Preview: Due October 10 - U.S. September CPI - Core returning to trend, gasoline softer

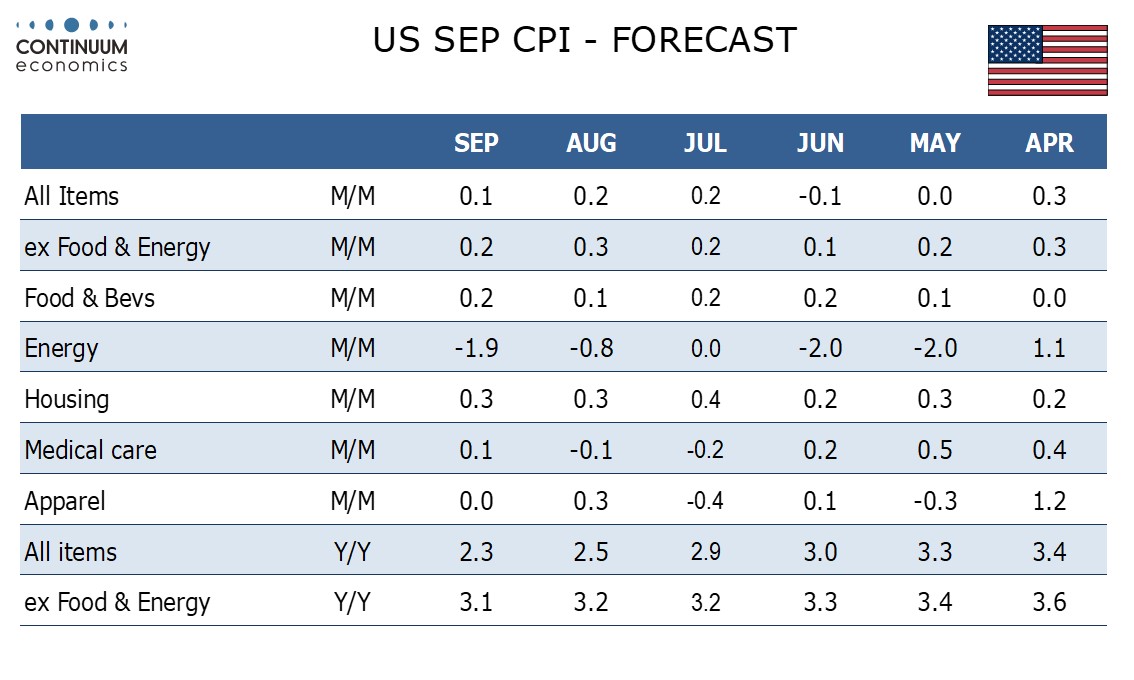

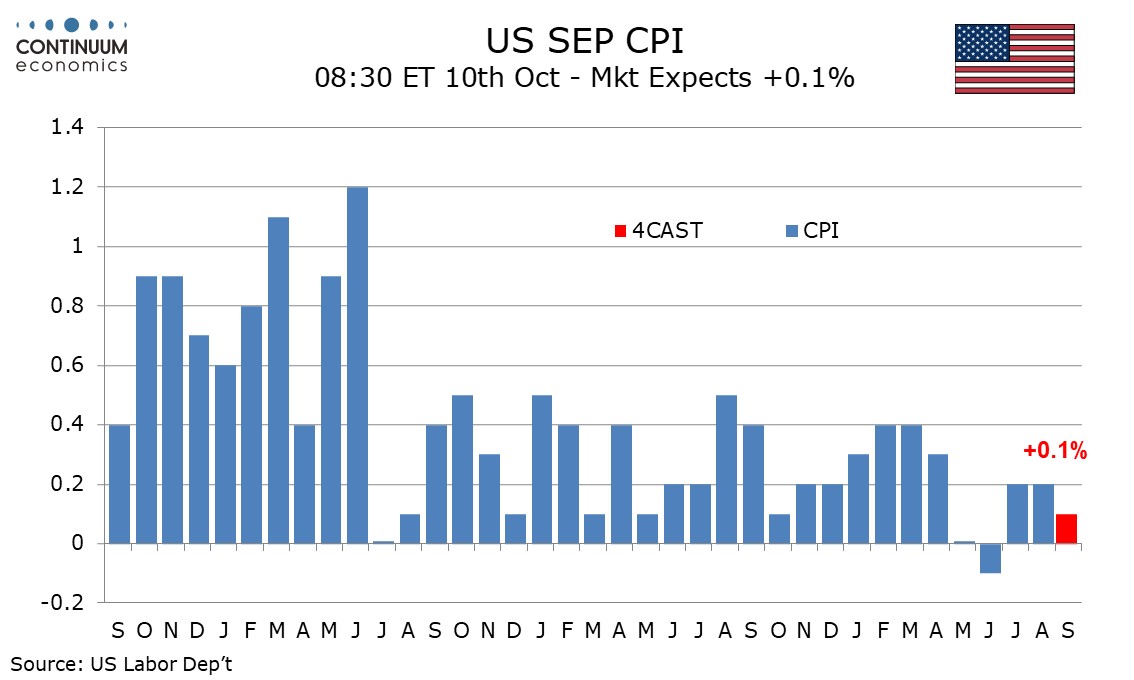

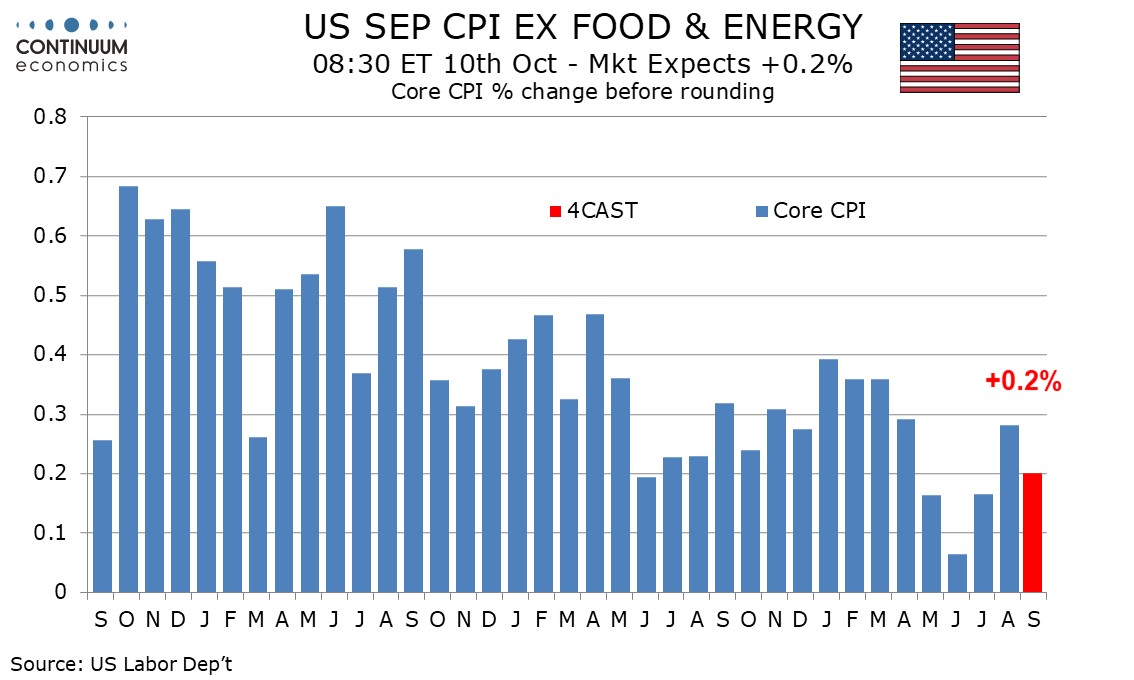

We expect September’s CPI to increase by 0.1% overall with a 0.2% increase ex food and energy. We expect the core CPI to be very close to 0.2% even before rounding, but with a significant decline in gasoline prices expected, we expect the headline CPI to rise by only 0.06% before rounding.

August’s core CPI rose by a four month high of 0.3%, 0.28% before rounding, lifted by above trend gains in owners’ equivalent rent, lodging away from home, and air fares. We expect these components to revert to trend in September. August’s 0.3% rise in core CPI offset a below trend 0.1% rise in June when owners’ equivalent rent, lodging away from home and air fares were all below trend.

We expect September’s core CPI to be slightly stronger than May’s and July’s, which were both rounded up to 0.2%, because we do not expect a significant negative from used autos, a component that has fallen in most recent months. Most components however are likely to look subdued.

Headline CPI will be restrained in September by a significant fall in gasoline. We expect food to remain subdued with a modest rise of 0.2%. We expect yr/yr CPI to slip to 2.3% from 2.5%, reaching its lowest since February 2021. We expect core CPI to slip to 3.1% after two straight months at 3.2%. This would be the lowest since March 2021.