Preview: Due September 6 - U.S. August Employment (Non-Farm Payrolls) - Less weak than a weather-restrained July

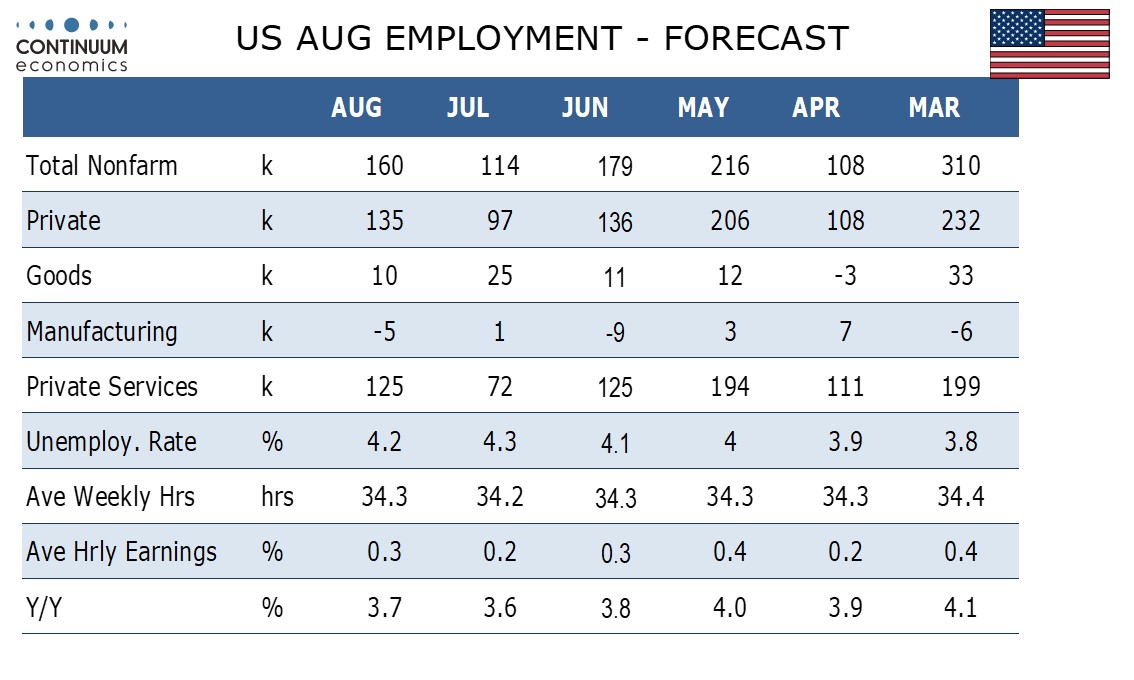

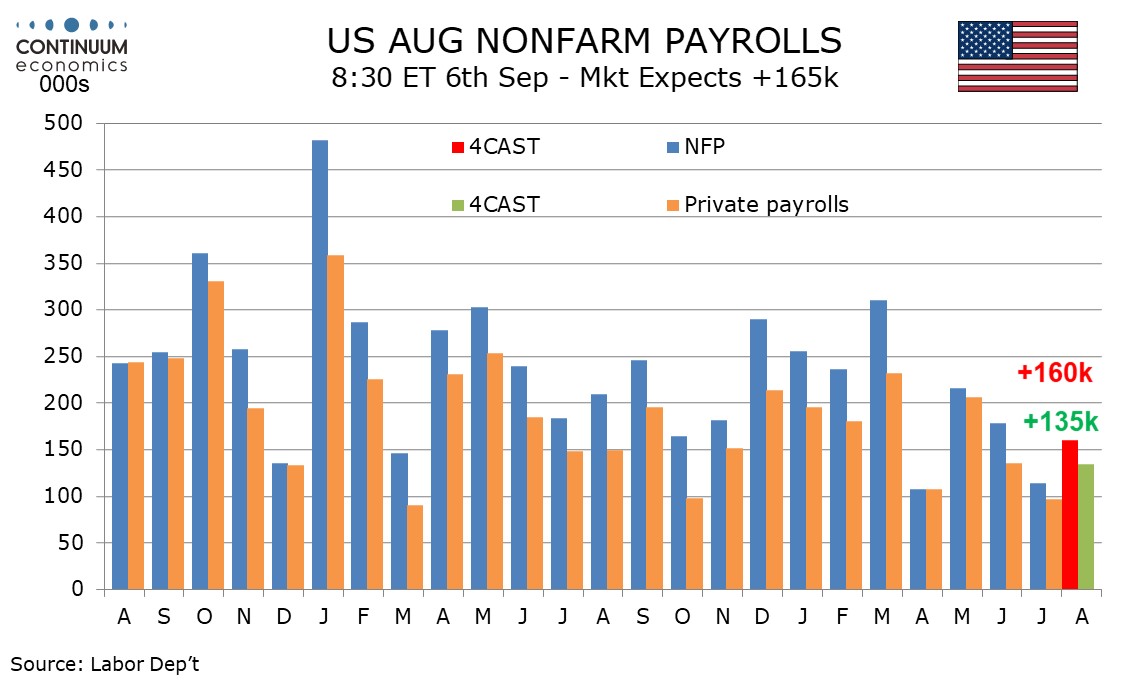

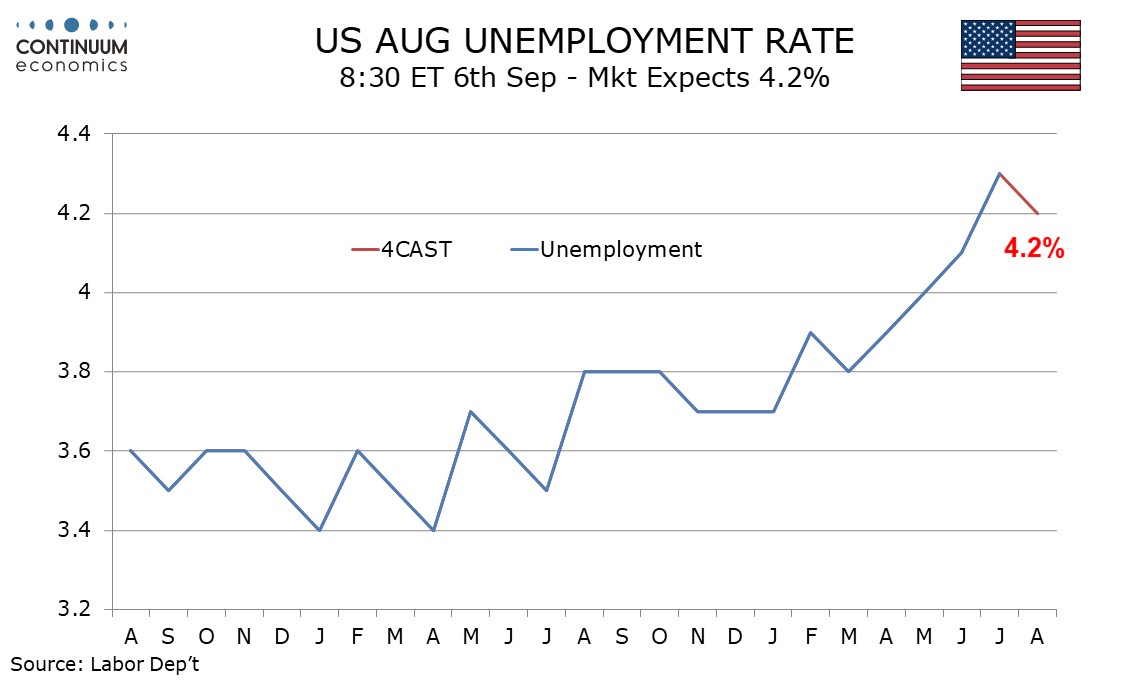

We expect August’s non-farm payroll to rise by 160k, 135k in the private sector, both slightly stronger than respective July gains of 114k and 97k that were probably restrained by weather but below 3-month averages of 170k and 146k, and thus implying a continued modest slowing in trend. We expect unemployment to correct lower to by 0.1% to 4.2% after rising by 0.2% to 4.3% in July, and a 0.3% rise in average hours earnings to follow a below trend 0.2% in July. A less weak payroll in August should help the FOMC decide to ease by 25bps on September 18 rather than by 50bps.

While July’s press release saw no discernable impact from Hurricane Beryl in the data, we suspect there was a modest negative impact. State data showed a 14.5k decline in Texas, the state most impacted by the hurricane. It is also possible that unusually hot weather in the Midwest had a negative impact in July.

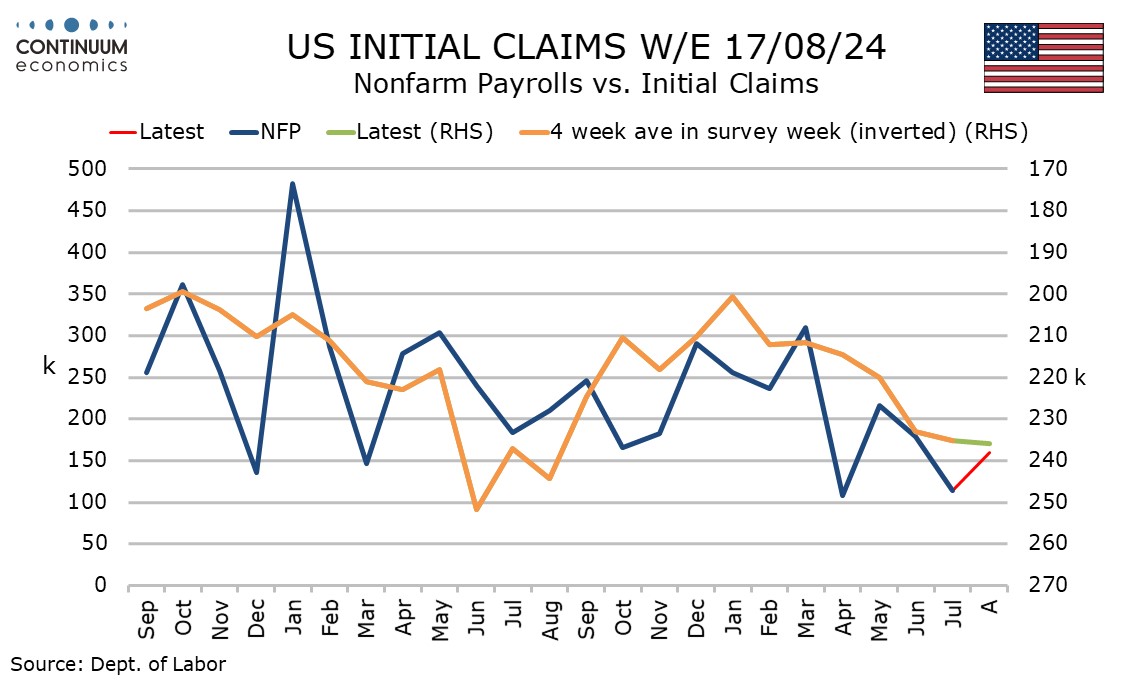

Initial claims data to the August survey week shows the 4-week average almost unchanged from July’s survey week, suggesting the labor market has not weakened further in August. Recent JOLTS job openings for July and ADP private sector employment data for August were weaker than expected, but neither in our view represented a sharp deviation from a gradually slowing trend.

Unemployment, having bottomed at 3.4% in April 2023, is clearly trending higher, but July’s 0.2% increase in the rate to 4.3% was steeper than trend, and caused by an above trend 420k increase in the labor force rather than job losses. We expect a 100k increase in August’s household survey estimate of employment, up from 67k in July, and an unchanged labor force to send unemployment down to 4.2%. July’s rate was 4.253% before rounding so it will not take much to see the rate correct lower.

The non-farm payroll continues to outperform the household survey, which calculates the unemployment rate, even after an unusually large downward revision to the March 2024 benchmark of 818k, announced on August 21 but not due to be incorporated in the data until early 2025. The benchmark revision implies an average monthly gain of 174k in the non-farm payroll in the 12 months to March, down from 242k before the revision, but still above 71k as implied by the household survey. Since March the average non-farm payroll gain has been 154k. This may be over-estimated, but with layoffs still low we are comfortable that employment is still rising, albeit by less than the labor force.

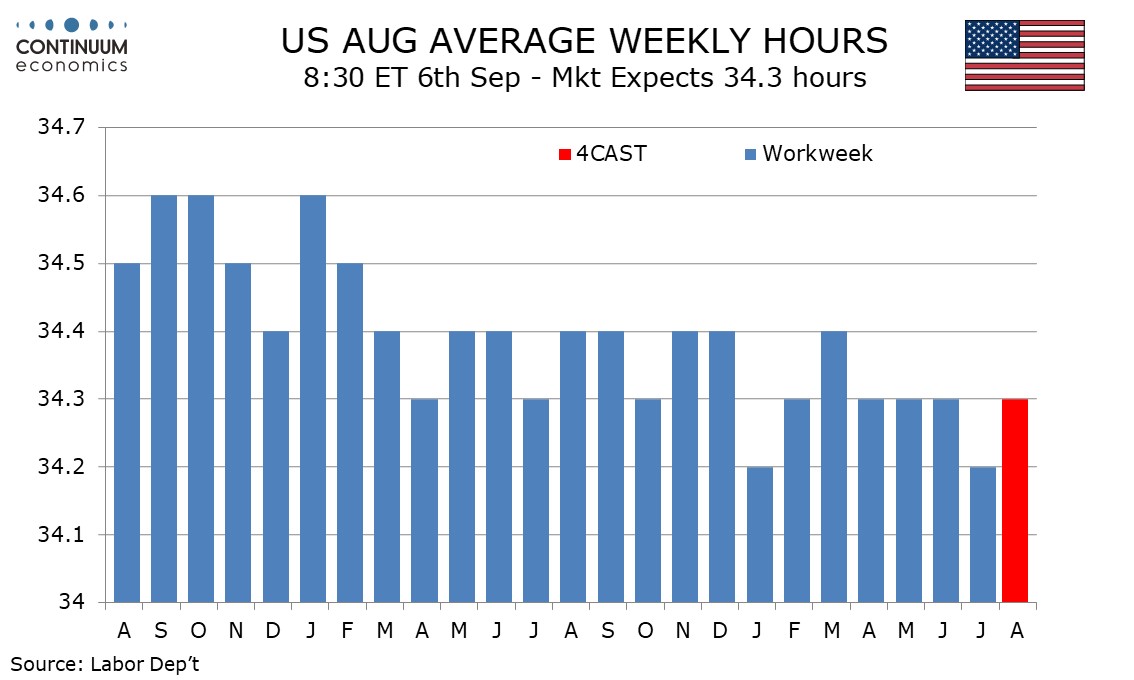

July’s workweek of 34.2 hours was the lowest since January, another month in which some bad weather was seen, and we expect a return to the 34.3 level seen in each month of Q2. This would leave aggregate hours worked up by 0.4% in August after a 0.3% decline in July.

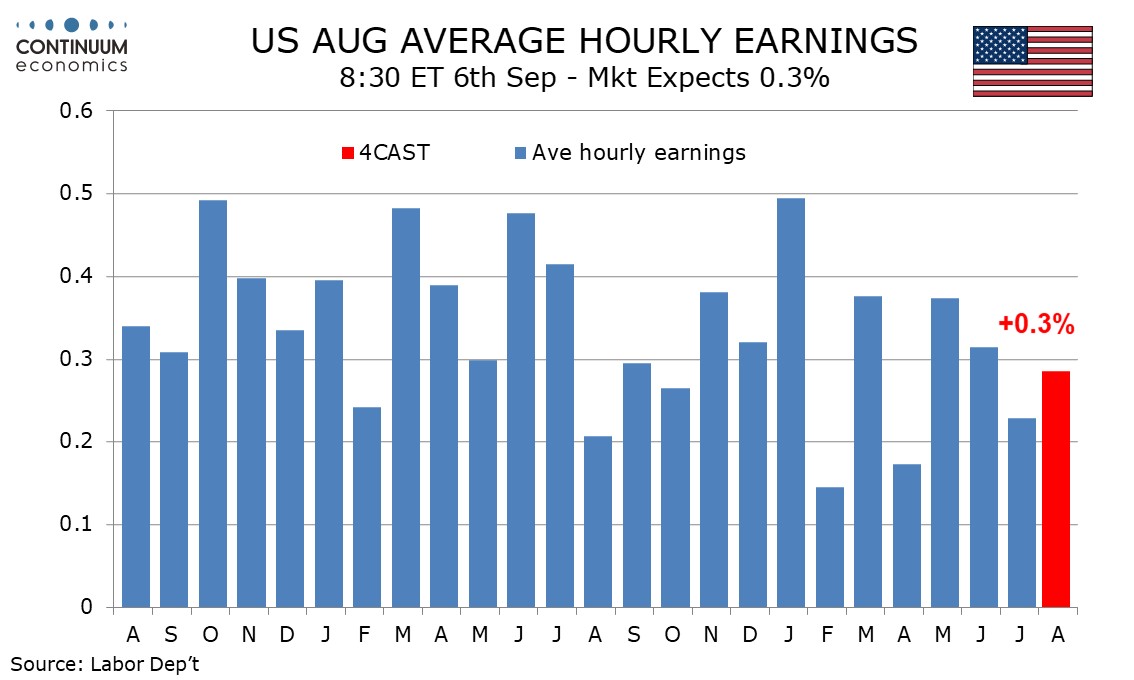

Average hourly earnings were also below trend in July with a rise of 0.2%, and this below trend outcome is less easy to attribute to weather. However, two straight gains of below 0.3% would be something not seen since late 2020 and we expect a return to trend at 0.3% in August. This would see yr/yr growth at 3.7%, up from 3.6% in July that was the lowest since May 2021 but below June’s 3.8%.