Preview: Due September 11 - U.S. August CPI - Subdued, if marginally stronger than in the preceding three months

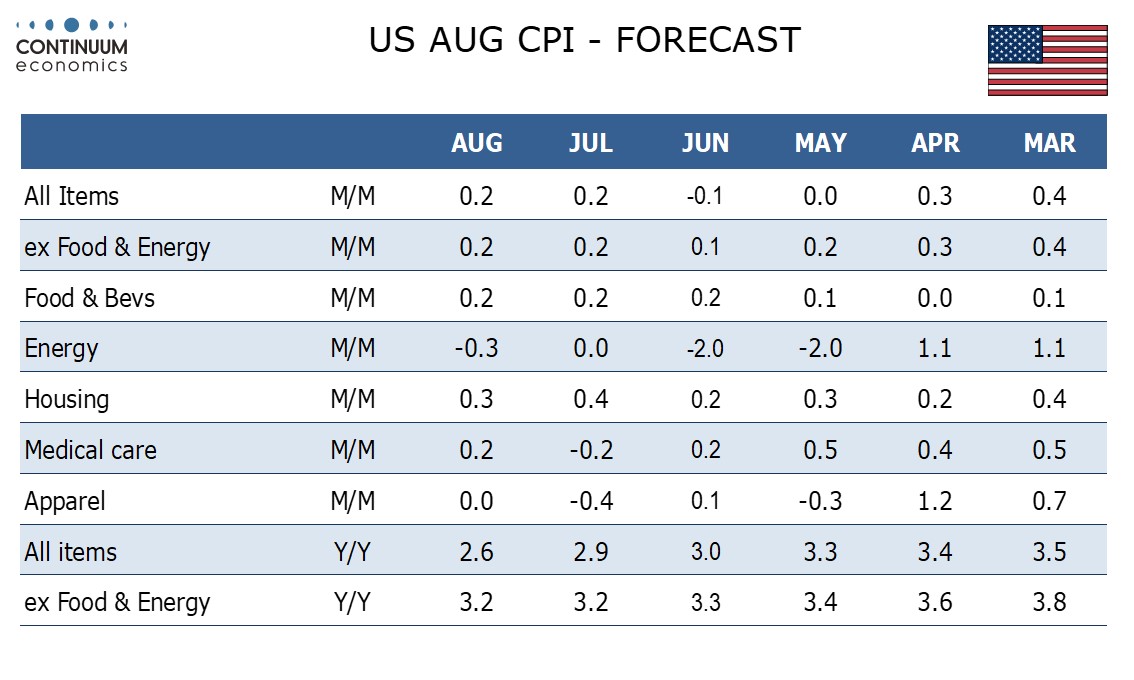

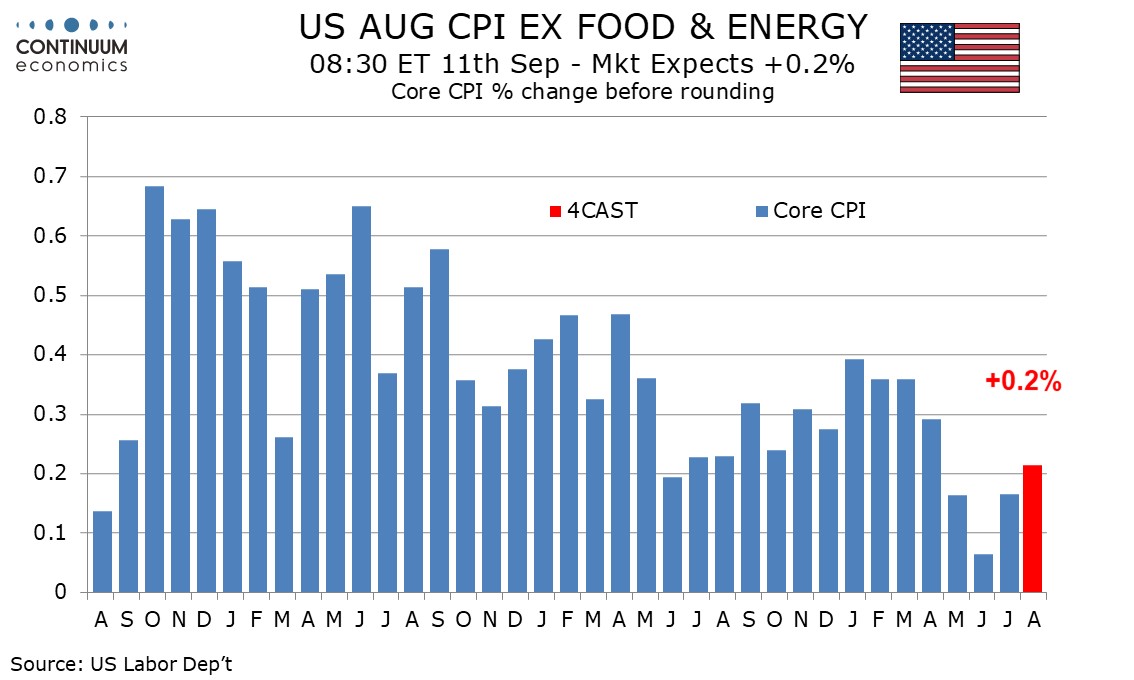

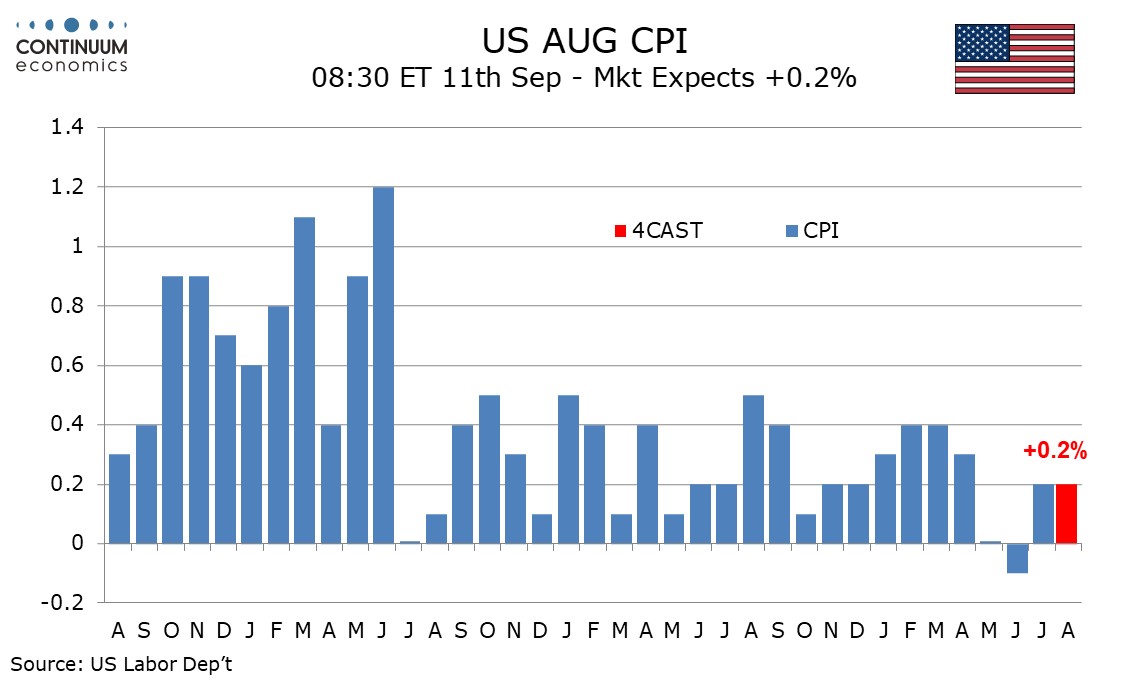

We expect August’s CPI to increase by 0.2% both overall and ex food and energy, with the respective gains before rounding being 0.18% and 0.21%. Such an ex food and energy rate would be slightly stronger before rounding than in the preceding three months, though not strong enough to trouble the FOMC.

We expect a slightly firmer ex food and energy rate, not because we expect any real strength in any components but because some components are unlikely to be quite as soft as in recent months. Used autos saw a particularly sharp decline in July while medical care also saw an unusual decline. Apparel has declined in two of the past three months while air fares have fallen significantly in the last three, though less so in July which hints we may be seeing some stabilization. Most of the above components are likely to be a little less weak in August. We do however expect a renewed loss of momentum in shelter after July corrected higher from a slower June outcome.

Gasoline prices saw a marginal decline in August but the impact on CPI will be small with energy prices seen down by only 0.3%. Food is likely to continue showing marginal increases with a third straight gain of 0.2%.

Year ago strength in energy prices is likely to see yr/yr CPI slip to 2.6% from 2.9%, reaching its lowest level since March 2021. However we expect the yr/yr ex food and energy rate to remain at July’s 3.2% pace, which was the slowest since April 2021.