FOMC Preview for September 18: A Cautious Start to Easing

The FOMC meets on September 18 and with recent data raising concern about emerging labor market weakness, and inflation down but not defeated, a cautious 25bps easing of the Fed Funds target, to 5.0-5.25% appears very likely. The statement is likely to leave the Fed’s options open to either accelerate or pause the pace of easing. The dots are likely to look quite dovish, particularly in comparison to June’s, but with a substantial variety of views.

The Decision and the Statement

Chairman Jerome Powell made it clear in his Jackson Hole speech on August 28 that the time had come for policy to adjust, with the Fed not seeking or welcoming further labor market cooling and that confidence in inflation returning to the 2% target had increased. He said the timing and pace of cuts would depend on data, outlook and risks. Shortly after a slightly disappointing August non-farm payroll was released Fed Governor Christopher Waller took a dovish turn, stating that the balance of risk had shifted towards the employment side of the mandate. He expressed a willingness to cut at consecutive meetings and to deliver larger cuts if necessary, but also expected cuts to be done carefully as the economy and employment continue to grow. That suggested he expected a 25bps move in September even before a slightly disappointing August CPI, which left a 25bps move looking almost certain.

Waller’s view that the risks had shifted to the downside suggests a dovish tone to the statement is likely, though after a 0.3% August core CPI increase the Fed will need to state that upside risks to prices persist, even if now outweighed by downside concerns on employment. The statement is likely to suggest that any future near term policy adjustments are likely to be easings, but is likely to leave the Fed the option of both pausing or easing by 50bps in the next meeting on November 7, with two non-farm payrolls and one CPI due to be released before then, as well as historical revisions to GDP. We expect the decision to ease by 25bps will be unanimous.

The SEP and the Dots

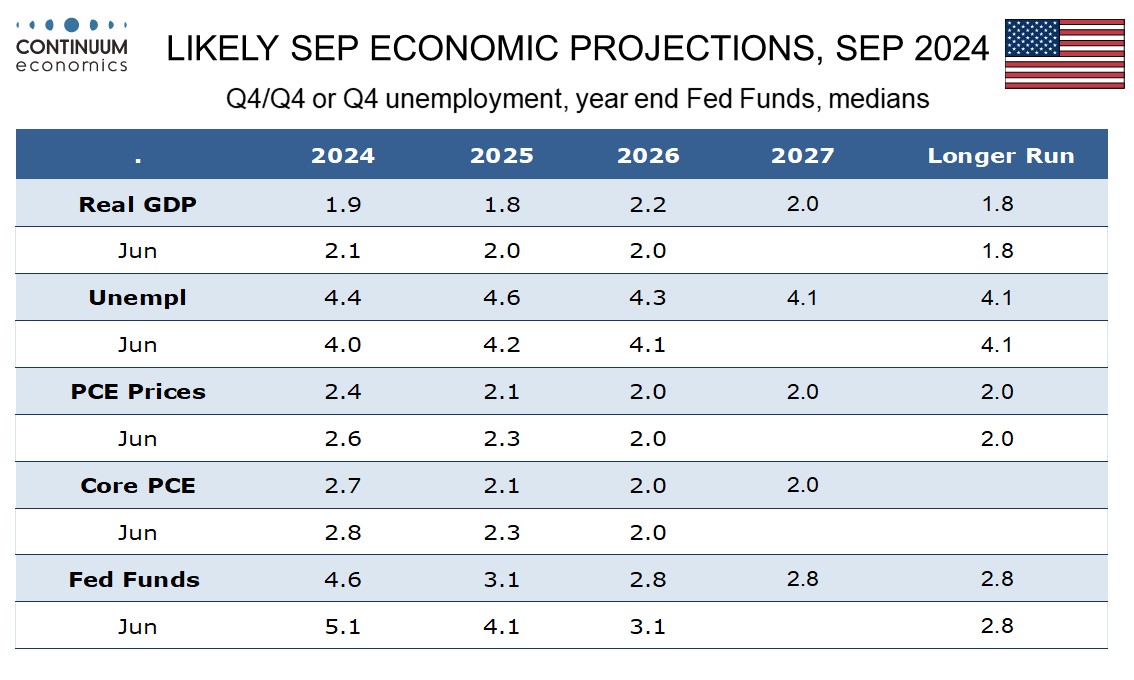

The dots are likely to look significantly more dovish than those of June 12, given the softer tone of the employment and CPI data for June, July and August released since then, even with the modest disappointment in August’s core CPI. The economic forecasts in the Summary of Economic Projections will see unemployment adjusted the most. In June the FOMC median estimate was that it would end 2024 at 4.0% before rising to 4.2% in 2025 and slipping back to the long run rate of 4.1% in 2026. It is already at 4.2% and likely to rise further. We expect the FOMC will see a median of 4.4% for end 2024 and 4.6% for end 2025. Near term forecasts for GDP and inflation will probably be nudged modestly lower too, though we expect core PCE prices will be seen ending 2025 marginally above target at 2.1%, if down from 2.3% in June. We expect the FOMC will continue to see the inflation target being reached in 2026 when GDP will be seen regaining momentum and unemployment moving back down. Forecasts for 2027 will appear for the first time, and then we expect the FOMC will see GDP growth near potential, inflation on target and the Fed Funds target at the long term neutral rate of 2.75%.

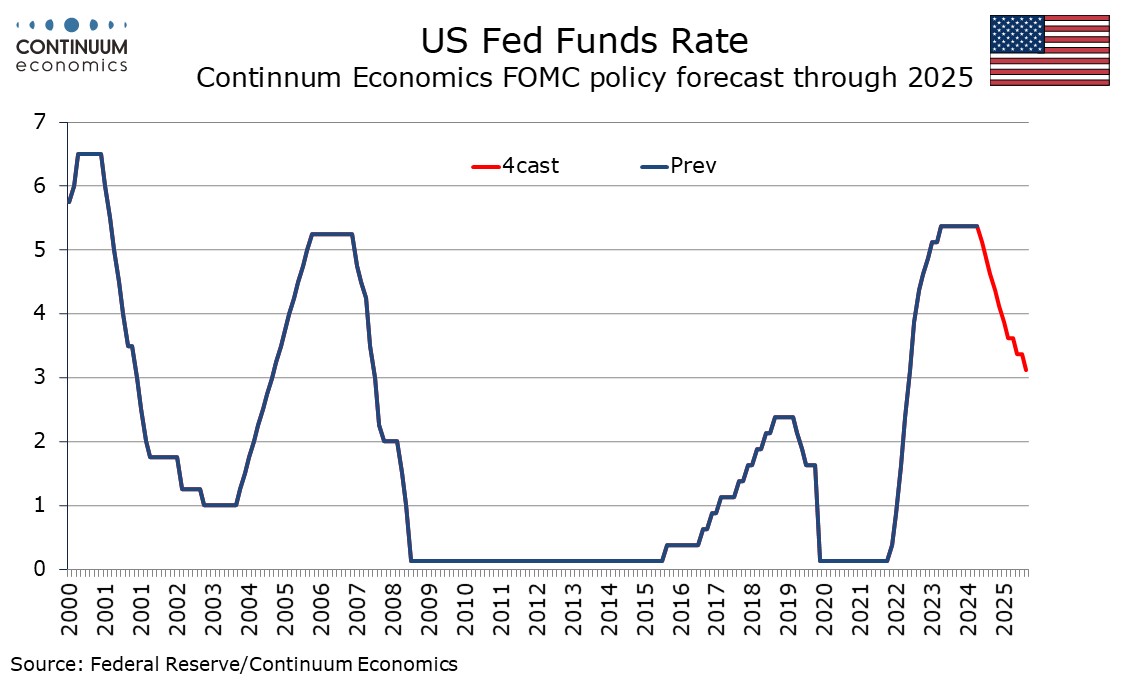

The dots will show how quickly the FOMC expects to get to neutral and we expect there will be quite a wide range of views visible within the dots. For 2024 we expect the median will project two more 25bps easings in the remaining two meetings of the year, meaning a total of 75bps in 2024 rather than the 25bps that was seen in June. We expect the median will see 150bps of easing in 2025, up from 100bps in June, putting the end 2025 Fed Funds target at 3.0-3.25% rather than 4.0-4.25%. This will require only a marginal further adjustment to achieve neutral in 2026. What we expect for the FOMC’s median dots are in line with our own view for 2024 and 2025, but we expect rates to stabilize marginally above 3.0% on a view that keeping inflation at target as the economy regains momentum may prove difficult.

The Press Conference

Chairman Jerome Powell at the press conference will justify the decision to ease by growing concerns over rising unemployment and reduced, though not eliminated, concerns over the strength of inflation. He will be careful to stress uncertainty, and leave his options open as to how much and how quickly rates will be lowered, but it will be clear that the Fed expects this move to be the first of several, even if it is not yet clear the Fed is on a path back to neutral. He will stress the dots are a median of a diverse set of views and not a plan. He is sure to be asked about the election, but will respond that this is not impacting the Fed’s decisions and the Fed will adjust to any post-election changes in the outlook as appropriate.