U.S. August Retail Sales continue to show resilience

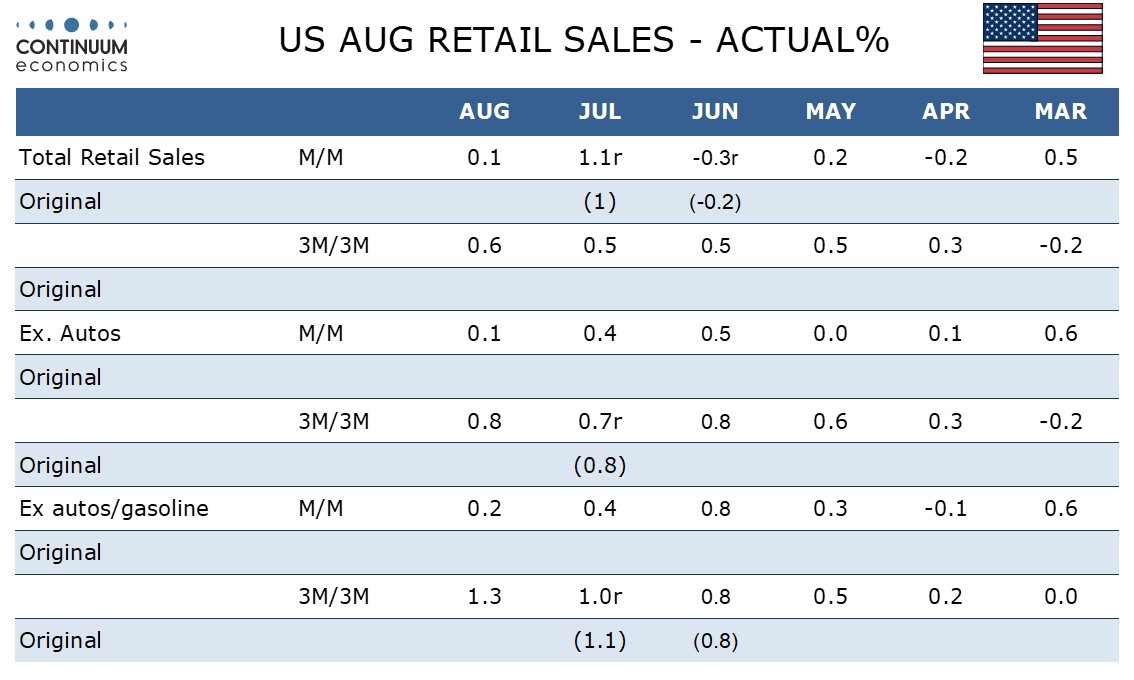

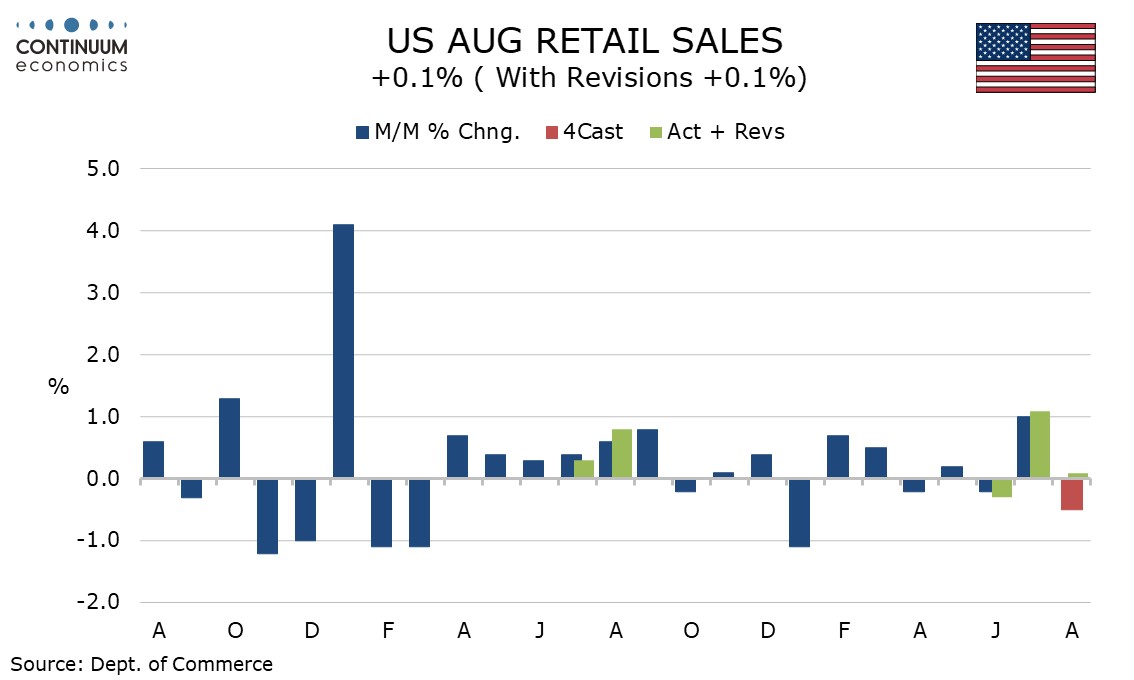

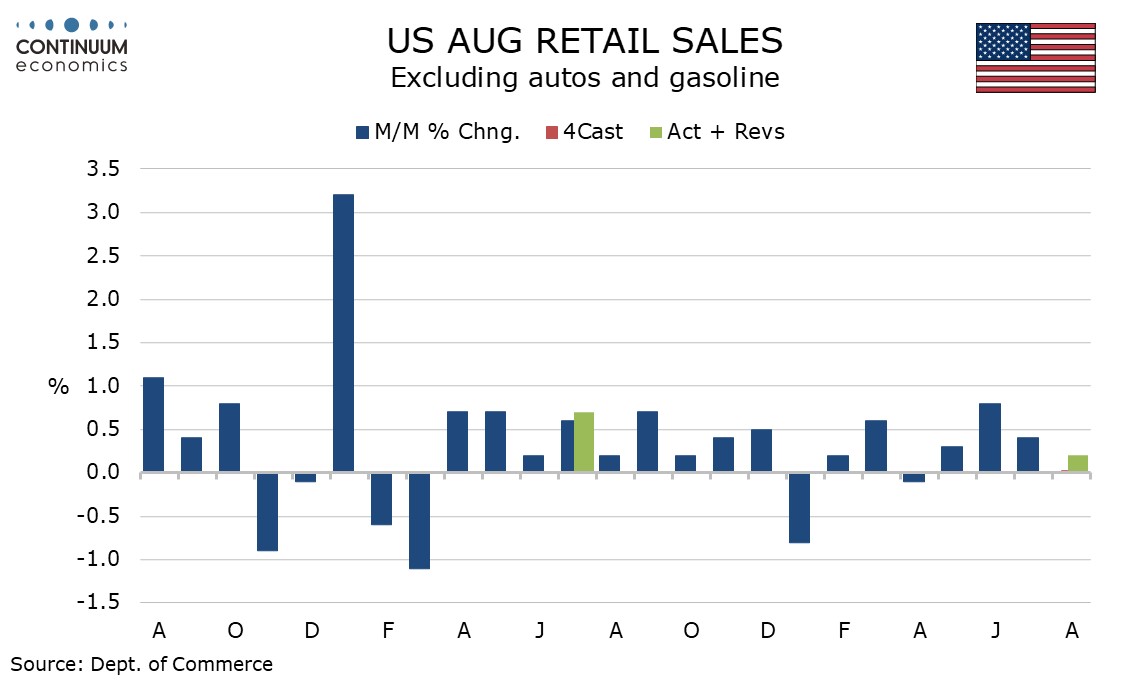

August retail sales have held up a little better than expected with a 0.1% increase though this is largely because autos were more resilient than industry data had suggested. Gains of 0.1% ex autos and 0.2% ex autos and gasoline were marginally softer than expected.

Revisions were minimal with June revised down to -0.3% from -0.2% and July revised up to a 1.1% increase from 1.0%. Changes in the core rates were not revised at all.

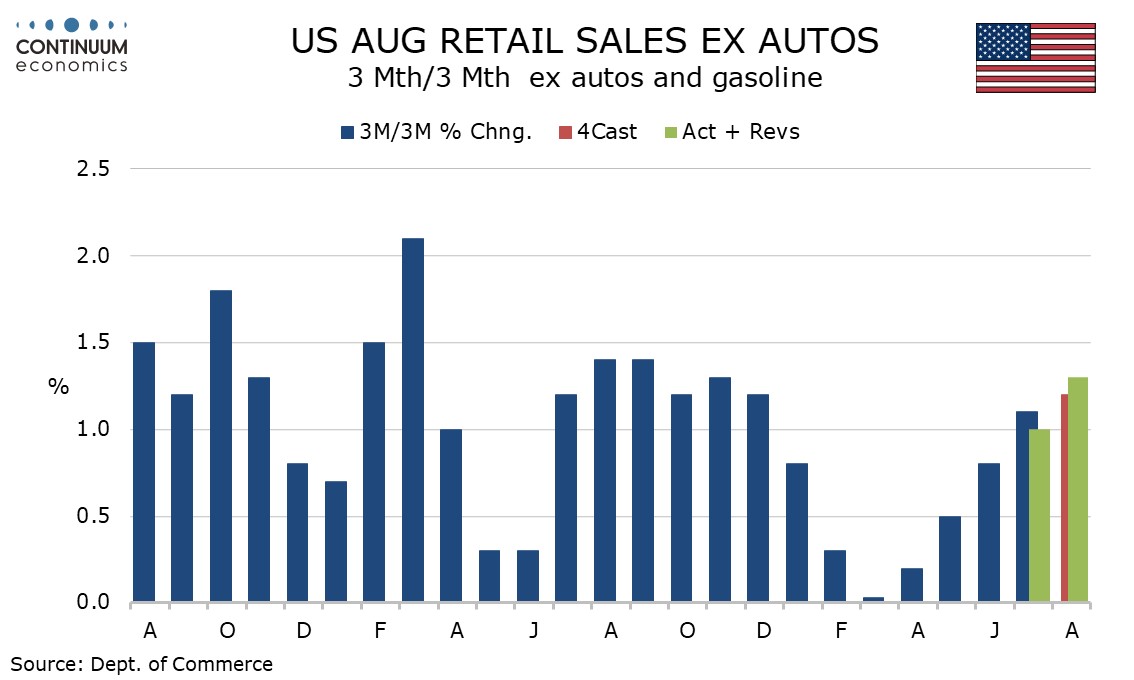

The subdued August increase follows a strong July overall and the modest gains in the core rates follow two straight healthy gains, meaning that 3-month/3-month rates have picked up in recent months with gains (not annualized) of 0.6% overall, 0.8% ex autos and 1.3% ex autos and gasoline, in each case the strongest of the year to date.

The resilience of consumer spending is outpacing real disposable income growth, and is vulnerable to slowing employment growth, though falling inflation is providing some support to real disposable income. Still, risk remains for a loss of momentum going forward.

The August data was mostly subdued with declines in food, gasoline, electronics and apparel offset by strength in health and personal care, miscellaneous stores and nonstore retailers. However, the control group, which contributes to GDP, rose by 0.3%, and this comes despite the CPI showing goods prices are edging lower.