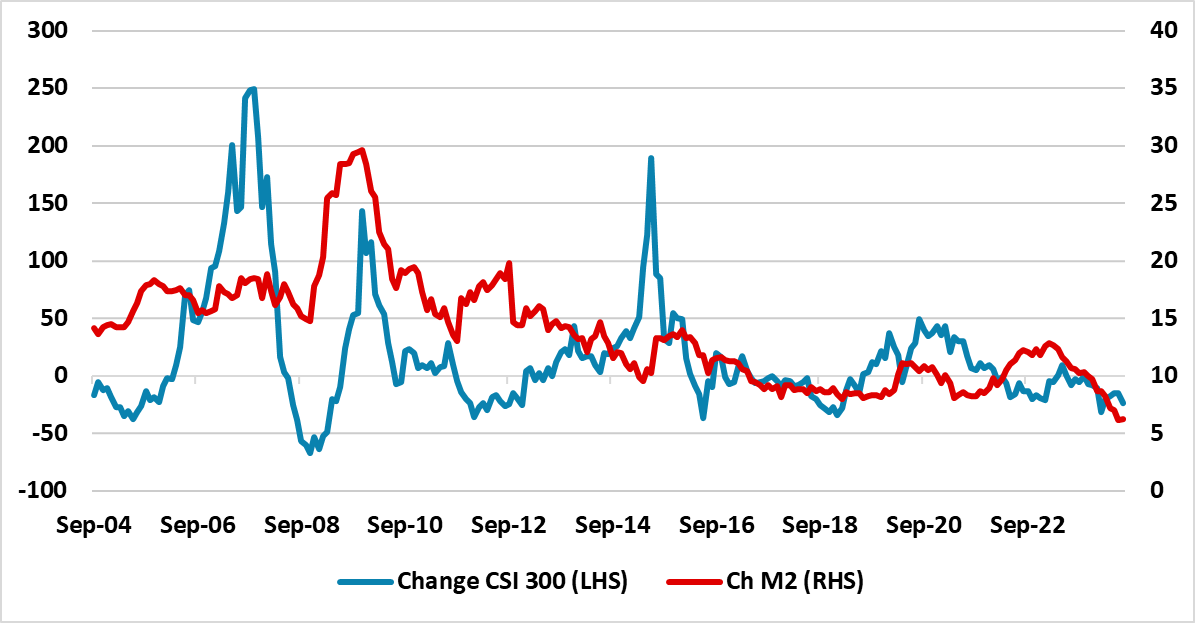

Global investors are concerned about these issues, but also the less business friendly policies compared to the golden years of 1990-2019 – with intermittent crackdowns on certain sectors. Local investor’s capital preservation psychology is also being driven by losses on equity products launched in 2021 at much higher CSI index levels (Figure 2). With property prices falling, corporate bonds having problems, some small rural banks shaky and not trusted, the choice for domestic investors is between low yielding deposits at more stable major banks or government bonds.

Figure 2: China CSI 300 Equity Index

Source Datastream/Continuum Economics

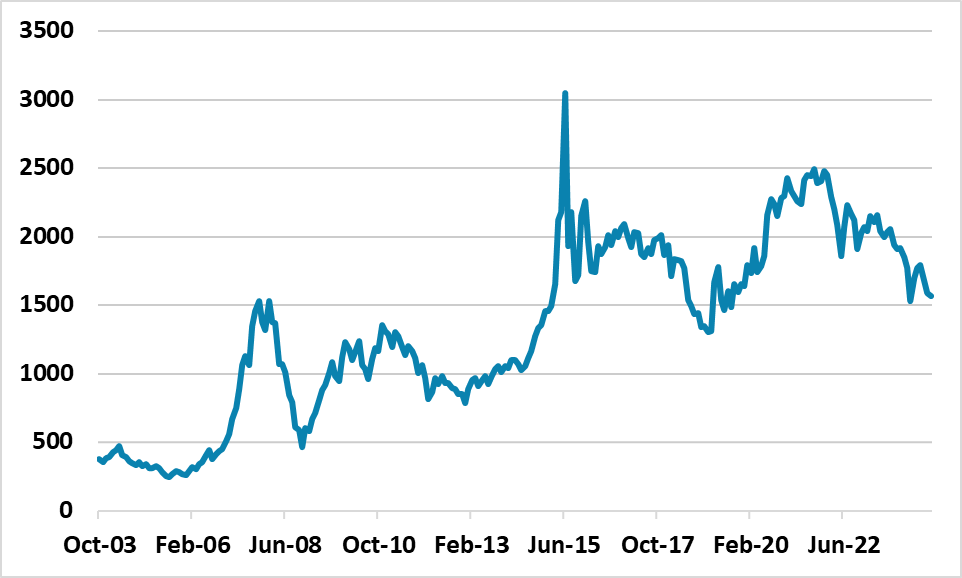

Local investor’s capital preservation psychology is also being encouraged by low M2 and lending growth by China’s standards. China domestic investor love the equity market when M2 is strong and plentiful (Figure 3), but now with weak M2 growth. China authorities are taking measures to sustain credit supply by encouraging larger sounder banks to support the economy and also pushing through mergers and takeovers for small weak rural banks. However, credit demand is weak, with households paying down credit on a net basis.

Figure 3: Change in CSI 300 and M2 Growth (%)

Source Continuum Economics

Thus we remain strategically underweight China equities in global and EM equity baskets, due to the structural slowing of growth and slowing EPS prospects. Event risk around the U.S. presidential election will also start to be considered. If Donald Trump is elected as president then that will likely accelerate global investors selling of China equity holdings on fears of higher tariffs and a trade war – though we feel Trump key priorities would likely be curtailing immigration and avoiding the 2017 tax cuts lapsing.

Further targeted policies could cause intermittent trading driven short-covering, but aggressive game changing policy would be required to sustain a rally. Scaling up the Yuan300bln purchase of completed homes for affordable housing to Yuan3-4trn; Yuan2-4trn income transfer or shopping vouchers to households; targeting 12-15% M2 growth or structural lift to health/unemployment and pension safety nets are four potential game changers but are all low probability. Equity-Bond valuations are so stretched that some new targeted policies could lift the market 10%, but this is a trading not an asset allocation opportunity. With India now overvalued, we prefer the broader EM Asia ex China that gives some India exposure but also taps into Indonesia/Malaysia and S Korea better valuations and that can benefit from the sentiment shift with Fed rate cuts.