Preview: Due October 4 - U.S. September Employment (Non-Farm Payrolls) - Initial claims suggest a stronger month

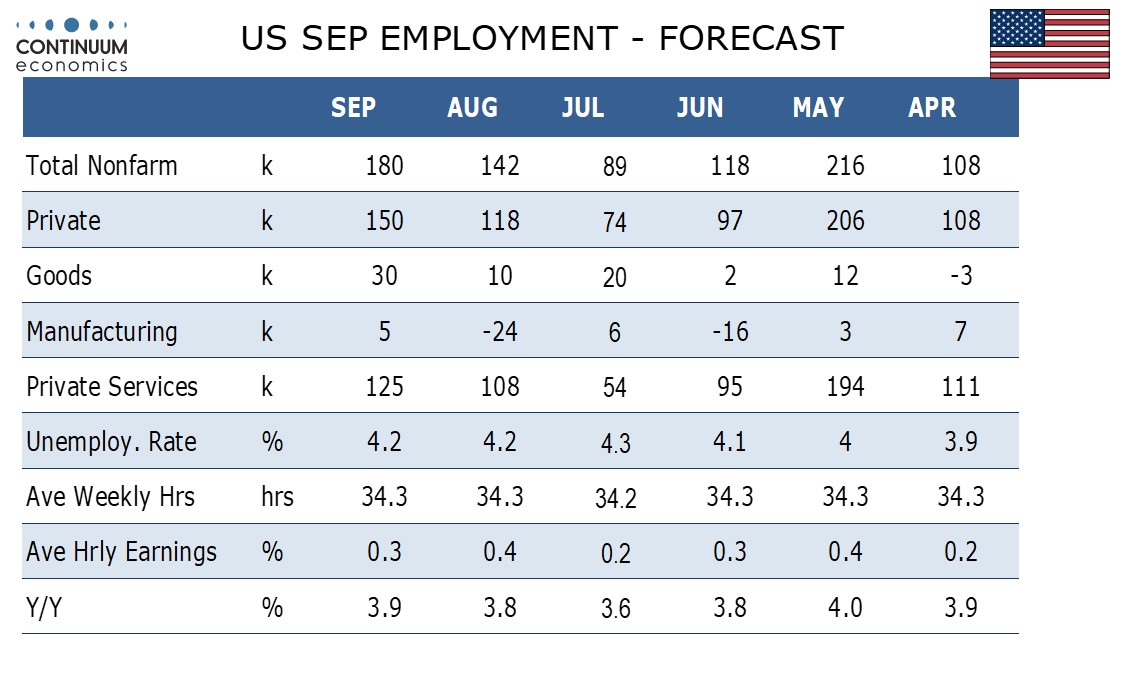

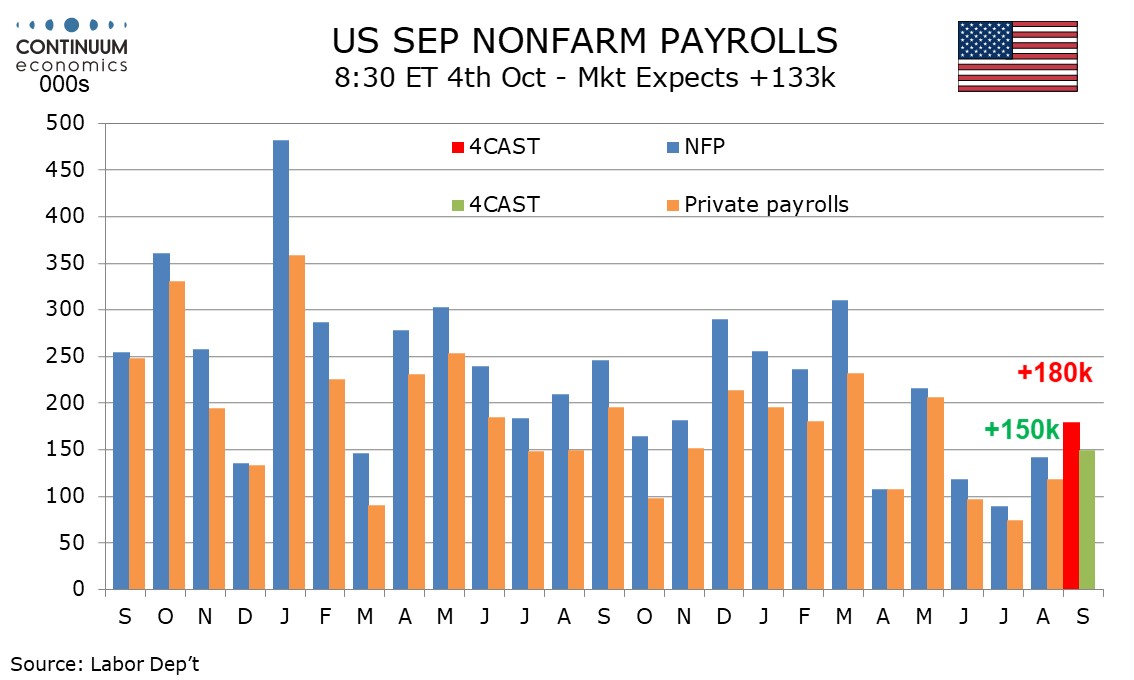

Lower initial claims suggest September’s nonfarm payroll will be a little stronger than the three preceding releases, which averaged 116k. We expect a 180k increase, with 150k in the private sector. We expect unemployment to be unchanged at 4.2% and an in line with trend 0.3% increase in average hourly earnings.

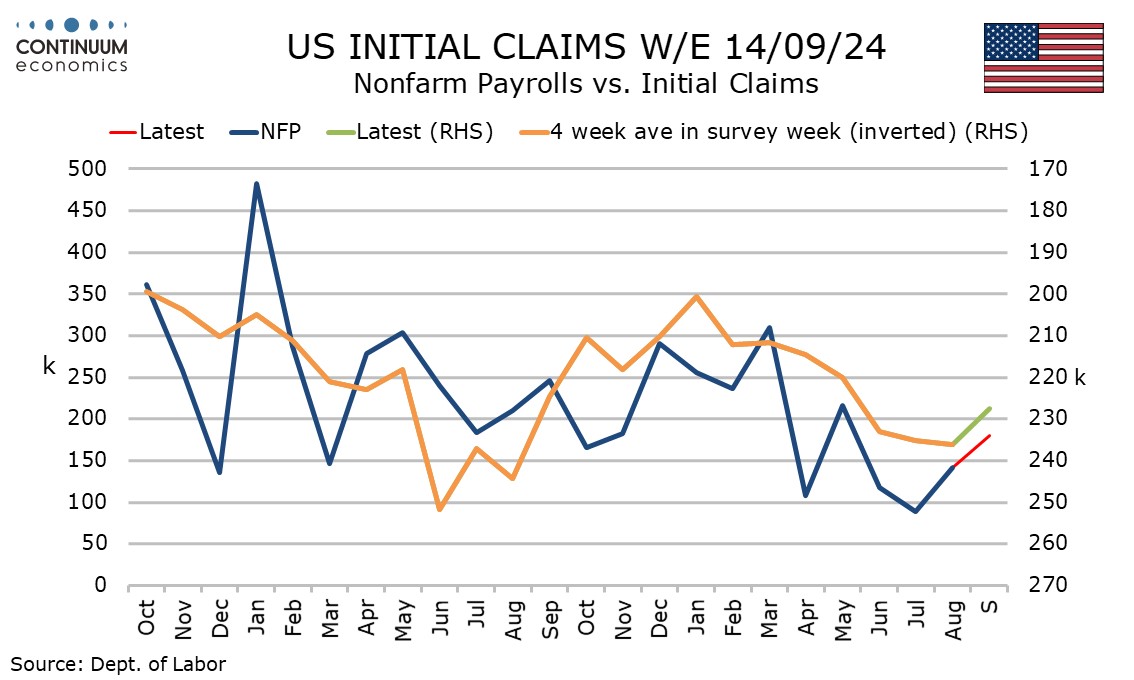

The four week average for initial claims in September’s nonfarm payroll survey week was the lowest since early June (slightly before June’s non-farm payroll was surveyed) and is thus lower than seen in the survey weeks for the June, July and August non-farm payrolls.

Private sector seasonal adjustments are more supportive in September though seasonal adjustments in government are negative due to the return of teachers after the summer break. We expect most components to be a little stronger than in recent months with few standing out. A strike at Boeing started too late to impact September’s payroll, but is a risk for October.

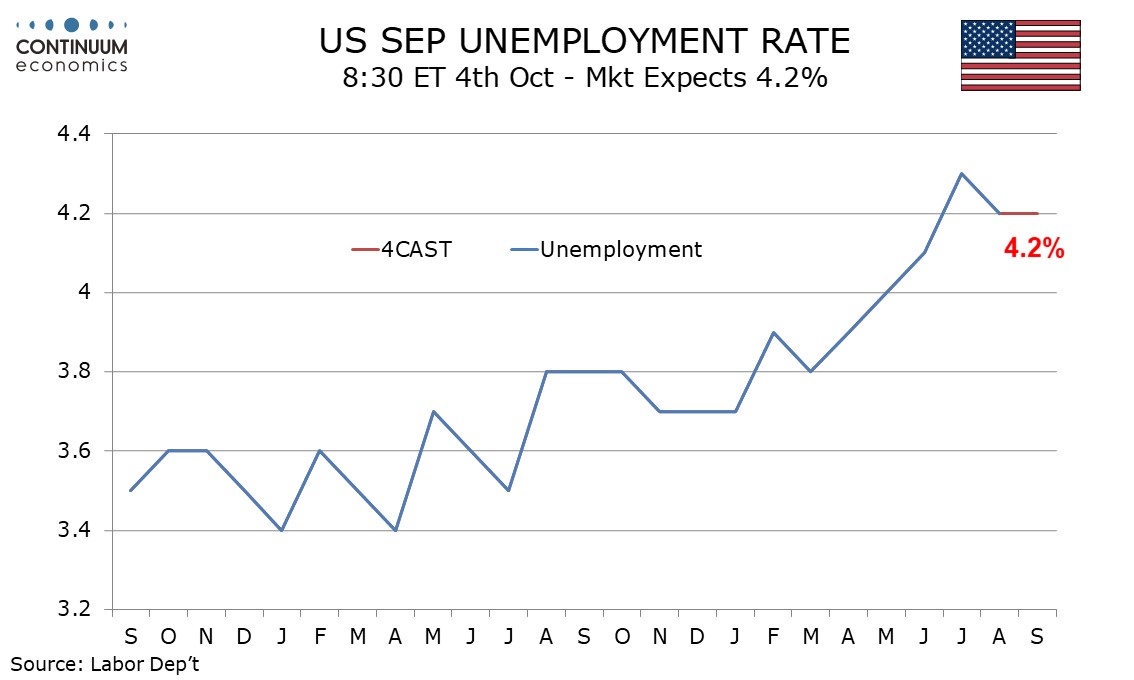

We expect employment and the labor force to rise by similar amounts in September, leaving unemployment unchanged at 4.2% after a dip from 4.3% in August when employment unusually outpaced the labor force. August’s dip followed four straight gains in the unemployment rate.

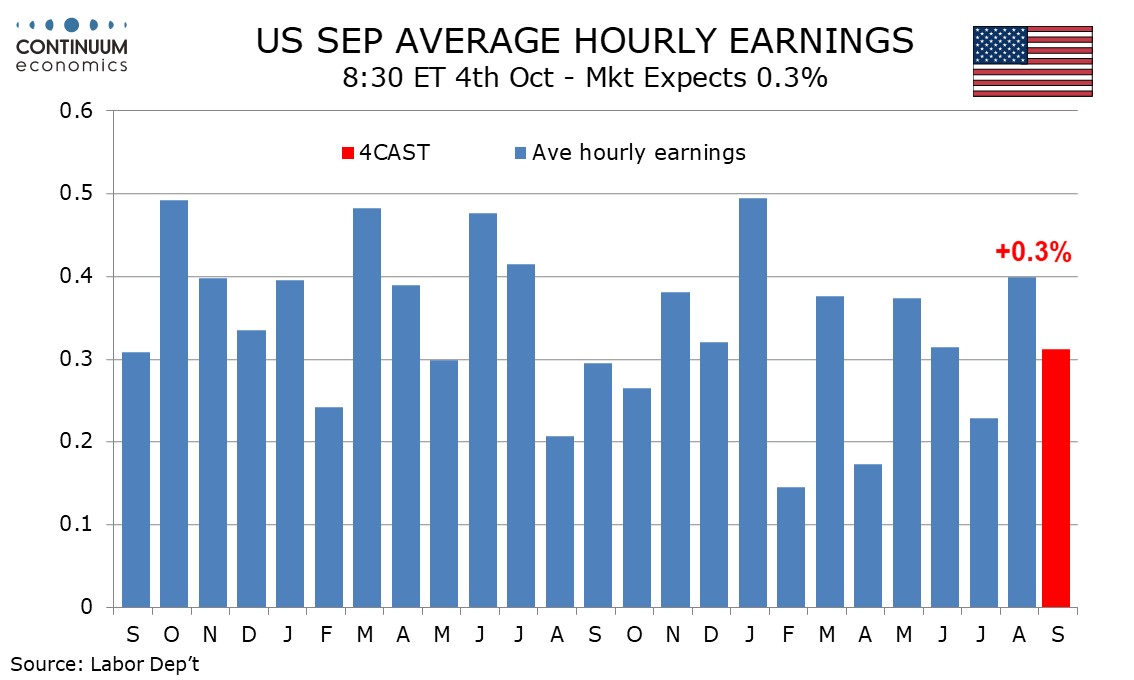

A 0.3% rise in average hourly earnings would be in line with trend after a 0.4% August increase corrected a 0.2% rise in July. Trend is still probably marginally above 0.3% as illustrated by the yr/yr pace which we expect to rise to 3.9% from 3.8%. Before the pandemic trend was marginally below 0.3% per month.

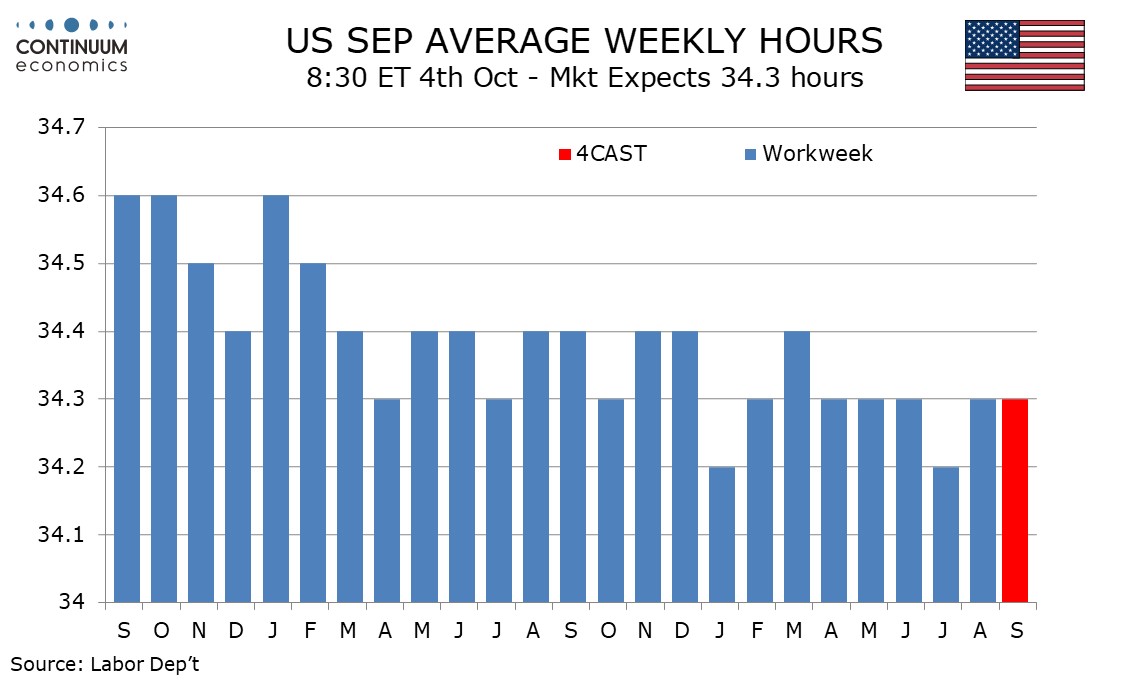

We expect the workweek to be unchanged at 34.3 hours. The only two months this year in which the workweek fell below that level, January and July, suffered from bad weather, and in the absence of a further slowing in the economy a dip looks unlikely this month, with weather not a significant concern.

An unchanged workweek and a moderate rise in employment would leave aggregate hours worked up by 0.1% in September and a modest 0.5% annualized in Q3, restrained in particular by weakness in July. Q3 GDP looks set to come in stronger than that, which argues against another weak payroll in September.